Title: Alaska Restricted Endowment to Religious Institution: A Comprehensive Overview Introduction: Alaska's restricted endowment to religious institutions is a financial framework that aims to support religious organizations in the state through a variety of funding programs and initiatives. This detailed description will delve into the intricacies of these endowments, exploring their purpose, eligibility criteria, and the different types of restricted endowments available to religious institutions in Alaska. Keywords: Alaska, restricted endowment, religious institution, funding programs, financial framework, eligibility criteria, support, initiatives. 1. Alaska Restricted Endowment Overview: The Alaska Restricted Endowment to Religious Institution refers to the specialized financial assistance provided by the state specifically to religious organizations. These endowments play a crucial role in enhancing the capacity of religious institutions to fulfill their charitable, educational, and community-oriented missions. 2. Purpose: The primary objective of Alaska's restricted endowment to religious institutions is to strengthen and support these organizations, ensuring they can sustain their operations, expand their outreach, and contribute to the overall well-being of Alaskan communities. By addressing various financial needs, these endowments enable religious institutions to continue their vital services. 3. Eligibility Criteria: a) Religious Institutions: To qualify for Alaska's restricted endowment, religious institutions must meet specific eligibility criteria, including being registered and recognized as a religious organization in the state. b) Non-profit Status: Eligible institutions must also possess a registered non-profit status or maintain a tax-exempt status under the appropriate sections of Alaska's tax code. c) Compliance with State Regulations: Compliance with local, state, and federal regulations concerning religious activities and organizational operations is necessary for eligibility. 4. Types of Restricted Endowments for Religious Institutions: a) Capital Endowment: This type of endowment focuses on providing long-term financial stability to religious institutions through investments in income-generating assets, such as real estate or stocks. b) Programmatic Endowment: Programmatic endowments are designed to support specific initiatives undertaken by religious institutions. These endowments can be utilized for educational programs, community outreach, religious studies, or expanding youth engagement, among others. c) Scholarship Endowment: Scholarships endowments aim to provide financial assistance to deserving students pursuing religious education or theological studies in approved institutions, thus promoting academic excellence within religious contexts. d) Maintenance Endowment: This type of endowment focuses on supporting the day-to-day maintenance and operations of religious institutions, including building repairs, utilities, and general upkeep. e) Outreach Endowment: Outreach endowments enable religious institutions to extend their community services, fund humanitarian initiatives, and engage in charitable activities within and beyond their immediate congregations and geographical areas. Conclusion: Alaska's restricted endowment to religious institutions serves as a valuable financial resource for supporting the growth, sustainability, and positive impact of these organizations. Through various types of endowments, religious institutions can enhance their capacity to serve their communities, promote education, and support individuals pursuing religious studies. These endowments play a crucial role in fostering the overall well-being of Alaskan society by providing a means for religious organizations to flourish and contribute meaningfully to their respective communities.

Alaska Restricted Endowment to Religious Institution

Description

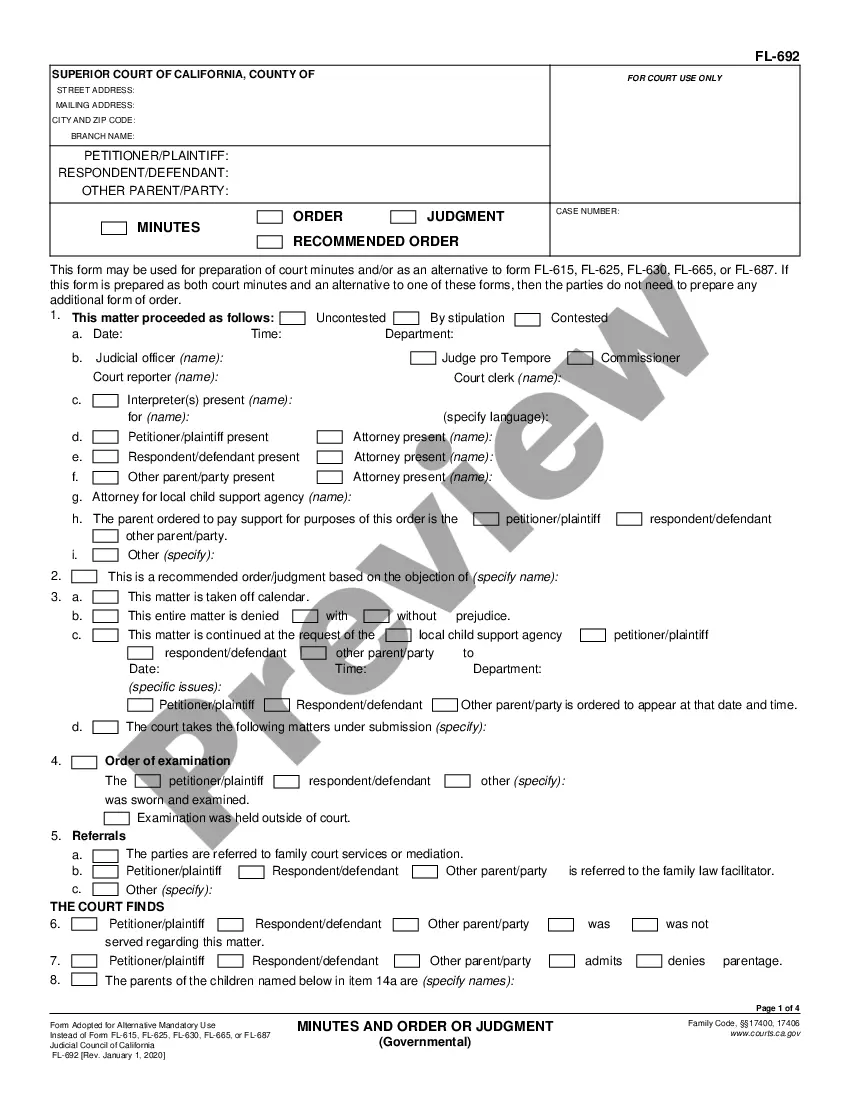

How to fill out Alaska Restricted Endowment To Religious Institution?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By utilizing the site, you can access thousands of forms for commercial and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Alaska Limited Endowment to Religious Institution within moments.

If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

Once you are satisfied with the form, validate your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to create an account.

- If you already hold a monthly subscription, Log In and download the Alaska Limited Endowment to Religious Institution from your US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously purchased forms in the My documents tab of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get you started.

- Confirm that you have selected the appropriate form for your locality/region.

- Click the Preview button to review the form's contents.

Form popularity

FAQ

The difference between restricted and unrestricted contributions lies in how the funds can be used. Restricted contributions, like those in an Alaska Restricted Endowment to Religious Institution, are earmarked for specific programs or projects. Unrestricted contributions offer organizations freedom to allocate funds as they see fit, enabling them to address various needs within the organization.

The two types of endowments are restricted and unrestricted endowments. An Alaska Restricted Endowment to Religious Institution is a prime example of a restricted endowment, as it limits the use of funds to designated religious purposes. Unrestricted endowments provide organizations with flexibility to use the funds as needed, allowing for broader financial support.

To start a nonprofit organization in Alaska, you need to follow a series of steps, including choosing a unique name and drafting bylaws. Register your organization with the state and apply for tax-exempt status with the IRS. For guidance on legal documentation and compliance, consider using platforms like uslegalforms, which can help you navigate the complexities of establishing a nonprofit.

The three types of endowments are permanent, term, and quasi-endowments. A permanent endowment, such as the Alaska Restricted Endowment to Religious Institution, keeps the principal intact while using the investment income for specific purposes. Term endowments can be spent after a certain period, while quasi-endowments can be utilized at the discretion of the organization.

The easiest nonprofit to start often aligns with an individual's personal interests and community needs, such as educational or environmental organizations. Setting up a nonprofit focused on these areas may require less regulatory burden and can often attract local support. Additionally, using the Alaska Restricted Endowment to Religious Institution can provide specific funding pathways for these types of organizations. Ultimately, clarity in mission and effective outreach are key to launching a successful nonprofit.

Starting a small business in Alaska involves researching your market, writing a solid business plan, and choosing the right legal structure. You should also look into grants and funding opportunities that may be available, including options tied to the Alaska Restricted Endowment to Religious Institution. Furthermore, registering with state authorities and ensuring compliance with regulations is crucial. Utilizing platforms like US Legal Forms can streamline these processes and support your entrepreneurial journey.

The most profitable nonprofit varies by sector and specific initiatives, but organizations focused on healthcare, education, and community services tend to excel. Nonprofits that effectively leverage funding opportunities like the Alaska Restricted Endowment to Religious Institution can achieve significant success. Profitability often comes from strong donor relationships and community involvement. Therefore, understanding your mission's financial aspects is essential for sustainability, regardless of the field.

To start a 501c3 in Alaska, you need to file articles of incorporation with the state and apply for federal tax-exempt status through the IRS. It's crucial to define your organization's mission clearly, especially regarding any Alaska Restricted Endowment to Religious Institution, as this may affect your acceptance for tax-exempt status. You may also want to consult resources like US Legal Forms for templates and guidance, making the process smoother. Consulting with legal professionals can also help navigate any complexities.

A restricted endowment refers to funds that are set aside for a specific purpose and cannot be used for general expenses. This financial structure often provides long-term stability for organizations, especially those targeting specific missions. For instance, the Alaska Restricted Endowment to Religious Institution allows donors to contribute to enduring projects within religious institutions in Alaska. By understanding this concept, organizations can better plan for their financial futures.

The best state to start a 501c3 often depends on specific goals, but many find Alaska favorable due to its supportive environment for nonprofit organizations. In Alaska, charitable organizations benefit from a flexible regulatory framework and an engaged community. Additionally, incorporating here allows access to Alaska Restricted Endowment to Religious Institution, enhancing fundraising opportunities. A strong nonprofit foundation can lead to increased community support and sustainability.

Interesting Questions

More info

6-106, 6-108 Administrative Code Chapter 11A. General Chapter 12A.