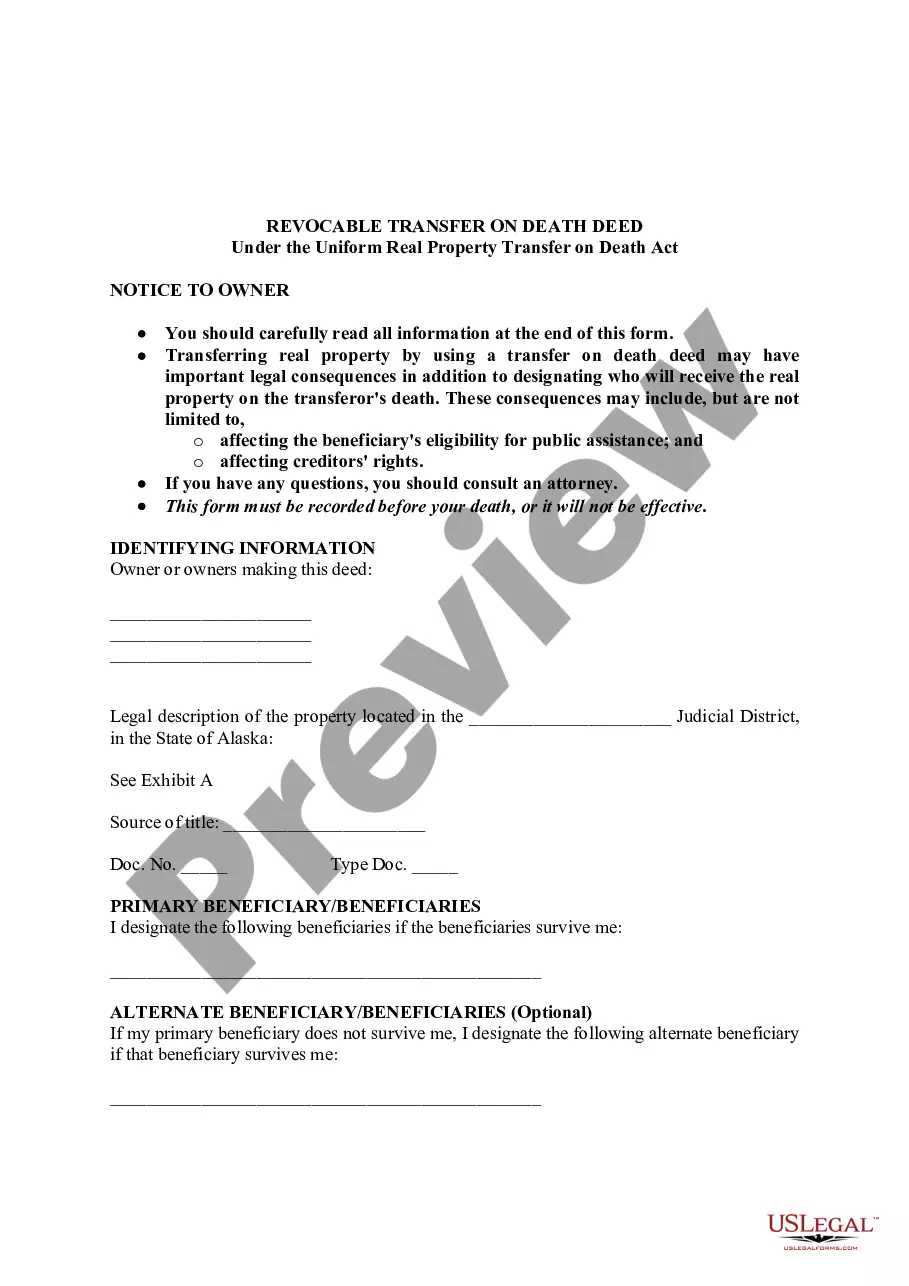

Alaska Revocable Transfer on Death Deed

Description

How to fill out Alaska Revocable Transfer On Death Deed?

Utilizing Alaska Revocable Transfer on Death Deed templates crafted by experienced attorneys enables you to avoid troubles during the document submission process.

Merely download the sample from our site, complete it, and seek legal advice to confirm it.

This approach will save you significantly more time and energy than asking legal counsel to create a document from scratch tailored to your specifications.

Utilize the Preview feature and examine the description (if accessible) to ascertain if you require this particular example; if so, just click Buy Now.

- If you possess a US Legal Forms subscription, just Log In to your account and revisit the sample webpage.

- Locate the Download button adjacent to the template you're reviewing.

- Once you download a template, you can find all your saved samples in the My documents section.

- If you lack a subscription, it's not an issue.

- Simply adhere to the step-by-step instructions below to register for your online account, acquire, and fill in your Alaska Revocable Transfer on Death Deed template.

- Verify that you’re downloading the correct form specific to your state.

Form popularity

FAQ

Transferring control Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

The transfer on death designation lets beneficiaries receive assets at the time of the person's death without going through probate.With TOD registration, the named beneficiaries have no access to or control over a person's assets as long as the person is alive.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

Because transfer-on-death beneficiary deeds do not become effective until you pass away, someone can challenge the validity of the deed after you die.Or, beneficiaries and family members can sue each other to take the property entirely. In this case, a court proceeding may be required to resolve the issue.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

Transfer-on-death (TOD) arrangements may be used to pass certain assets to designated beneficiaries. A beneficiary form states who will directly inherit the asset at your death.TOD arrangements require minimal paperwork to establish.