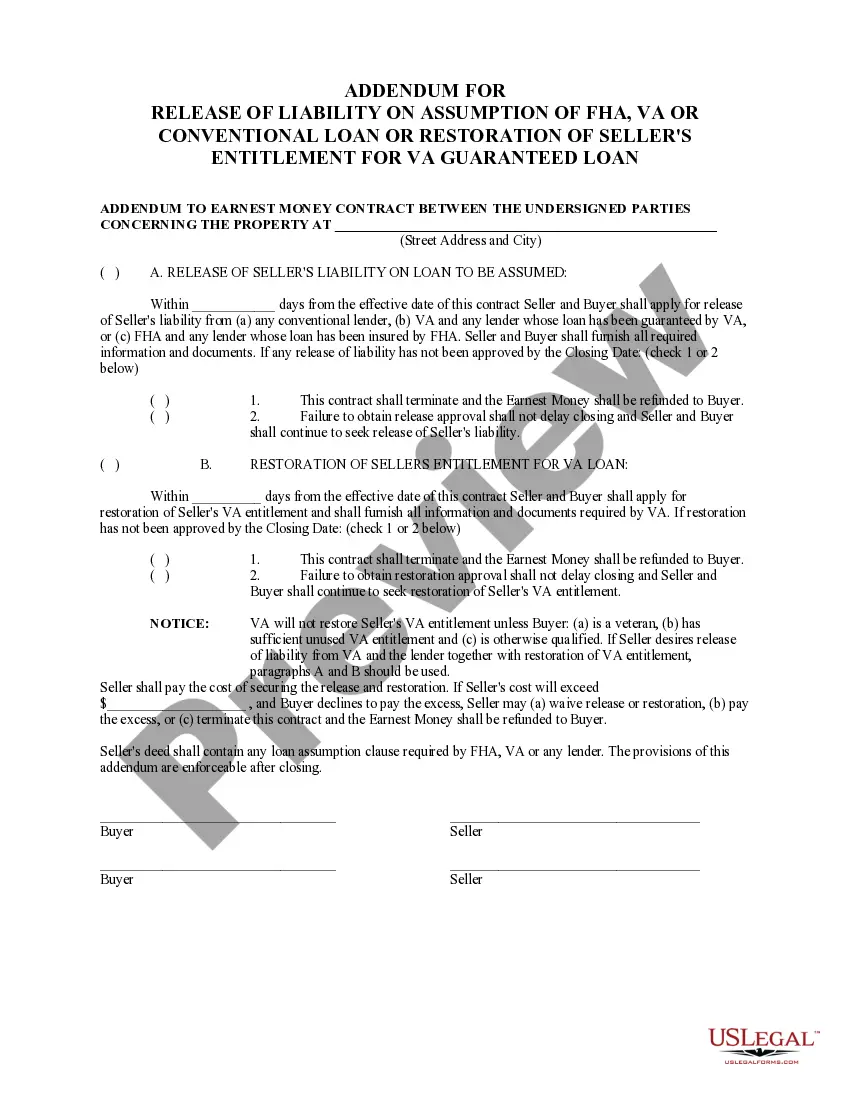

Alaska Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

If you want to complete, download, or print legitimate document layouts, use US Legal Forms, the biggest selection of legitimate kinds, which can be found on the web. Use the site`s simple and easy hassle-free research to find the files you will need. Different layouts for business and personal purposes are sorted by categories and says, or search phrases. Use US Legal Forms to find the Alaska Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan in a couple of mouse clicks.

Should you be currently a US Legal Forms client, log in in your account and click the Down load switch to have the Alaska Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. You may also access kinds you formerly saved from the My Forms tab of your own account.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for your proper area/land.

- Step 2. Take advantage of the Review choice to look over the form`s content material. Do not neglect to read through the outline.

- Step 3. Should you be unhappy using the develop, take advantage of the Search industry towards the top of the screen to discover other versions in the legitimate develop design.

- Step 4. Once you have identified the shape you will need, click on the Get now switch. Choose the pricing plan you prefer and put your qualifications to sign up for the account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Find the file format in the legitimate develop and download it on your own device.

- Step 7. Complete, change and print or indication the Alaska Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan.

Every legitimate document design you get is the one you have forever. You have acces to each develop you saved in your acccount. Select the My Forms segment and decide on a develop to print or download once more.

Remain competitive and download, and print the Alaska Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan with US Legal Forms. There are millions of expert and condition-particular kinds you may use for your personal business or personal needs.

Form popularity

FAQ

The Bottom Line The FHA amendatory clause protects borrowers because if the appraisal comes back low, the buyer can cancel the transaction and get their earnest money back. Signing on the dotted line for a home that appraises for below the sales price could result in a bad investment for both lenders and buyers.

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

For VA loan assumptions, the only way to safeguard your entitlement is to have a Veteran assume your loan and substitute their entitlement for yours. Unless that happens, Veterans will not regain their entitlement with a loan assumption ? it will remain tied to the property until the loan is repaid in full.

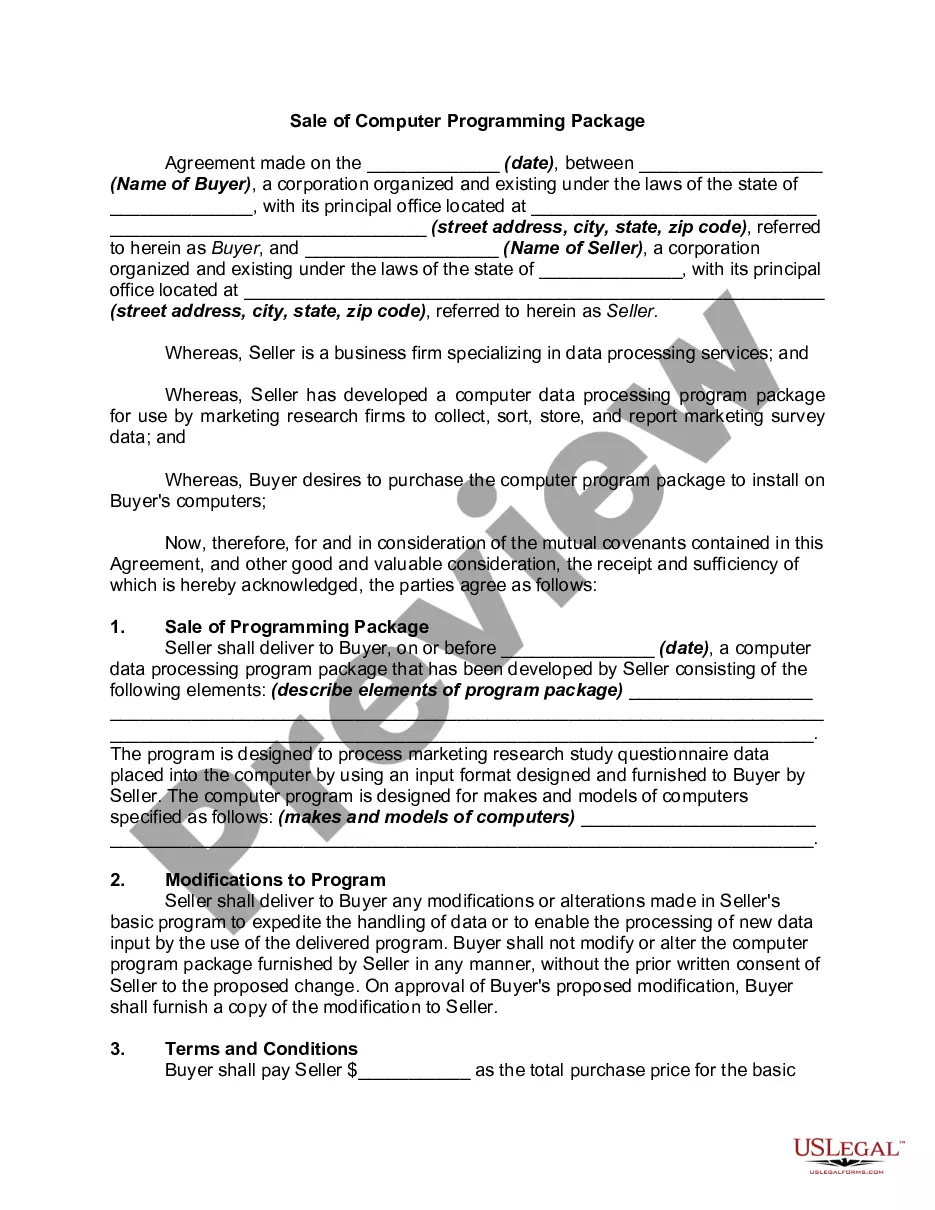

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.

VA loans include certain contingencies that protect earnest money deposits and allow them to be refunded to the buyer under specific circumstances. Some of the most common VA contract contingencies include a home inspection contingency, financing contingency, home sale contingency and appraisal contingency.

The essential purpose of the FHA and VA amendatory/escape clauses is to give the buyer the right to terminate the sales contract if the sales price exceeds the appraised value of the Property. Form 2A4-T includes the prescribed wording of the FHA and VA amendatory/escape clauses.

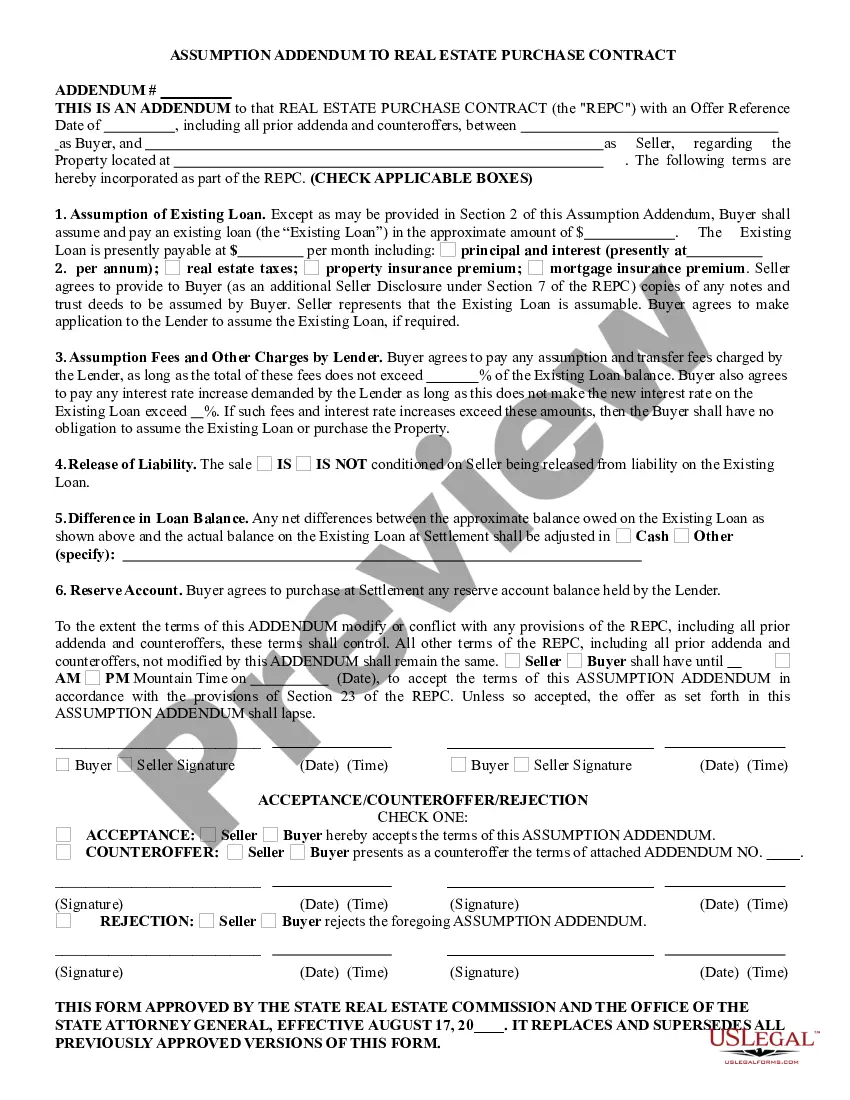

Addendum for Release of Liability on Assumed Loan and/or Restoration of Seller's VA Entitlement. Description: This Addendum is used in conjunction with the Loan Assumption Addendum if the Seller wants to be released from future liability of the loan.

If the purchaser(s) is creditworthy and assumes the liability to the lender and VA to the same extent that you did when you obtained the loan, you will be released from liability on the loan. To obtain a release from liability, you should check with the company to whom you make your payments before you sell your home.