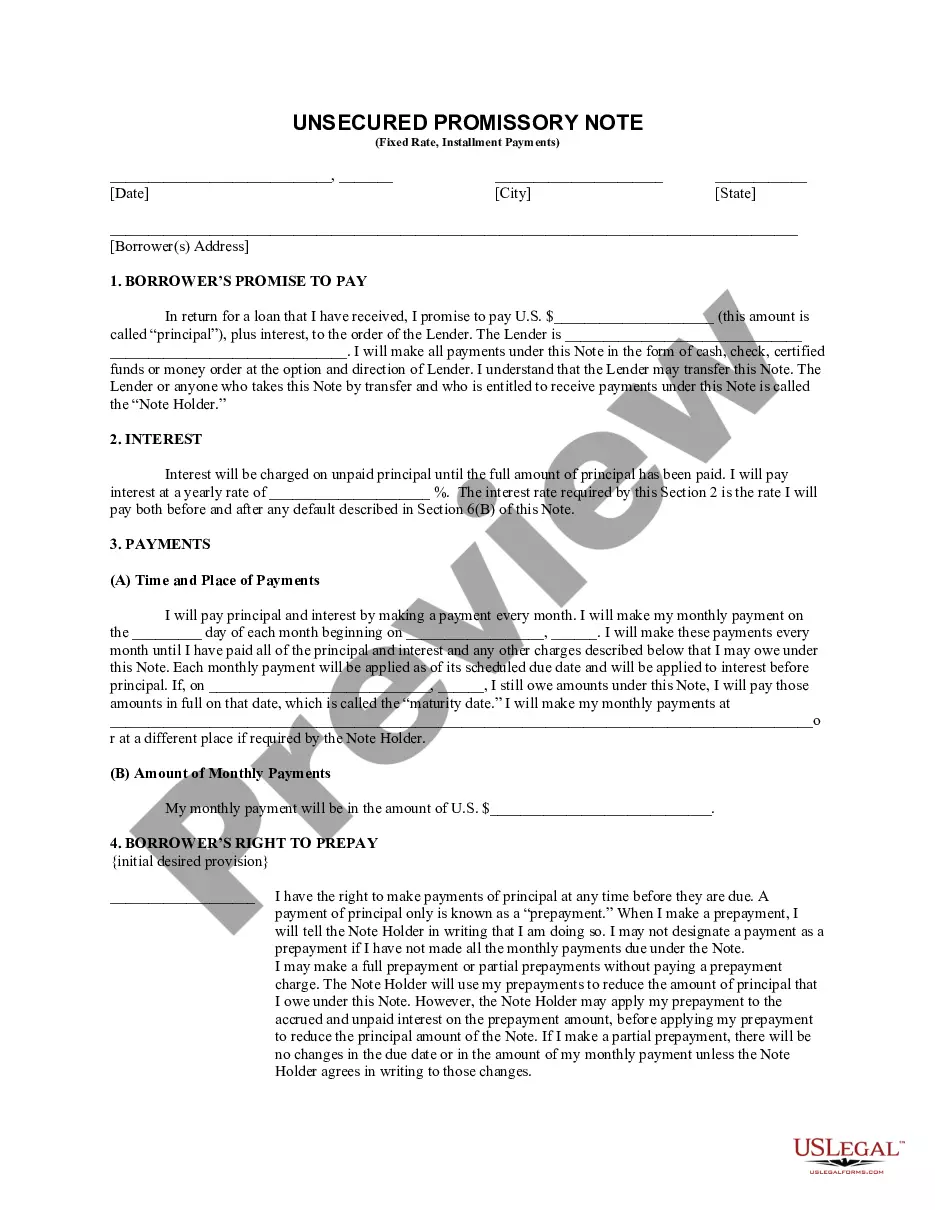

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Alaska Unsecured Installment Payment Promissory Note for Fixed Rate

Description Promissory Letter For Tuition Fee

How to fill out Promise To Pay Letter Sample?

Employing Alaska Unsecured Installment Payment Promissory Note for Fixed Rate templates crafted by expert attorneys allows you to avoid stress when submitting paperwork.

Simply download the form from our site, complete it, and request a lawyer to validate it.

This can save you considerably more time and money than searching for a legal expert to create a document entirely from the beginning to meet your requirements.

Utilize the Preview option and review the description (if available) to determine if you need this specific template, and if so, just click Buy Now.

- If you’ve already purchased a US Legal Forms subscription, just Log In to your account and revisit the templates page.

- Locate the Download button near the documents you are examining.

- After downloading a document, all your saved forms can be found in the My documents section.

- If you lack a subscription, that's not an issue.

- Simply follow the outlined steps below to register for your account online, obtain, and fill out your Alaska Unsecured Installment Payment Promissory Note for Fixed Rate template.

- Verify and make sure that you are downloading the correct state-specific form.

Example Of Promissory Note For Tuition Fee Form popularity

How To Draft A Promissory Note Other Form Names

Promissory Note For Late Payment Of Tuition Fee FAQ

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

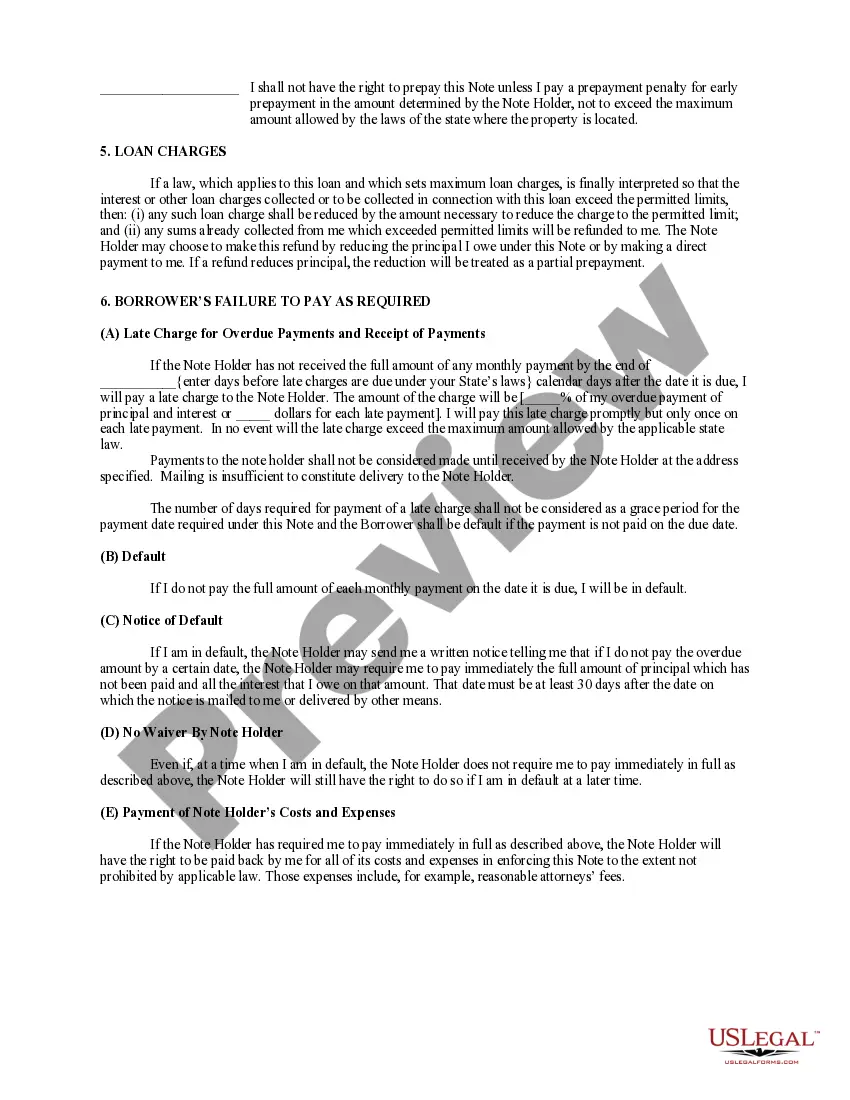

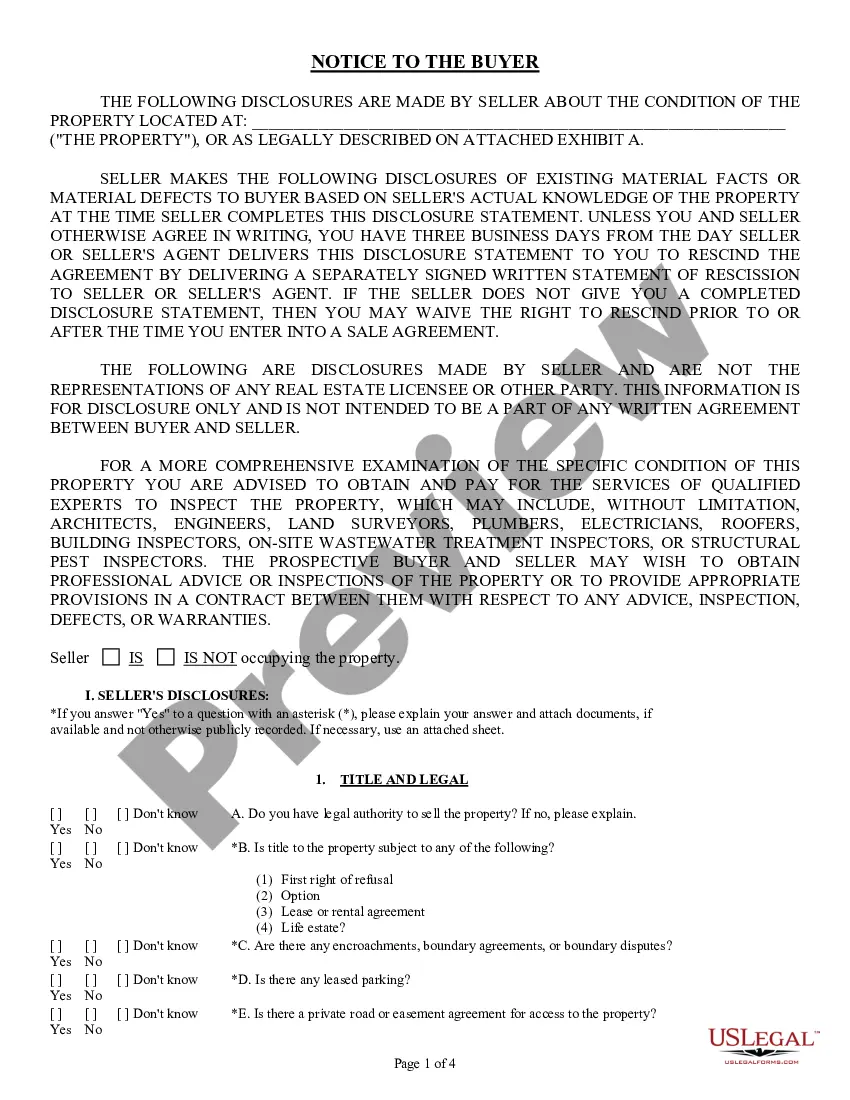

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

I hereby affix my signature to this agreement. Done this _____ Day of _________ 20____. To whom it may concern, This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P____________________.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.