A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

Alaska Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor

Description

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

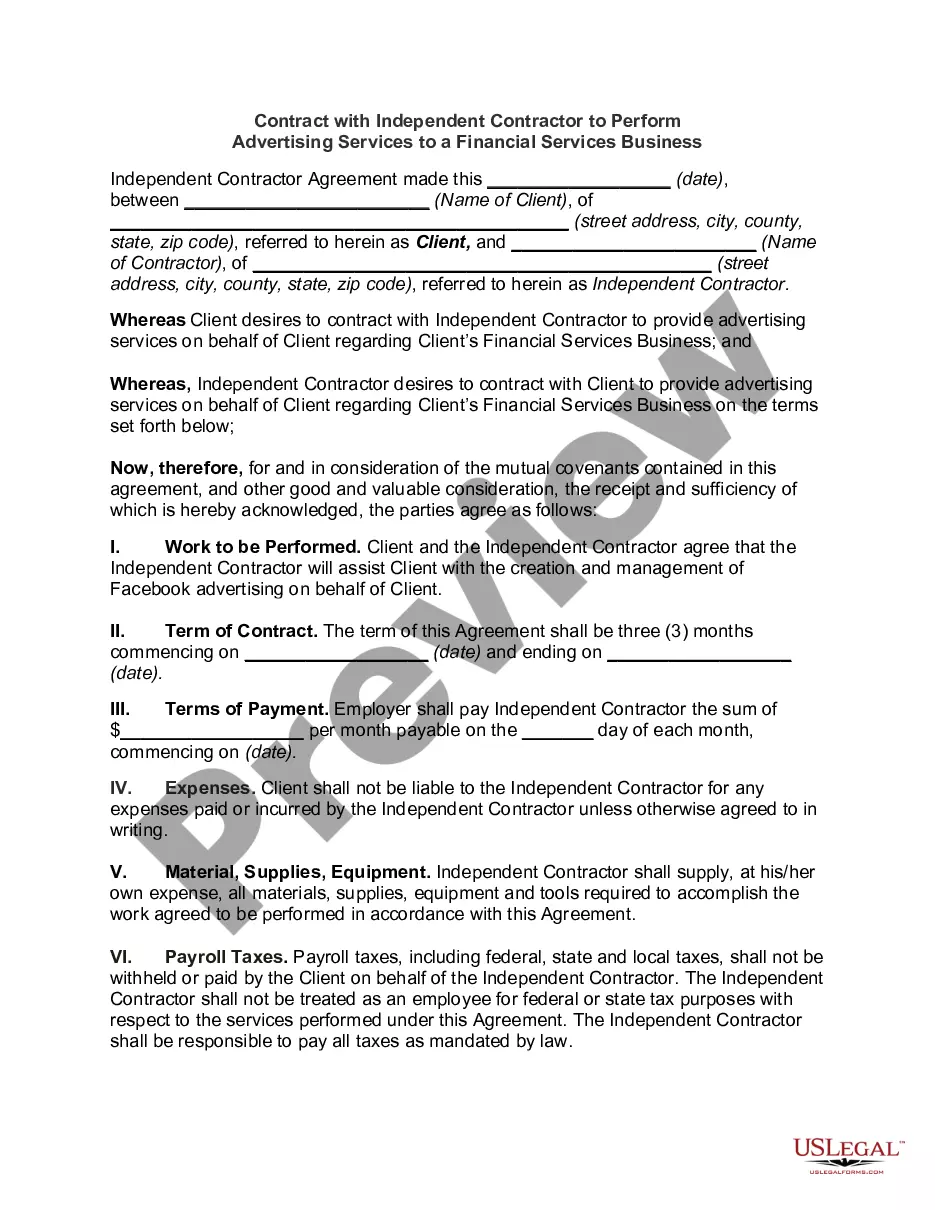

US Legal Forms - one of the largest collections of legitimate documents in America - offers a variety of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Alaska Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor in just seconds.

Review the form information to confirm you have selected the appropriate form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In and download the Alaska Trust Agreement to Hold Funds for Minor from the US Legal Forms catalog.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/state.

- Click the Preview button to review the form's details.

Form popularity

FAQ

A settlement trust fund is a financial arrangement specifically designed to hold funds for a minor who has received compensation from a personal injury action. In many cases, these funds arise from legal settlements made on behalf of the minor, and managing them requires careful planning. The Alaska Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor provides a structured and secure way to oversee these assets until the minor reaches adulthood. By using this type of trust agreement, you can ensure that the funds are used appropriately, providing long-term financial security for the minor.

Alaska Civil Rule 65 defines the procedures for obtaining both temporary and permanent injunctions in civil cases. This rule is essential for protecting the interests of parties, including those involved in an Alaska Trust Agreement to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors. Being aware of this rule equips you with the knowledge needed to seek necessary court interventions effectively.

Civil Rule 69 governs the enforcement of judgments and outlines the procedures for executing a judgment in Alaska. This rule ensures that parties can collect what they are owed, and is particularly relevant in cases involving Alaska Trust Agreements to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors, where proper handling of settlements is crucial for the minor's future. Understanding this rule can assist you in enforcing your rights effectively.

Rule 68 in Alaska incentivizes parties to settle disputes before trial by outlining the consequences of rejecting a reasonable settlement offer. If a party does not accept a reasonable offer and then loses, they may face penalties regarding costs. This rule could apply to cases involving Alaska Trust Agreements to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors, emphasizing the importance of considering settlement options.

To petition a minor compromise in Alaska, you must file a petition in the court detailing the specifics of the settlement and how it benefits the minor. This process often involves creating an Alaska Trust Agreement to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors to ensure that the funds are managed properly. Working with legal professionals or services like UsLegalForms can simplify this process and help you comply with the necessary legal requirements.

Civil Rule 65 addresses the process for obtaining injunctions and restraining orders within the Alaska legal framework. These legal tools can protect the interests of minors, especially in cases involving Alaska Trust Agreements to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors. Familiarity with Rule 65 helps ensure that courts can effectively prevent harm while legal matters are resolved.

Civil Procedure Rule 60 in Alaska provides a mechanism for parties to seek relief from a judgment under specific circumstances. This rule is particularly useful if there has been a mistake, inadvertence, or newly discovered evidence affecting important agreements, such as an Alaska Trust Agreement to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors. Understanding this rule helps parties correct issues that could impact minor beneficiaries.

Rule 40 in Alaska refers to the guidelines governing the assignment of cases to judges. It aims to promote efficiency in the judicial process, ensuring that cases, including those involving Alaska Trust Agreements to Hold Funds for Minors Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minors, are handled without unnecessary delays. Knowing this rule can help you navigate the legal landscape more effectively.

One of the biggest mistakes parents make when setting up a trust fund is not accurately updating the trust as circumstances change. An Alaska Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor can become outdated if parents don't keep the beneficiary's needs in mind. Another common error is failing to choose a reliable trustee. Ensuring ongoing communication and review can save parents from future complications. Platforms like U.S. Legal Forms can help you create and maintain an effective trust fund.

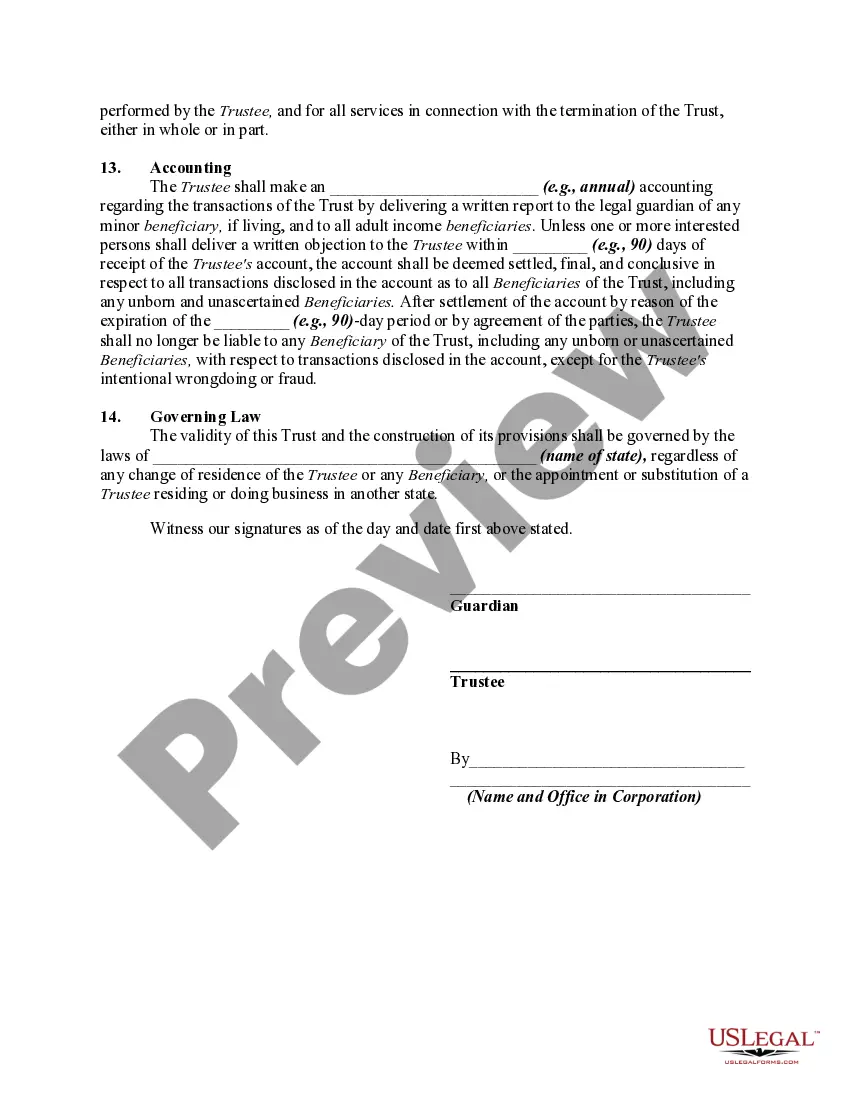

To settle a trust, the trust document must be executed and funds need to be transferred into the trust. In an Alaska Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, this means designating a trustee who will manage the funds on behalf of the minor. It is crucial to follow local laws and guidelines during the settlement process to ensure the trust is legally binding. U.S. Legal Forms offers resources that can guide you through each step of settling a trust.