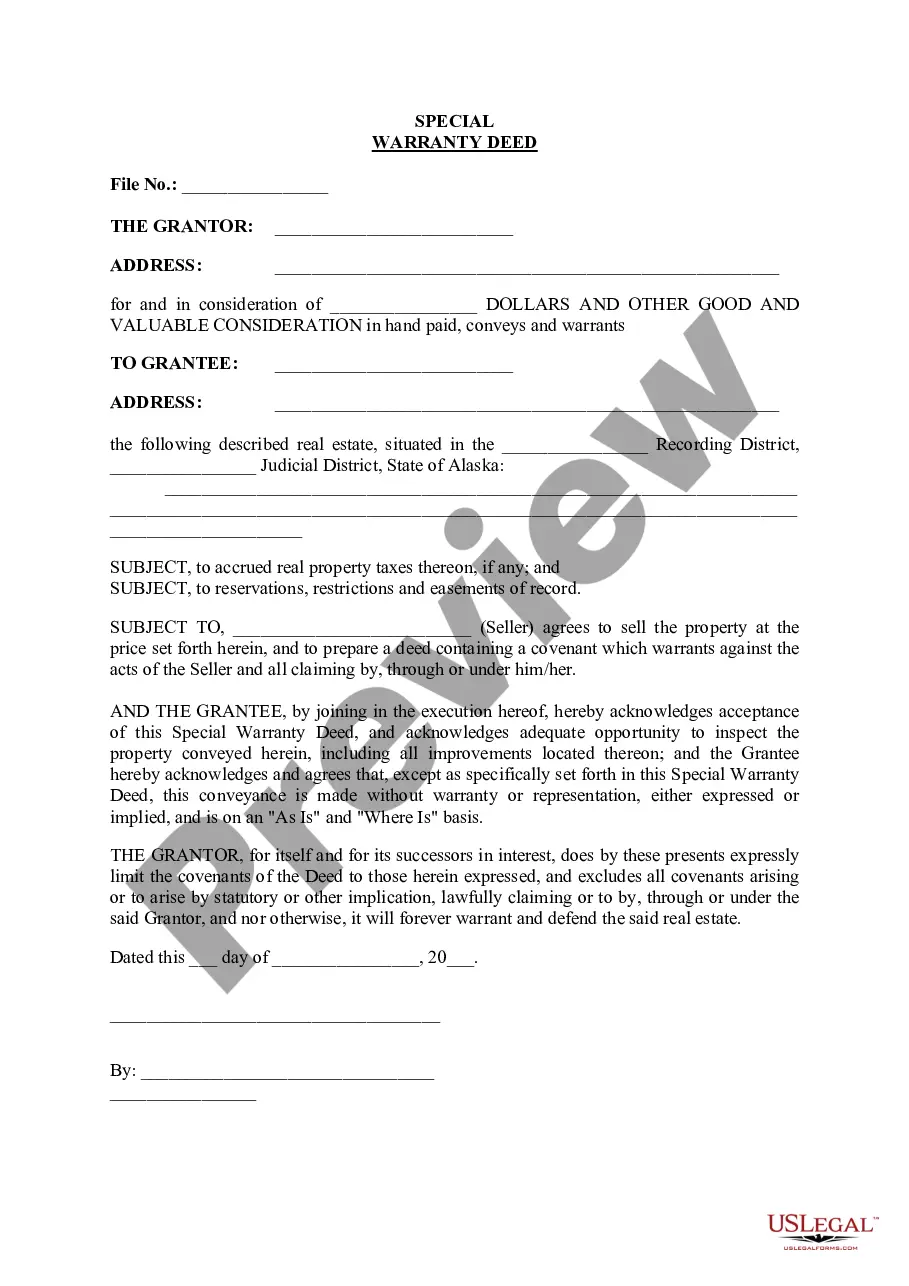

Alaska Special Warranty Deed

Description Special Warranty Deed Alaska

How to fill out Alaska Special Warranty Deed?

Utilize US Legal Forms to acquire a printable Alaska Special Warranty Deed.

Our court-acceptable forms are composed and frequently revised by experienced attorneys.

Ours is the most comprehensive Forms directory available online and offers budget-friendly and precise samples for individuals, legal practitioners, and small to medium-sized businesses.

Select Buy Now if it’s the template you desire, create your account, and make a payment via PayPal or credit card. Download the template to your device and feel free to reuse it multiple times. Use the Search engine if you wish to discover another document template. US Legal Forms provides thousands of legal and tax samples and packages for business and personal requirements, including the Alaska Special Warranty Deed. Over three million users have already successfully used our service. Choose your subscription plan and acquire high-quality forms in just a few clicks.

- The templates are organized into state-specific sections and many can be previewed before downloading.

- To access templates, clients must possess a subscription and Log In/">Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For those without a subscription, follow these instructions to swiftly find and download the Alaska Special Warranty Deed.

- Ensure you obtain the correct form for the state in which it is needed.

- Examine the document by reviewing its description and utilizing the Preview feature.

Warranty Deed Form Alaska Form popularity

Warranty Deed Alaska Other Form Names

FAQ

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

Special warranty deeds are most commonly used with commercial property transactions. Single-family and other residential property transactions will usually use a general warranty deed. Many mortgage lenders insist upon the use of the general warranty deed.

A general warranty deed covers the property's entire history.With a special warranty deed, the guarantee covers only the period when the seller held title to the property. Special warranty deeds do not protect against any mistakes in a free-and-clear title that may exist before the seller's ownership.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

Unlike a warranty deed or special warranty deed, a quitclaim deed makes no assurances whatsoever about the property.For example, in a divorce situation where one spouse deeds the house to the other spouse. Quitclaim deeds are commonly used to transfer real property to an LLC or a living trust.

A special warranty deed is common when a house has been foreclosed on by a bank because the previous owner did not pay their mortgage.The special warranty deed that the bank provides to the new buyer provides no protection for the period of time before the bank took ownership of the property.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.