This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

Alaska Secured Promissory Note

Description Alaska Language On Promissory Note Secured By Real Property

How to fill out Alaska Secured Promissory Note?

Using Alaska Secured Promissory Note templates created by experienced attorneys allows you to sidestep complications when filling out paperwork.

Just download the template from our site, complete it, and have a lawyer review it.

This approach can save you significantly more time and money compared to hiring an attorney to draft a document from the ground up for you.

Streamline the time you allocate to document preparation with US Legal Forms!

- If you possess a US Legal Forms subscription, simply Log In to your account and navigate back to the form section.

- Locate the Download button adjacent to the templates you're examining.

- Once you download a template, your saved samples will appear in the My documents tab.

- If you lack a subscription, it's not a major issue. Just follow the steps outlined below to register for your account online, obtain, and complete your Alaska Secured Promissory Note template.

- Verify that you’re downloading the correct state-specific document.

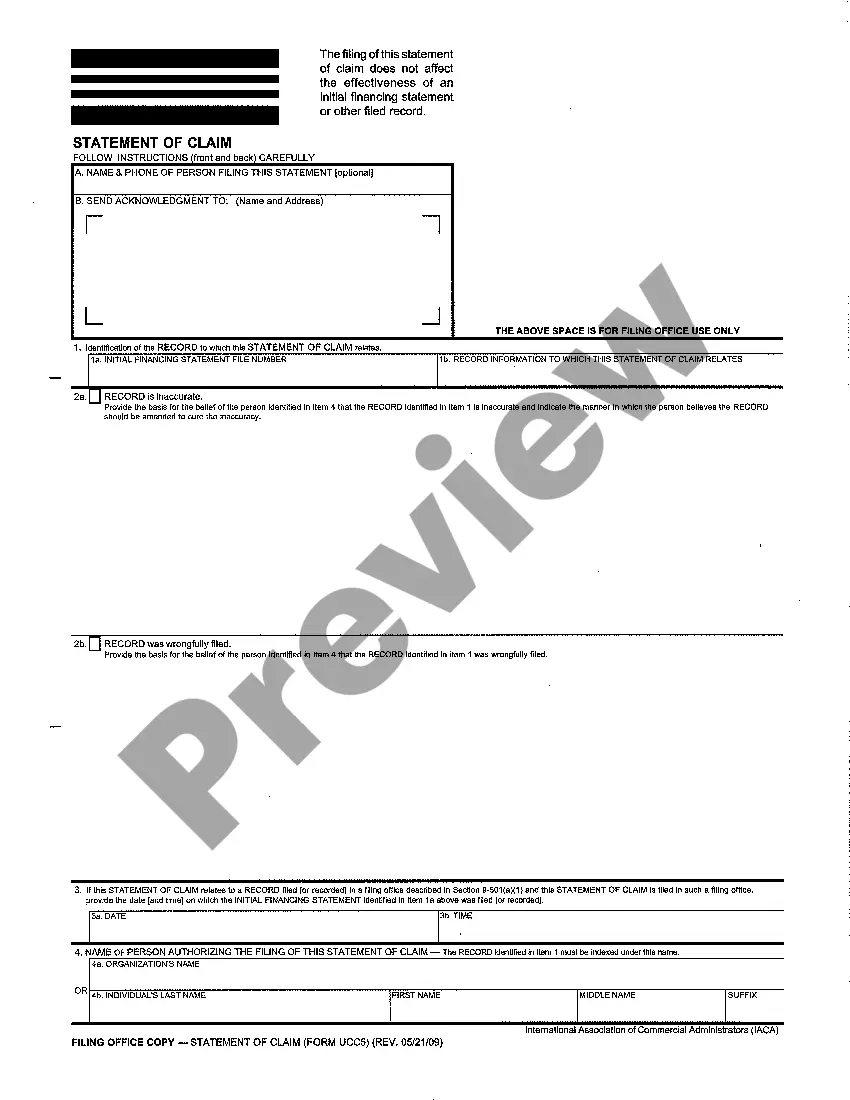

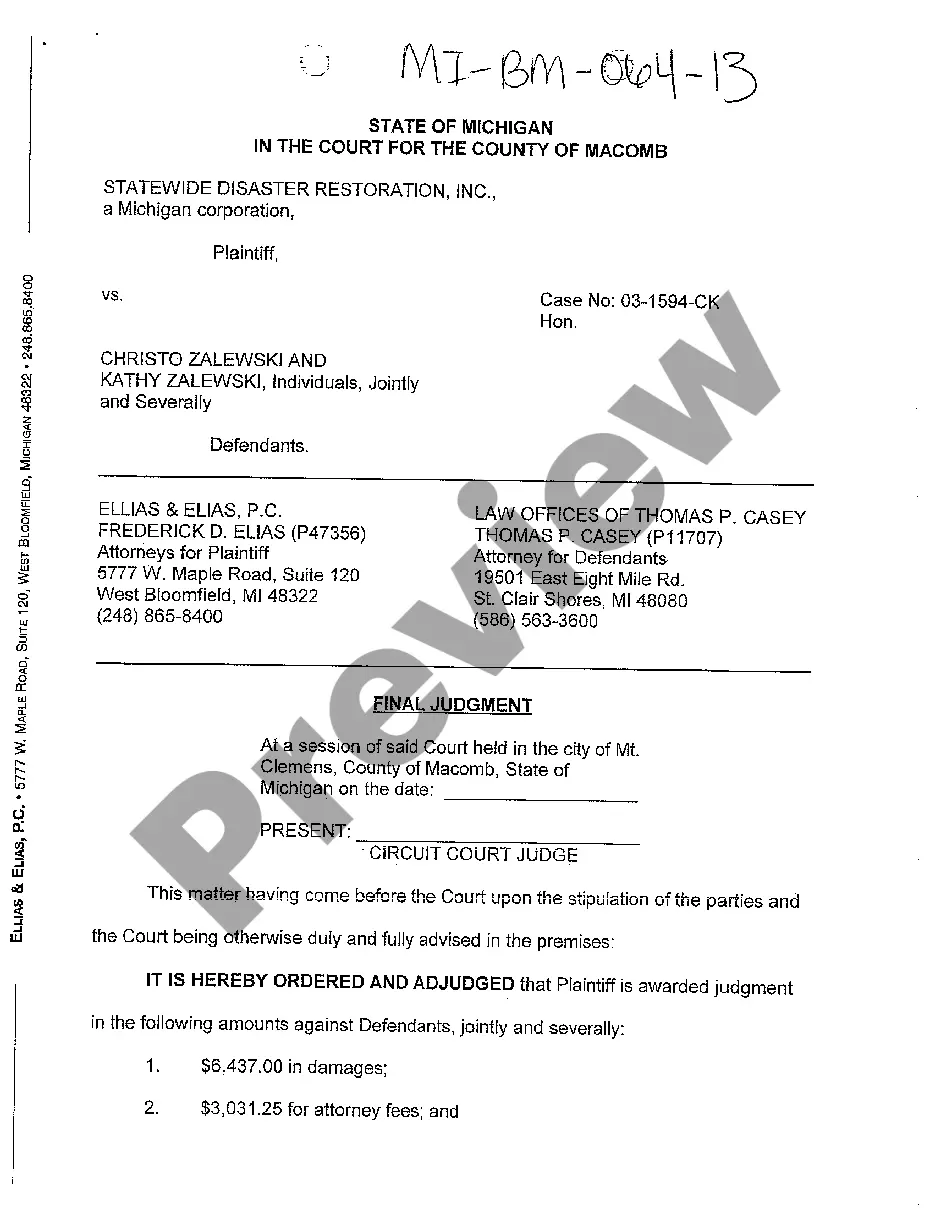

- Use the Preview feature to view the details (if available) to ascertain if this particular template is what you need, and if it is, click Buy Now.

Form popularity

FAQ

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.