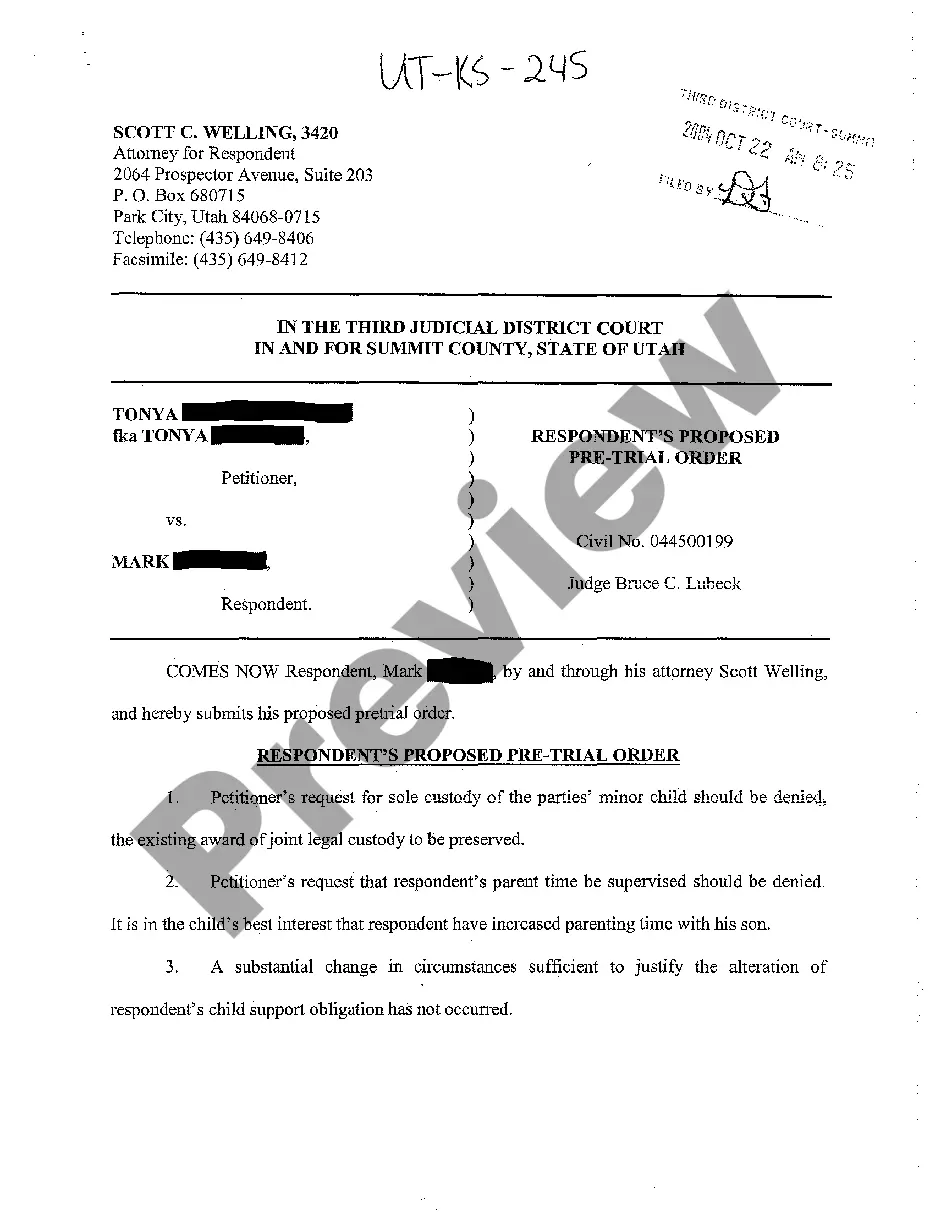

Dear State Tax Commission, I am writing to submit my payment for the taxes owed to the state of Alaska. Below, please find the detailed information about my payment, including the amount, payment method, and relevant reference numbers. Amount: EX, XXX.XX Taxpayer Name: [Your Name] Taxpayer Identification Number: [Your Tax ID] Date of Payment: [Date of Payment] Payment Method: [Check/Credit Card/Electronic Funds Transfer] Payment Reference Number: [Reference Number] I have enclosed a check in the amount of EX, XXX.XX, made payable to the Alaska State Tax Commission, which is to be attributed to my tax account [Your Tax ID]. Please ensure that this payment is promptly and accurately credited to my account. In case the preferred payment method is via credit card, kindly find the following details: — Card Type: [Visa/Mastercard/American Express] — Cardholder Name: [Your Name as it appears on the card] — Card Number: [Card Number— - Expiration Date: [Expiration Date] — CVV Code: [CVV Code] Alternatively, if you prefer electronic funds transfer, kindly provide me with the necessary information to initiate the transfer, including the bank account number, routing number, and any additional instructions. It is crucial that this payment is processed and applied to my account in a timely manner to avoid any penalties or interest charges. I kindly request that you confirm the receipt and application of this payment via mail or email for my records. Thank you for your prompt attention to this matter. Should you require any additional information or have any questions, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] Possible variations of Alaska Sample Letter to State Tax Commission sending Payment: 1. Alaska Sample Letter to State Tax Commission sending Electronic Funds Transfer Payment 2. Alaska Sample Letter to State Tax Commission sending Credit Card Payment 3. Alaska Sample Letter to State Tax Commission sending Check Payment.

Alaska Sample Letter to State Tax Commission sending Payment

Description

How to fill out Alaska Sample Letter To State Tax Commission Sending Payment?

If you wish to complete, down load, or print lawful document layouts, use US Legal Forms, the greatest selection of lawful kinds, that can be found on the Internet. Take advantage of the site`s simple and practical search to get the documents you want. Different layouts for enterprise and personal functions are categorized by categories and states, or keywords. Use US Legal Forms to get the Alaska Sample Letter to State Tax Commission sending Payment in a few click throughs.

In case you are presently a US Legal Forms consumer, log in in your bank account and then click the Download button to have the Alaska Sample Letter to State Tax Commission sending Payment. Also you can entry kinds you formerly saved within the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form to the right metropolis/nation.

- Step 2. Take advantage of the Preview method to look over the form`s content material. Don`t neglect to read through the information.

- Step 3. In case you are unhappy using the type, use the Look for field at the top of the display screen to locate other models of your lawful type design.

- Step 4. Once you have identified the form you want, go through the Acquire now button. Opt for the rates program you choose and add your accreditations to sign up to have an bank account.

- Step 5. Process the purchase. You may use your credit card or PayPal bank account to perform the purchase.

- Step 6. Pick the structure of your lawful type and down load it on the device.

- Step 7. Total, revise and print or indicator the Alaska Sample Letter to State Tax Commission sending Payment.

Every single lawful document design you get is your own property forever. You possess acces to every type you saved inside your acccount. Select the My Forms section and choose a type to print or down load yet again.

Be competitive and down load, and print the Alaska Sample Letter to State Tax Commission sending Payment with US Legal Forms. There are thousands of skilled and condition-particular kinds you may use for the enterprise or personal requirements.

Form popularity

FAQ

America's largest and northernmost state also has the lowest taxes in the nation, as there are no statewide income or sales taxes in Alaska. Residents do need to file a federal tax return, though no state paperwork is required.

Alaska does not have a state income tax for individuals.

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

As with other states, Alaska residents have federal and FICA taxes withheld from their paychecks. This money goes to the IRS, which puts it toward your annual income taxes and, in the case of FICA taxes, Medicare and Social Security.

Alaska is the only state in the United States where a large part of the land mass of the state is not subject to a property tax. Although property tax is the primary method of raising revenues for the majority of the larger municipalities in the state, smaller municipalities favor a sales tax.

The State of Alaska currently does not have an individual income tax; therefore, no employee withholding for state income tax is required.

Alaska Income Tax Calculator 2022-2023. If you make $70,000 a year living in Alaska you will be taxed $8,168. Your average tax rate is 11.67% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Alaska has a 2.0 to 9.40 percent corporate income tax rate. Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent. Alaska's tax system ranks 3rd overall on our 2024 State Business Tax Climate Index.