Alaska Corporate Resolution for Bank Account

Description

How to fill out Corporate Resolution For Bank Account?

If you need to acquire, generate, or print authentic document templates, utilize US Legal Forms, the largest compilation of legal forms accessible online.

Utilize the website's straightforward and user-friendly search feature to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords. Utilize US Legal Forms to download the Alaska Corporate Resolution for Bank Account with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Alaska Corporate Resolution for Bank Account with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal purposes.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to get the Alaska Corporate Resolution for Bank Account.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/state.

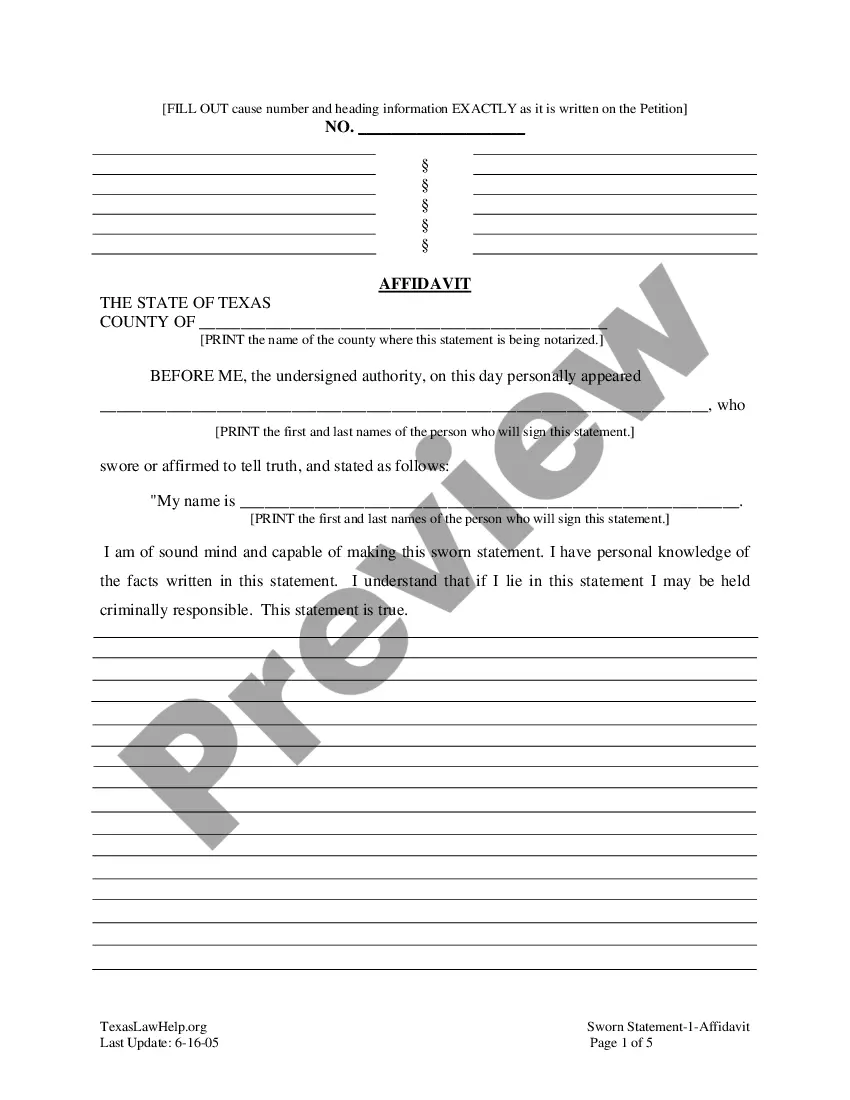

- Step 2. Use the Preview option to review the form's content. Remember to read through the summary.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find other forms in the legal form template.

- Step 4. Once you have located the form you need, click the Buy Now button. Choose the payment plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account for payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Alaska Corporate Resolution for Bank Account.

Form popularity

FAQ

Resolution is the restructuring of a bank by a resolution authority through the use of resolution tools in order to safeguard public interests, including the continuity of the bank's critical functions, financial stability and minimal costs to taxpayers.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution form is used when a corporation wants to document major decisions made during the year. It is especially important when decisions made by a corporation's directors or shareholders are in written form. 1. Steps for Writing a Corporate Resolution.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.