A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

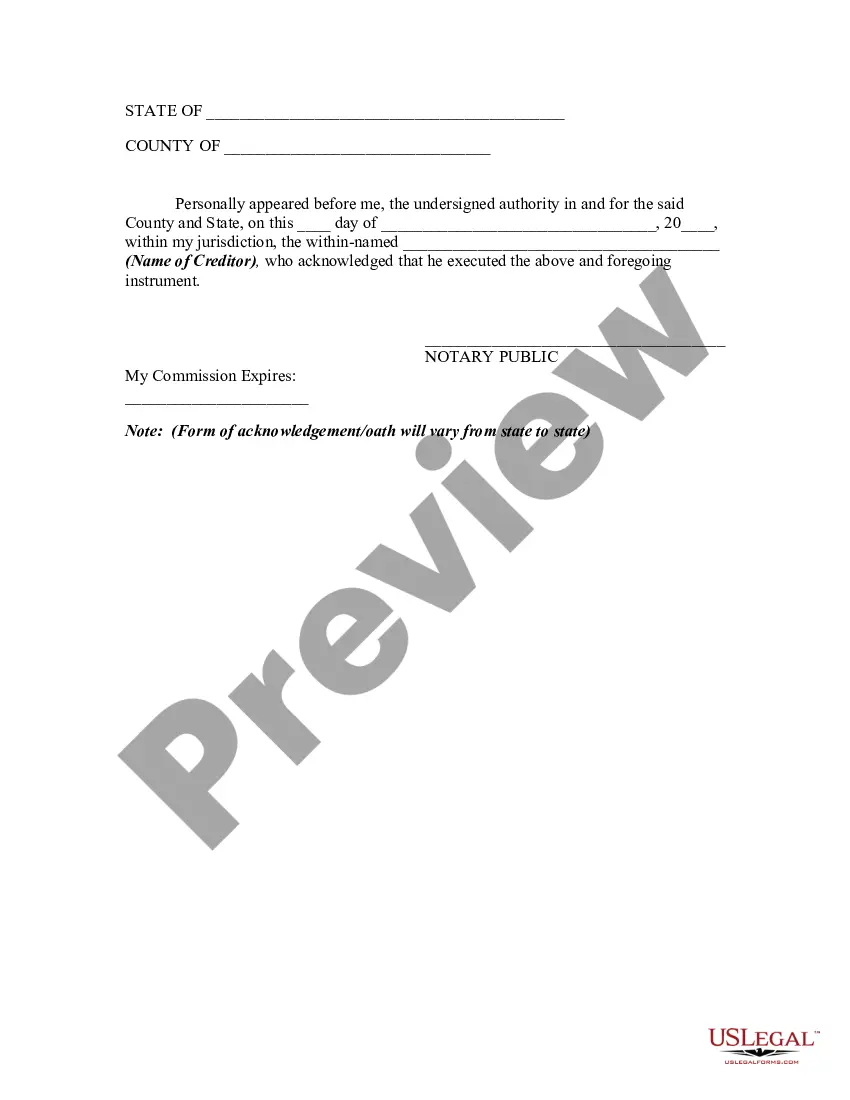

Title: Understanding Alaska Release of Claims Against an Estate By Creditor: Types and Detailed Description Introduction: The Alaska release of claims against an estate by a creditor is a legal document that allows a creditor to release any outstanding claims they may have against the estate of a deceased person in Alaska. In this article, we will delve into the different types of Alaska release of claims against an estate by creditor and provide a detailed description of this legal process. Types of Alaska Release of Claims Against an Estate By Creditor: 1. General Release: A general release is a comprehensive document that absolves the creditor from all claims against the estate. It releases the creditor from further pursuit of any outstanding debt, whether known or unknown, which may have arisen before the decedent's death. 2. Limited Release: A limited release differs from a general release in that it specifically limits the scope of the creditor's claims against the estate. This type of release is typically used when the creditor agrees to waive only a portion of the debt or accepts a settlement amount. Detailed Description of Alaska Release of Claims Against an Estate By Creditor: The Alaska release of claims against an estate by a creditor serves several crucial purposes in the probate process. It ensures the fair distribution of assets to all beneficiaries and provides protection to the estate's executor or personal representative by resolving potential credit disputes. Here is a step-by-step breakdown of the process: 1. Identifying the Creditor and Debt: The creditor must accurately identify themselves and provide documentation supporting their claim against the estate. This may include invoices, contracts, loan agreements, or other evidence of the debt. 2. Drafting the Release Agreement: The creditor, in coordination with their legal counsel, drafts a release agreement containing the specific terms under which they are willing to release their claim against the estate. The agreement should state the amount of debt being released and any additional terms or conditions agreed upon. 3. Negotiation and Review: Once the release agreement is drafted, it is presented to the estate's personal representative or executor for review. Negotiations may occur to reach a mutually acceptable resolution that benefits both parties involved. 4. Execution of the Release: Once both parties agree upon the terms, the creditor signs the release agreement in the presence of a notary public to ensure its validity. The personal representative or executor also signs the document, acknowledging the release of claims. 5. Filing and Documentation: After execution, the release agreement must be appropriately filed with the Probate Court in Alaska. This ensures its inclusion in the estate's official records and provides legal protection to both parties. Conclusion: The Alaska release of claims against an estate by a creditor is a vital legal process that helps resolve outstanding debts and protects the estate's assets. Understanding the different types of release options available ensures creditors can navigate this process effectively, promoting a smoother probate procedure in Alaska. If you are a creditor with a claim against an estate, consulting an attorney with experience in probate and estate law is recommended to ensure your interests are protected throughout the release process.