Alaska Authority to Borrow Money - Resolution Form - Corporate Resolutions

State:

Multi-State

Control #:

US-0060-CR

Format:

Word;

Rich Text

Instant download

Description

Form with which the directors of a corporation may authorize an officer or representative to take necessary steps to borrow money on behalf of the corporation.

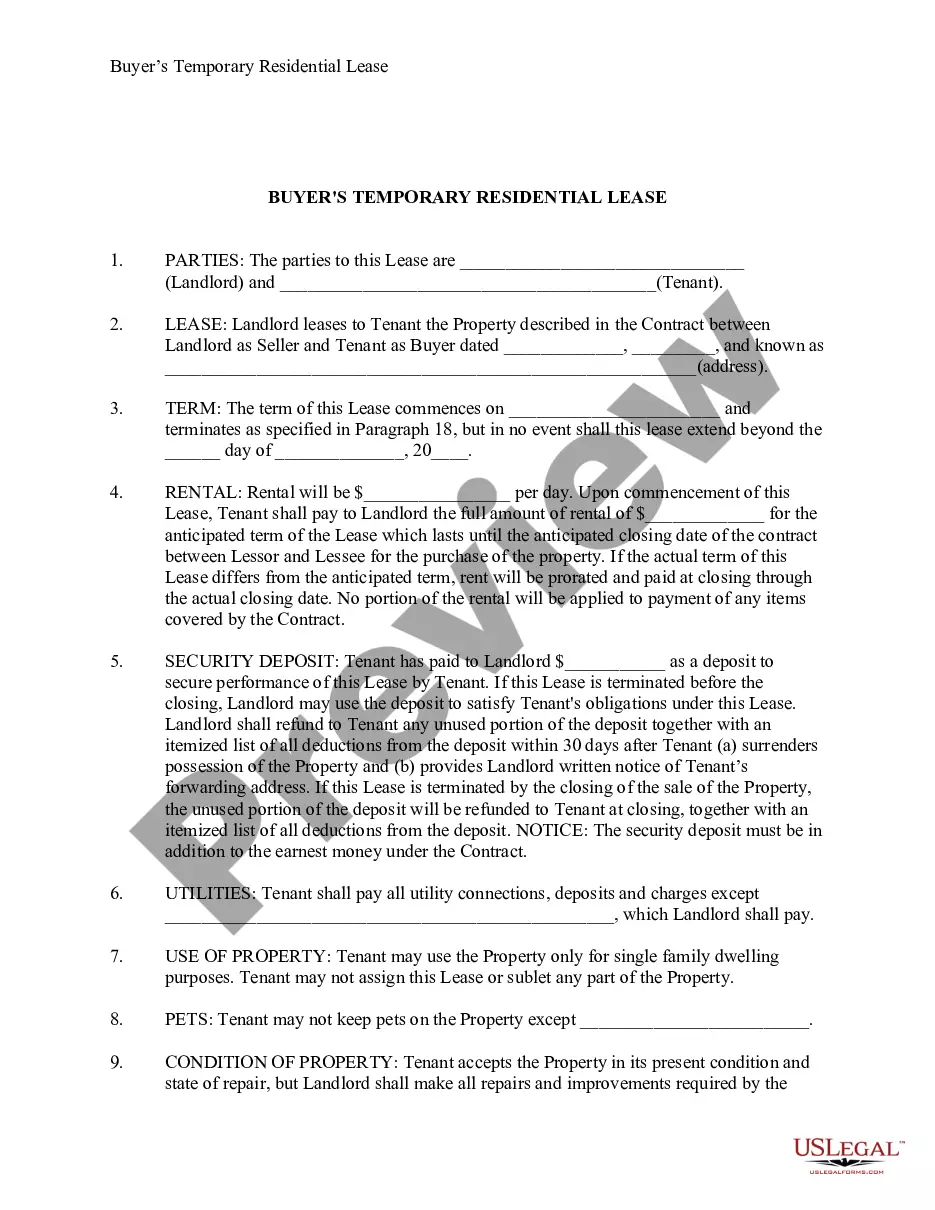

Free preview

How to fill out Authority To Borrow Money - Resolution Form - Corporate Resolutions?

You can spend hours online trying to locate the legal document template that matches the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been vetted by experts.

You have the option to download or print the Alaska Authority to Borrow Money - Resolution Form - Corporate Resolutions from our service.

If available, use the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Alaska Authority to Borrow Money - Resolution Form - Corporate Resolutions.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have chosen the correct document template for the area/region of your choice.

- Review the form description to confirm you have selected the right form.