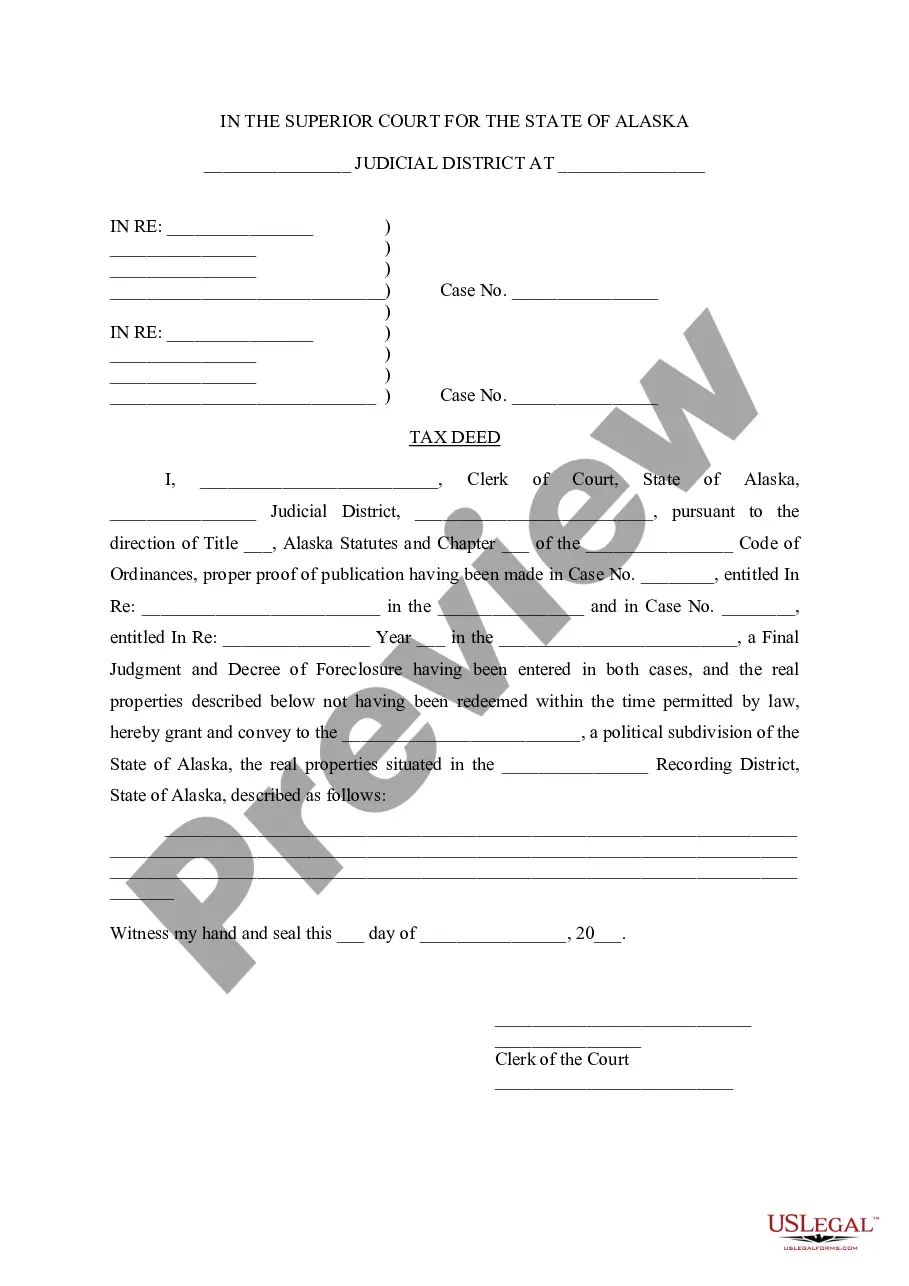

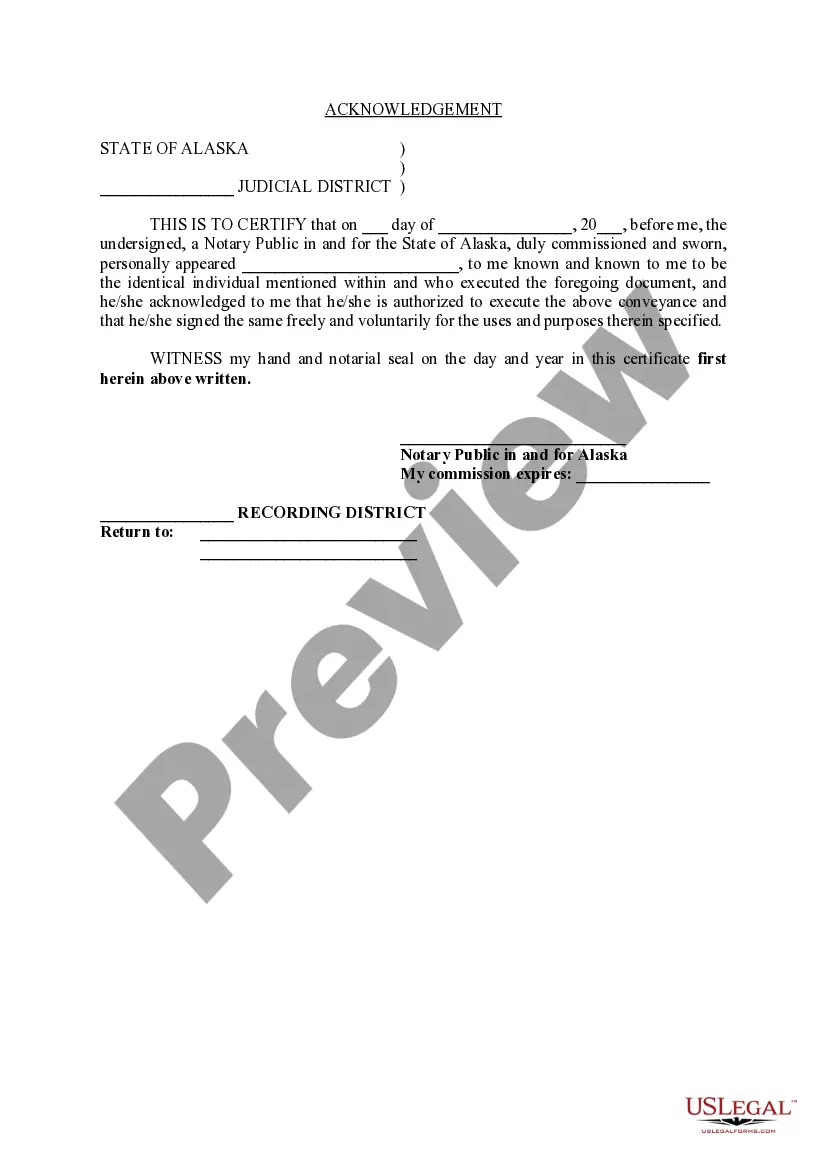

Alaska Tax Deed

Description

How to fill out Alaska Tax Deed?

Utilize US Legal Forms to acquire a downloadable Alaska Tax Deed.

Our legally acceptable forms are crafted and frequently refreshed by experienced attorneys.

Ours is the most extensive collection of forms available online, providing economical and precise templates for clients, legal professionals, and small to medium-sized businesses.

Examine the form by reading its description and utilizing the Preview function. If it’s the template you require, click Buy Now. Create your account and complete the payment via PayPal or credit card. Download the template to your device and you are free to reuse it multiple times. If you seek another document template, use the search engine. US Legal Forms provides a vast array of legal and tax templates and packages for both business and personal purposes, including the Alaska Tax Deed. Over three million users have successfully utilized our service. Select your subscription plan and obtain high-quality forms with just a few clicks.

- The documents are organized into state-specific categories.

- Several documents can be previewed prior to downloading.

- Customers must maintain a subscription and sign in to their account to access templates.

- Click Download beside any template you wish to obtain and locate it in My documents.

- For those without a subscription, adhere to the following steps to swiftly find and download the Alaska Tax Deed.

- Ensure that you select the correct form corresponding to the required state.

Form popularity

FAQ

The property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges.Before being transferred to the winning bidder, the property should be cleared of all mortgages and liens against it.

Tax deed sales must eliminate any community association liens and debts acquired prior to the tax deed. Tax deed sales must reduce any code enforcement liens to hard costs if the tax deed investor timely addresses such liens and underlying issues after purchasing the tax deed.

The Bottom LineTax deed auctions let investors acquire real estate that has been foreclosed because of unpaid taxes. Properties can be purchased at significant discounts to market value, but the complexity and risks of tax deed investing are also significant.

A tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. Tax deeds are sold to the highest bidder at auction for a minimum bid of the outstanding taxes plus interest and the costs associated with the sale.

Once the property is sold at a tax deed sale, the property is conveyed to the new buyer, wiping out most debts or encumbrances, including mortgages, and giving the buyer ownership to the property from the sale date forward.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

The biggest difference between a tax deed sale and the foreclosure sale has to do with due diligence by the buyer.The buyer is also liable for homeowner or condominium association fees after the tax deed is issued by the Clerk of Court.

In a tax deed sale, the property itself is sold. The sale takes place through an auction, with a minimum bid of the amount of back taxes owed plus interest, as well as costs associated with selling the property. The highest bidder wins the property.