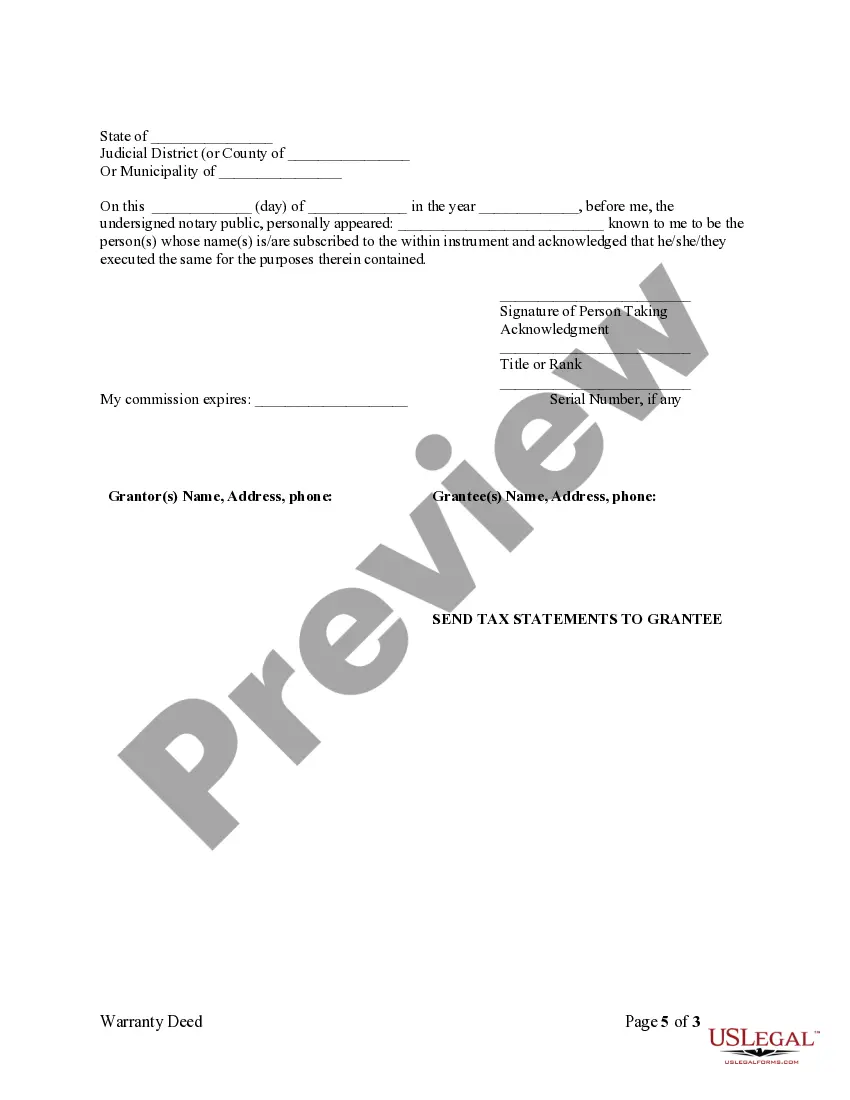

This form is a Warranty Deed where the grantor(s) retain a life estate in the named property.

Alaska Warranty Deed for Parents to Child with Reservation of Life Estate

Description Life Estate Deed Alaska

How to fill out Alaska Warranty Deed For Parents To Child With Reservation Of Life Estate?

Among countless complimentary and premium instances that you can discover on the web, you cannot be sure of their validity.

For instance, who created them or if they possess the expertise to handle the matters you need them for.

Stay calm and utilize US Legal Forms!

Once you’ve registered and paid for your subscription, you can utilize your Alaska Warranty Deed for Parents to Child with Reservation of Life Estate as frequently as required or as long as it remains active in your region. Edit it with your chosen offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Find Alaska Warranty Deed for Parents to Child with Reservation of Life Estate templates created by expert attorneys and steer clear of the expensive and time-consuming task of searching for a lawyer and then compensating them to draft documents that you can easily access yourself.

- If you have a subscription, Log In to your account and find the Download button next to the form you’re seeking.

- You'll also have the ability to view your previously saved documents in the My documents section.

- If you are using our site for the first time, adhere to the steps below to obtain your Alaska Warranty Deed for Parents to Child with Reservation of Life Estate smoothly.

- Ensure that the document you are viewing is valid in your jurisdiction.

- Examine the document by reviewing the description with the Preview feature.

Life Estate Deed Form Form popularity

FAQ

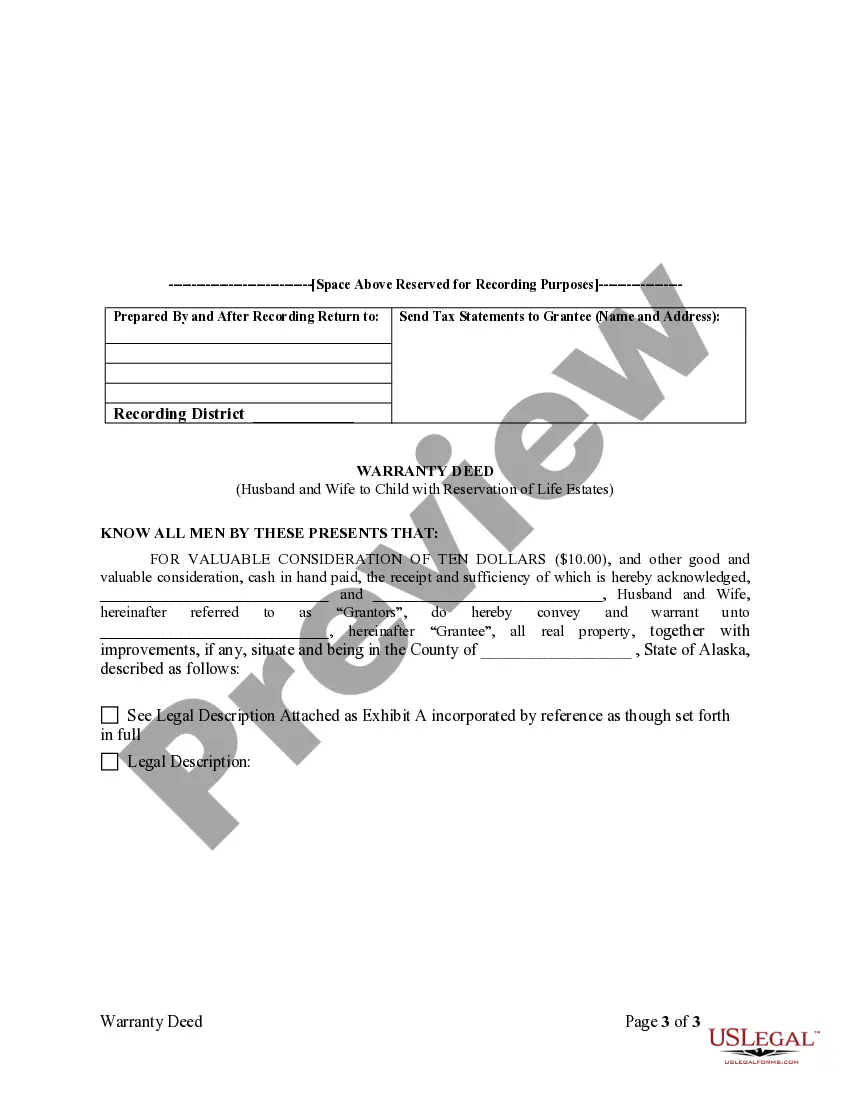

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

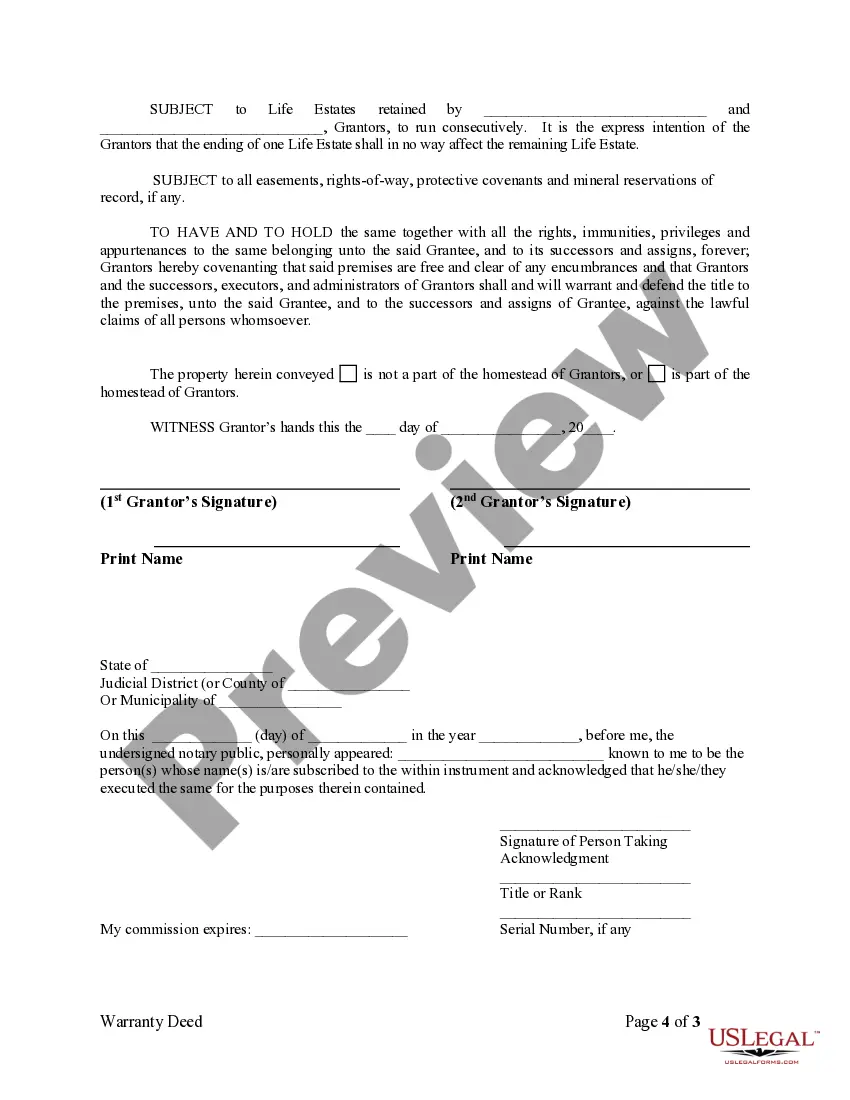

To accomplish this, you need to have the life estate deed that shows you have the right to own the property after the life estate holder dies. Using the information in this deed, along with the deceased's death certificate, you can prepare and record the required title transfer document to clear title.

Lady bird deeds differ from traditional life estate deeds in that the life tenant continues to have the right to sell or mortgage his / her home without beneficiary consent. In fact, the life tenant is even able to cancel the deed or change the beneficiary.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

A Life Estate may be created in real property or in personal property. It is a term used to describe ownership of an asset for the duration of the person's life. The owner of a Life Estate is called a 'life tenant'. The life tenant has the right to possession and enjoyment of the asset and its income until their death.