The Alaska Deferred Compensation Agreement — Short Form is a contractual arrangement allowing employees to defer a portion of their income, typically in the form of salary or bonuses, to be received at a later date. This agreement is specifically designed for individuals working in Alaska and offers various benefits to participants, including tax advantages and retirement planning options. The primary purpose of the Alaska Deferred Compensation Agreement — Short Form is to provide employees with the flexibility to defer a portion of their compensation and invest it for future use. By deferring a portion of their income, employees can potentially reduce their current taxable income, allowing them to save on taxes in the immediate term. Moreover, the agreement also allows employees to accumulate funds for retirement, as the deferred compensation can be invested in various investment options such as mutual funds, stocks, bonds, or other qualified investments. This enables employees to grow their retirement savings over time, potentially resulting in a larger nest egg for their retirement years. The Alaska Deferred Compensation Agreement — Short Form may have different variations based on the specific employer or organization offering the plan. Different plan options could include Roth deferrals, which enable employees to contribute after-tax income and potentially withdraw the funds tax-free in retirement, or traditional pre-tax deferrals where the contributions are tax-deductible in the year they are made. Participants in the agreement may also benefit from employer matching contributions, which can further boost their retirement savings. These employer matches may be subject to certain vesting requirements, meaning employees must remain with the company for a certain period to fully access the employer's contributions. Additionally, the Alaska Deferred Compensation Agreement — Short Form may offer features such as catch-up contributions for employees who are closer to retirement age, allowing them to contribute additional amounts beyond the regular annual limits. This feature enables individuals to accelerate their savings as they approach their desired retirement date. Overall, the Alaska Deferred Compensation Agreement — Short Form provides employees with a valuable tool to save for retirement while potentially reducing current tax burdens. It offers a range of investment options and features that can be tailored to individual circumstances, allowing participants to effectively plan and manage their long-term financial goals.

Alaska Deferred Compensation Agreement - Short Form

Description

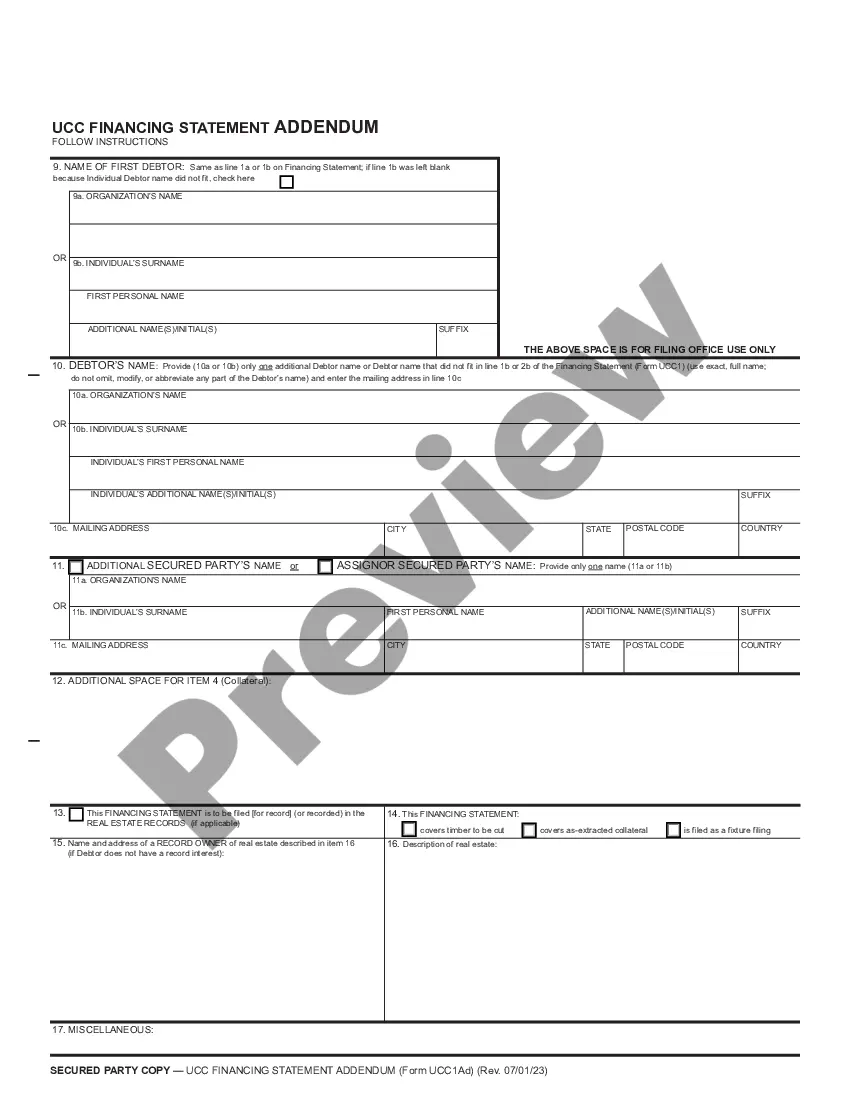

How to fill out Alaska Deferred Compensation Agreement - Short Form?

If you intend to be thorough, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest variety of legal documents available online.

Take advantage of the site’s user-friendly and convenient search feature to locate the documents you require.

Various templates for business and personal purposes are sorted by categories and suggestions, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to create an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the purchase.

- Utilize US Legal Forms to locate the Alaska Deferred Compensation Agreement - Short Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Alaska Deferred Compensation Agreement - Short Form.

- You can also access documents you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Preview option to review the form's details. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to explore other versions of the legal form format.

Form popularity

FAQ

Deferred compensation plans come in two types qualified and non-qualified. Qualified retirement plans such as 401(k), 403(b) and 457 plans, are offered to all employees and are taxed when the contribution is made to the account.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

What is a deferred compensation plan? A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Deferred compensation plans are funded informally. There is essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

Money saved in a 457 plan is designed for retirement, but unlike 401(k) and 403(b) plans, you can take a withdrawal from the 457 without penalty before you are 59 and a half years old.

A 457 plan is a tax-deferred retirement savings plan. Funds are withdrawn from an employee's income without being taxed and are only taxed upon withdrawal, which is typically at retirement, after the funds have had several years to grow.

Deferred compensation is a portion of an employee's compensation that is set aside to be paid at a later date. In most cases, taxes on this income are deferred until it is paid out. Forms of deferred compensation include retirement plans, pension plans, and stock-option plans.

The Deferred Compensation Plan allows you to voluntarily set aside a portion of your income either before it is taxed or after it has been taxed. The amount set aside, plus any change in value (interest, gains and losses), is payable to you or your beneficiary at a future date.

More info

IFID Business Solutions Other Deferred Compensation Plan related legal terms that may have to be written down to be legally valid in all jurisdictions.