Alaska Noncompetition Agreement between Buyer and Seller of Business

Description

How to fill out Noncompetition Agreement Between Buyer And Seller Of Business?

Are you presently situated in a position where you require documentation for occasional business or personal reasons almost all the time.

There are countless legal document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms offers numerous form templates, such as the Alaska Noncompetition Agreement between Buyer and Seller of Business, which can be tailored to comply with state and federal requirements.

Once you find the correct form, click Get now.

Choose the pricing plan you prefer, input the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Alaska Noncompetition Agreement between Buyer and Seller of Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the appropriate city/state.

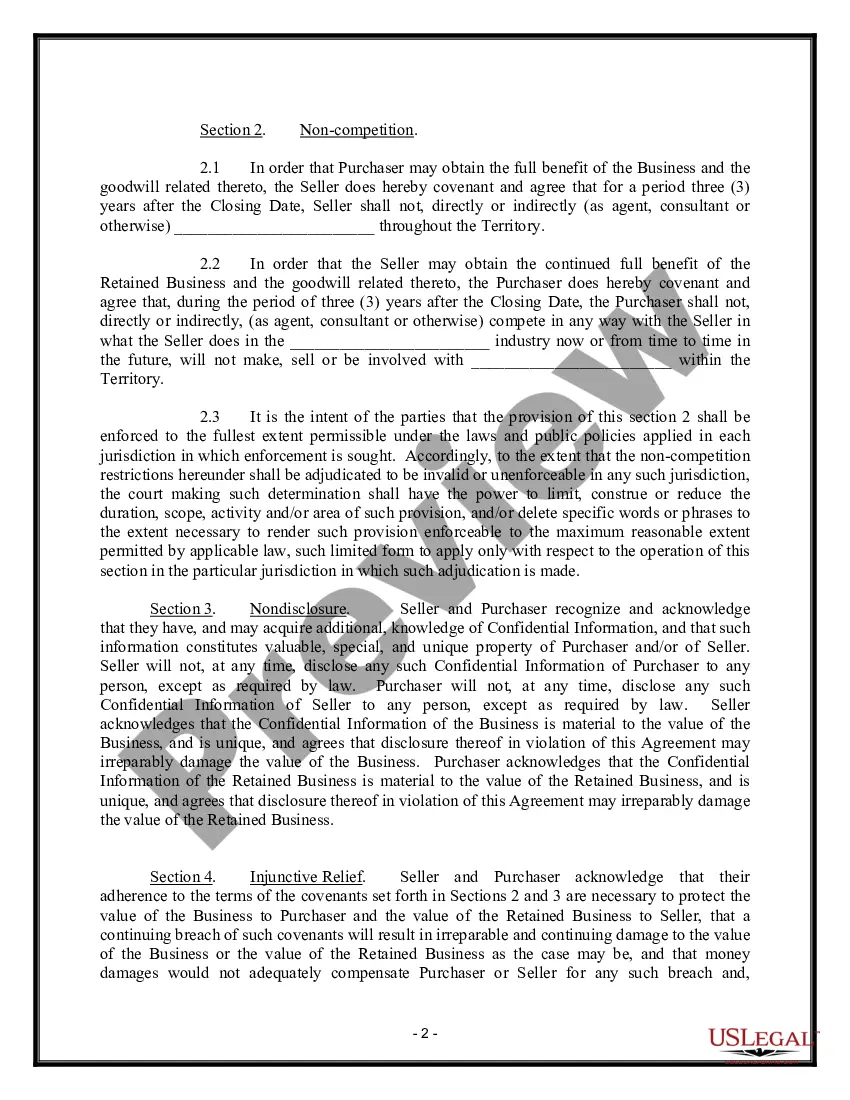

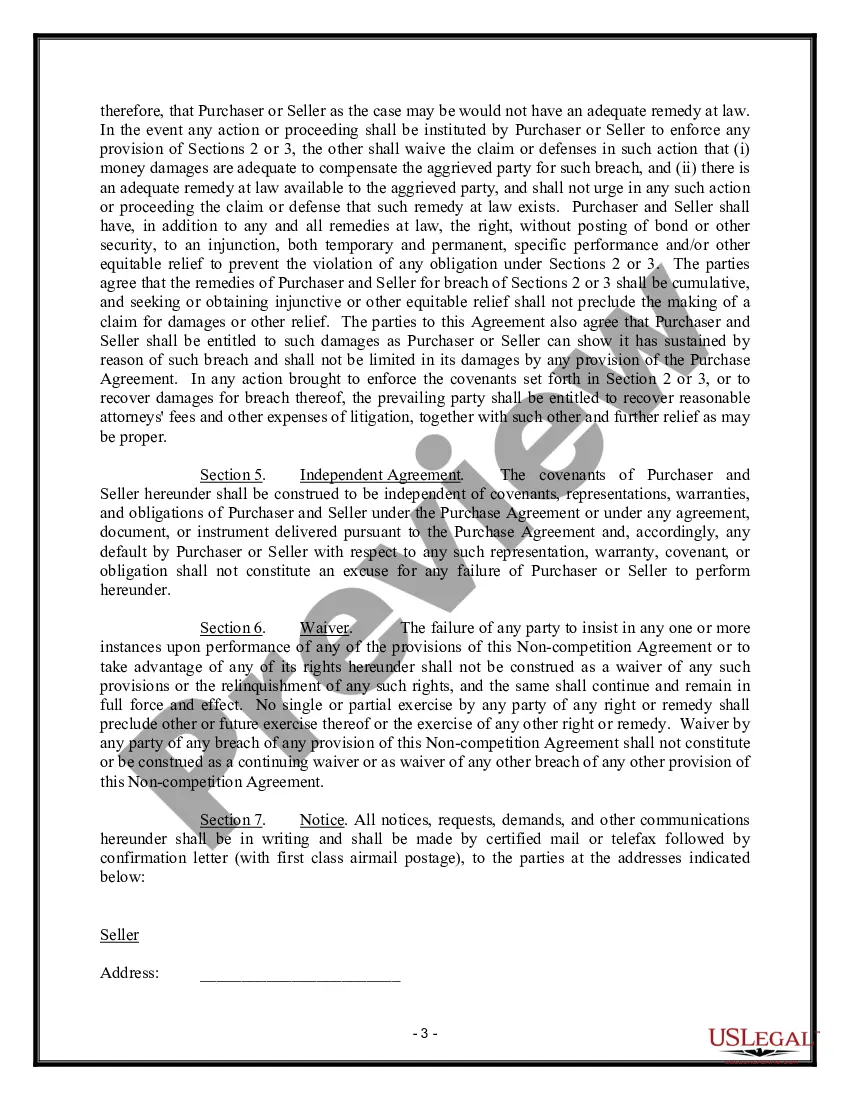

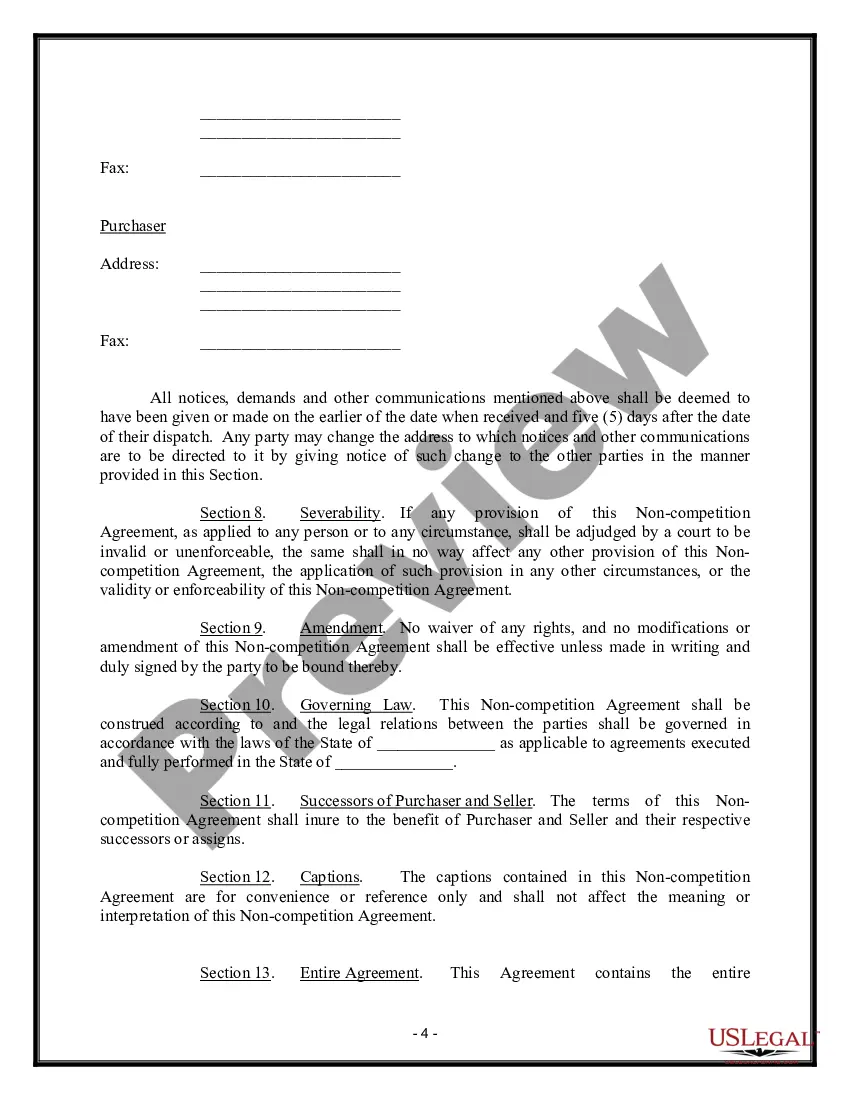

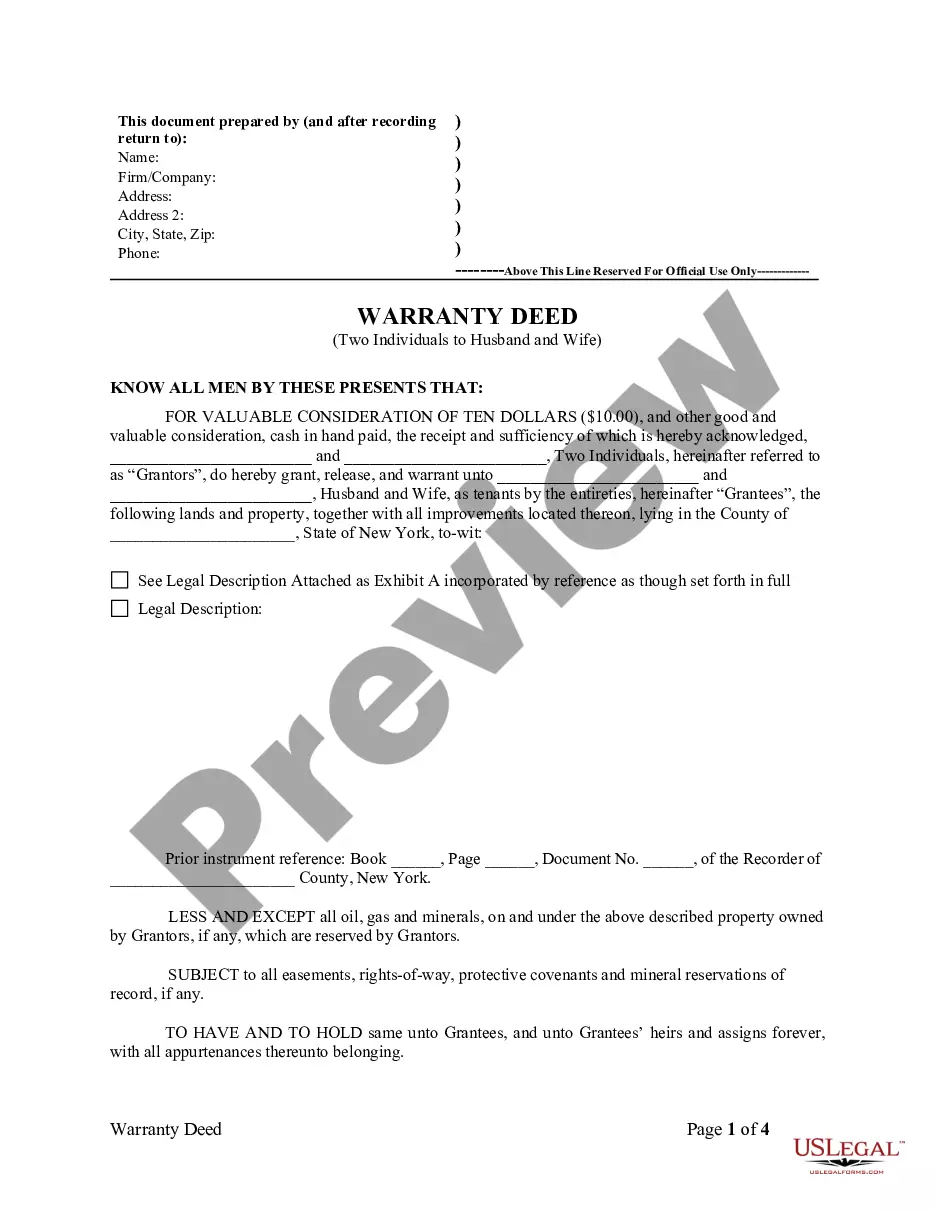

- Use the Preview button to inspect the form.

- Read the description to confirm you have selected the correct template.

- If the form is not what you are looking for, utilize the Search field to find the template that satisfies your requirements.

Form popularity

FAQ

The enforceability of non-compete agreements varies based on state law and specific terms within the agreement. Courts assess whether the restrictions are reasonable in terms of duration, geographical area, and industry scope. To navigate these complexities, especially regarding an Alaska Noncompetition Agreement between Buyer and Seller of Business, using a resource like USLegalForms can be invaluable for drafting and understanding the legal standards.

Many non-compete agreements are unenforceable due to overly broad restrictions or lack of consideration. Courts often scrutinize these agreements to ensure they serve legitimate business interests. Understanding the enforceability of an Alaska Noncompetition Agreement between Buyer and Seller of Business is important, as each state has different laws that govern such contracts.

compete clause in the context of selling a business limits the seller from starting or joining a competing business for a specified period. This clause protects the buyer by ensuring they do not face direct competition from the previous owner. When drafting an Alaska Noncompetition Agreement between Buyer and Seller of Business, clear and reasonable terms are crucial for both parties.

If you have signed a non-compete agreement in Texas, you may find that it restricts your ability to work for a competitor. These agreements can be enforceable depending on the specific terms and conditions set forth in the contract. When considering an Alaska Noncompetition Agreement between Buyer and Seller of Business, consult legal professionals to understand how it may affect your future employment opportunities.

Filling out a non-compete agreement involves providing clear and specific information about the parties involved, the duration of the agreement, and the geographic limitations. Ensure you outline any obligations and considerations that both parties must adhere to during and after the agreement’s term. Using a platform like uslegalforms can simplify the process—offering templates and guidance to create a comprehensive Alaska Noncompetition Agreement between Buyer and Seller of Business.

A covenant not to compete is a legal agreement that restricts one party from entering a similar business within a certain geographic area for a specified time. This type of agreement protects business interests and customer relationships. In the context of an Alaska Noncompetition Agreement between Buyer and Seller of Business, this covenant aims to maintain fair competition and secure the buyer's investment. It serves as a critical element in business sale negotiations.

Whether a non-compete agreement stands up in court depends on its terms and the jurisdiction applicable. Courts generally uphold these agreements if they are reasonable in scope, duration, and geographic area. However, if a non-compete is overly restrictive, it may face challenges. An Alaska Noncompetition Agreement between Buyer and Seller of Business can strengthen your position; having it structured correctly ensures better enforceability.

California has strict laws against non-compete agreements, but there are specific exceptions. If the non-compete agreement relates to the sale of a business, it may be enforceable under certain conditions. Other exceptions may include circumstances involving partnerships or shareholder agreements. Understanding these nuances can help you evaluate any Alaska Noncompetition Agreement between Buyer and Seller of Business in a broader context.

When it comes to taxes on a non-compete during a business sale, the IRS considers payments for a non-compete contract as ordinary income. This means your tax obligations will likely be at your normal income tax rate. You may receive specific guidance from tax professionals familiar with the intricacies of an Alaska Noncompetition Agreement between Buyer and Seller of Business. Proper tax planning will ensure you maximize your benefits while minimizing liabilities.

To navigate around a non-compete clause, first, review its terms for specific limitations. You may negotiate with the party protecting their interests to seek modifications. Additionally, establishing a clear separation of your new business from the previous one may offer a way to operate without conflict. Remember, consulting with a legal advisor knowledgeable in the Alaska Noncompetition Agreement between Buyer and Seller of Business can help clarify your options.