Alaska Complaint regarding Group Insurance Contract

Description

How to fill out Complaint Regarding Group Insurance Contract?

US Legal Forms - one of several biggest libraries of authorized forms in America - offers a wide range of authorized papers layouts you can down load or produce. While using site, you may get thousands of forms for company and personal functions, categorized by types, states, or key phrases.You can get the most recent models of forms much like the Alaska Complaint regarding Group Insurance Contract in seconds.

If you already have a monthly subscription, log in and down load Alaska Complaint regarding Group Insurance Contract in the US Legal Forms library. The Down load button can look on every single kind you see. You have access to all in the past acquired forms inside the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, allow me to share easy directions to help you started off:

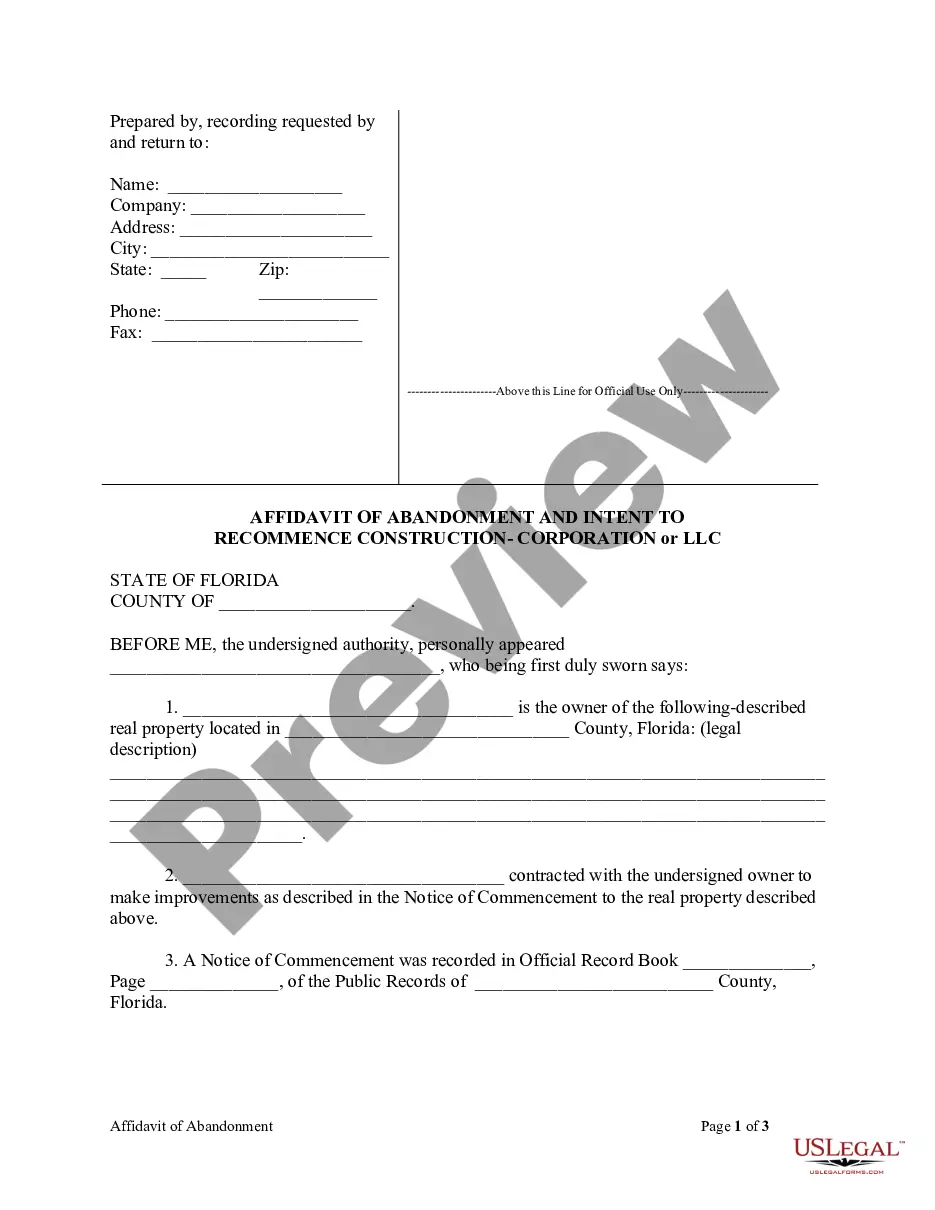

- Be sure you have picked out the correct kind for your personal city/state. Select the Review button to examine the form`s content material. See the kind information to ensure that you have selected the appropriate kind.

- When the kind doesn`t satisfy your needs, utilize the Research field at the top of the display screen to get the one who does.

- Should you be happy with the form, validate your decision by visiting the Get now button. Then, opt for the costs prepare you want and offer your qualifications to register to have an accounts.

- Approach the purchase. Utilize your credit card or PayPal accounts to complete the purchase.

- Pick the format and down load the form on the device.

- Make modifications. Complete, revise and produce and sign the acquired Alaska Complaint regarding Group Insurance Contract.

Every format you added to your account does not have an expiration particular date and it is your own forever. So, if you would like down load or produce one more duplicate, just go to the My Forms area and click on on the kind you want.

Gain access to the Alaska Complaint regarding Group Insurance Contract with US Legal Forms, the most considerable library of authorized papers layouts. Use thousands of skilled and condition-specific layouts that fulfill your business or personal demands and needs.

Form popularity

FAQ

The Insurance Commissioner runs the Georgia Department of Insurance and is elected every four years in a statewide vote.

Insurance and Safety Fire Commissioner John F. King was appointed by Governor Brian P. Kemp in 2019 and elected to the position in 2022. A native of Mexico, King is Georgia's first Hispanic statewide elected official.

As Director of the Alaska Division of Insurance, Wing-Heier oversees and enforces the Division's mission to regulate the insurance industry to protect Alaskan consumers. Wing-Heier is a 30-year resident of Alaska.

The Office of Insurance and Safety Fire Commissioner licenses and regulates insurance companies; ensures that insurance rates, rules, and forms comply with state law; investigates suspicions of insurance fraud; and conducts inspections of buildings and houses to prevent fire outbreak.

File Your Complaint File your complaint by using our online Consumer Complaint Portal. Visit our online Consumer Complaint Portal. Create an account. ... File your complaint by email or by mail. Fill out the Complaint Form as instructed. The preferred and most efficient process is the online complaint process above.

If you experience a insurance related claims-handling issue after a disaster, you are welcome to contact Consumer Services at the Alaska Division of Insurance 907-269-7900 with your concerns.

Attach copies of documents related to the transaction described in the complaint, including any contracts, invoices or receipts. Please do not send originals. Once you have all this together, mail it to us at the address at the top of the form or email it to us at consumerprotection@alaska.gov.

Fill out the Complaint Form as instructed. The preferred and most efficient process is the online complaint process above. Email and mail are both slower processes. Mail to: Georgia Department of Insurance. 2 Martin Luther King Jr. Drive. Suite 716 West Tower. Atlanta, Georgia 30334.