The Alaska Restricted Endowment to Educational, Religious, or Charitable Institution is a program specifically designed to support and empower organizations in Alaska that are working towards educational, religious, or charitable objectives. This endowment fund ensures a stable and long-term source of funding for these institutions, enabling them to carry out their important work and make a lasting impact in the communities they serve. An Alaska Restricted Endowment to Educational, Religious, or Charitable Institution can be established by individuals, families, or organizations who are passionate about promoting education, religion, or charitable causes within the state. These endowments are typically created with a specific purpose in mind, such as funding scholarships for students, supporting the operations of religious institutions, or providing resources for charitable organizations. There are different types of Alaska Restricted Endowment to Educational, Religious, or Charitable Institution based on their focus and objectives. Some common types include: 1. Educational Endowment: This type of endowment is dedicated to supporting educational institutions, programs, and initiatives in Alaska. It may provide resources for scholarships, faculty development, research grants, or improving educational infrastructure. The goal is to enhance educational opportunities and promote academic excellence within the state. 2. Religious Endowment: A religious endowment focuses on sustaining religious organizations and initiatives in Alaska. It may support the operation of churches, synagogues, mosques, or other religious institutions, as well as contribute to religious education, pastoral training, or community outreach programs. The objective is to nurture spiritual growth, religious understanding, and social development within the community. 3. Charitable Endowment: This category encompasses a wide range of organizations dedicated to serving the community and addressing various social issues. Charitable endowments may support nonprofits working in areas such as healthcare, poverty alleviation, environmental conservation, arts and culture, or disaster relief. These endowments are designed to provide sustainable resources for ongoing charitable efforts, ensuring long-term positive impact. Establishing an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution allows donors to leave a lasting legacy by supporting causes they deeply care about. It offers a means to provide ongoing financial stability for organizations striving to make a difference in Alaska's education, religion, or charitable sectors. By leveraging the power of endowments, these institutions can expand their reach, improve services, and successfully achieve their missions for generations to come.

Alaska Restricted Endowment to Educational, Religious, or Charitable Institution

Description

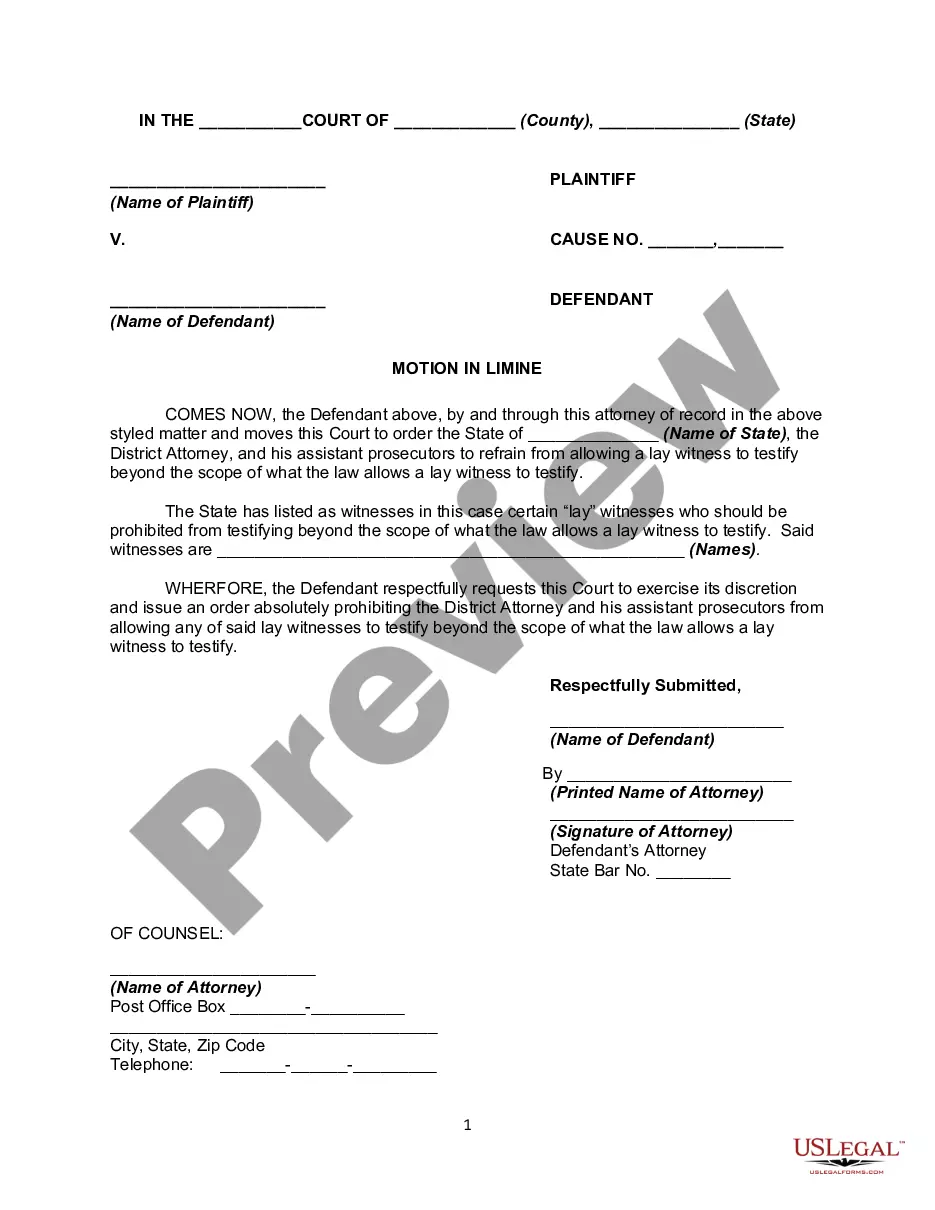

How to fill out Alaska Restricted Endowment To Educational, Religious, Or Charitable Institution?

If you need to thorough, acquire, or produce authorized document topics, utilize US Legal Forms, the premier assortment of legal forms, which can be located online.

Make use of the site's basic and user-friendly search to locate the files you require. Various topics for business and personal uses are organized by categories and jurisdictions, or by keywords and phrases.

Leverage US Legal Forms to discover the Alaska Restricted Endowment to Educational, Religious, or Charitable Institution in just a few clicks.

Every legal document template you download is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Alaska Restricted Endowment to Educational, Religious, or Charitable Institution with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal needs.

- If you are a current US Legal Forms user, Log In to your account and click on the Download button to obtain the Alaska Restricted Endowment to Educational, Religious, or Charitable Institution.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

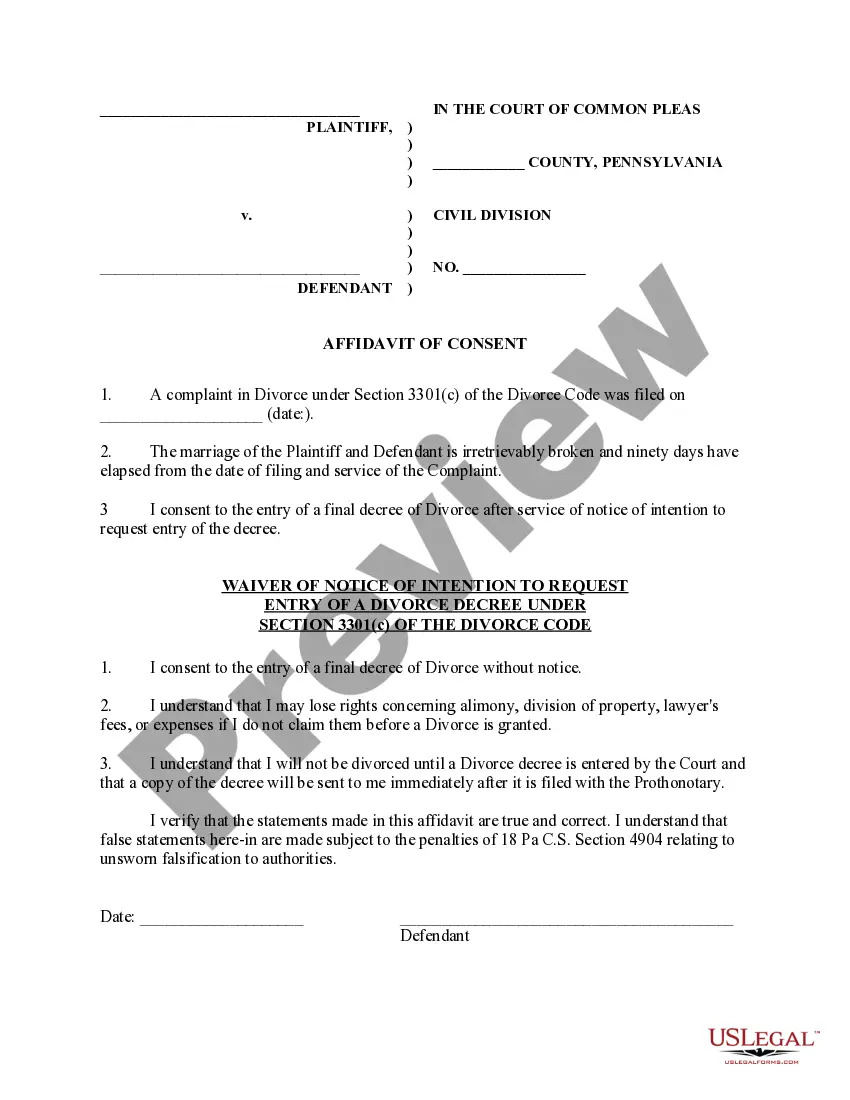

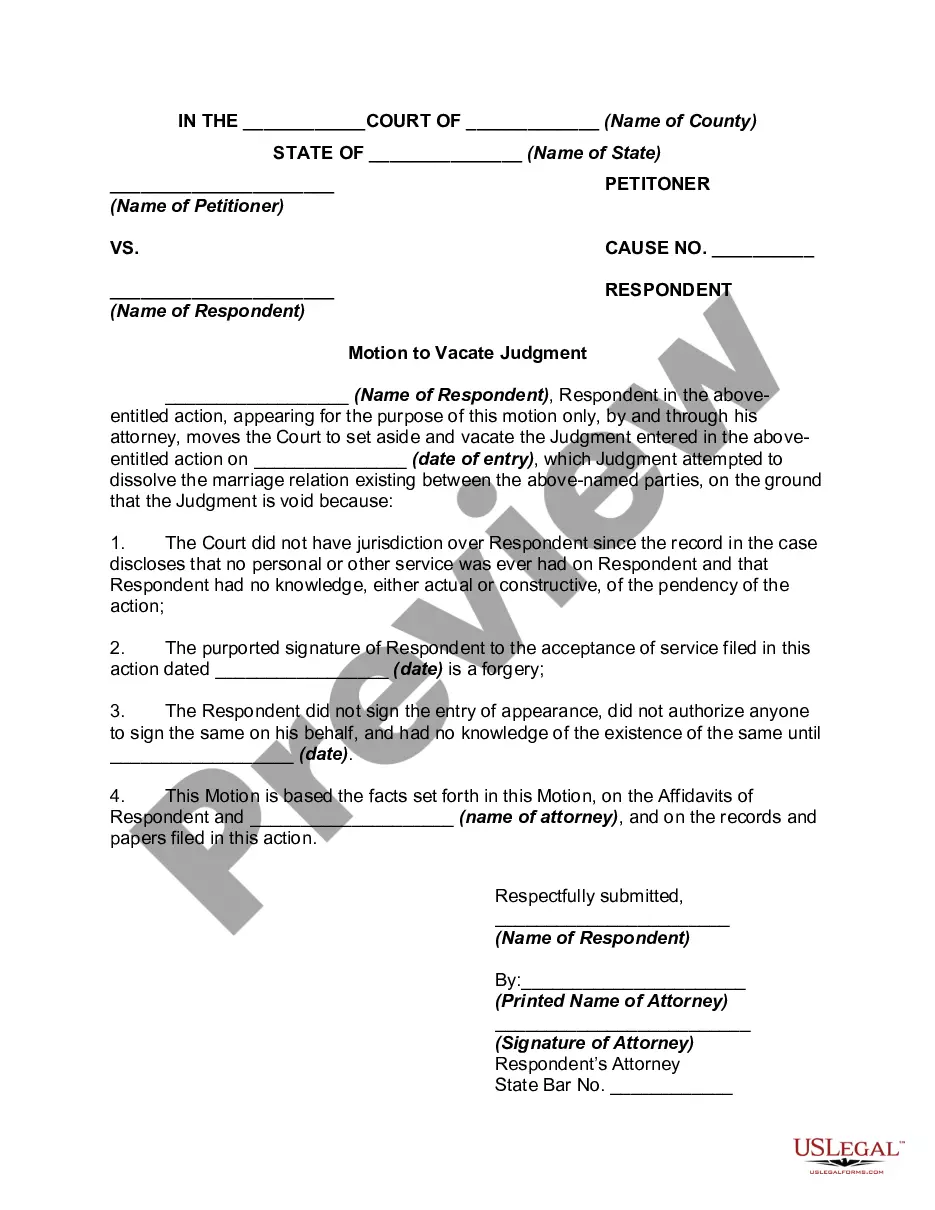

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variations of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Alaska Restricted Endowment to Educational, Religious, or Charitable Institution.

Form popularity

FAQ

Starting a small business in Alaska involves thorough planning and understanding local regulations. You should define your business strategy and target market while considering the unique opportunities in Alaska's economy. If you’re also interested in a non-profit venture, you might explore setting up an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution as part of your business model.

While each state has unique benefits for starting a 501c3, Alaska shines for non-profits aimed at educational and charitable causes. The state offers specific incentives for organizations focusing on community improvement, particularly those that can establish an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding the specific state benefits can enhance your non-profit’s success.

To start a 501c3 in Alaska, you first need to establish a mission and gather a board of directors. After drafting your articles of incorporation and bylaws, you will apply for federal tax exemption. This process can be complex, but platforms like USLegalForms can guide you through establishing an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution.

Starting a non-profit focused on local needs often proves easiest and most impactful. Many individuals begin with community services or educational programs, which can qualify for an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution. By addressing immediate local concerns, you can attract support and streamline your operations.

The profitability of a non-profit often depends on its mission and how effectively it operates. Non-profits that focus on high-demand causes, such as health services or education, can be particularly successful. However, establishing an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution may provide financial stability and long-term benefits by attracting donations and grants.

Yes, in Alaska, non-profits typically need a business license to operate legally. This requirement helps ensure accountability and transparency, which is crucial when managing donations and funding related to an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution. You can apply for the business license with the city's local government where your organization operates.

To register a nonprofit corporation in Alaska, begin by preparing your articles of incorporation, ensuring your mission aligns with providing an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution. After drafting these documents, submit them to the Alaska Division of Corporations. Finally, complete all necessary federal filings, including obtaining your Employer Identification Number from the IRS.

While the ease of registering a non-profit can vary by state, many find Delaware to be one of the most straightforward. It provides simple filing processes, minimal initial fees, and a flexible structure ideal for supporting Alaska Restricted Endowment to Educational, Religious, or Charitable Institution goals. However, be sure to consider your organization's mission and needs before choosing a state.

Becoming a nonprofit in Alaska involves several steps. Start by forming a board of directors and drafting bylaws that govern operations related to any Alaska Restricted Endowment to Educational, Religious, or Charitable Institution. You should then file your articles of incorporation with the state's Division of Corporations and secure your nonprofit status by applying for tax-exempt status with the IRS once your organization is set up.

To register a non-profit organization in the USA, you must choose a unique name and ensure it aligns with your mission, such as supporting an Alaska Restricted Endowment to Educational, Religious, or Charitable Institution. Next, file the appropriate articles of incorporation with your state's Secretary of State office. Additionally, you will need to apply for an Employer Identification Number (EIN) from the IRS and file for tax-exempt status if applicable.

Interesting Questions

More info

61.210) “The Public Service Commission is authorized to establish procedures for the review and approval of a certified or noncertified corporation's application for a Certificate of Public Convenience and Necessity to engage in business within the State of Alaska.” § 11.61.140 — Public Service commission and public office. (a) Public service. The public service is the public body which employs and maintains personnel for its public safety, health, education, emergency preparedness, and welfare functions to accomplish the public purpose and to the general benefit of the people of the State of Alaska. § 11.61.150 — Authority of Public Service Commission. The Public Service Commission has made a finding that a certified or noncertified corporation has met the conditions under a public service statute, rule, or regulation so that it is exempt from the laws and regulations governing the operation of businesses operating in that public service.