Alaska Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

It is feasible to spend hours online attempting to discover the valid document template that meets the state and federal criteria you require.

US Legal Forms provides an extensive array of valid forms that are verified by professionals.

You can actually download or print the Alaska Leaseback Provision in Sales Agreement from the service.

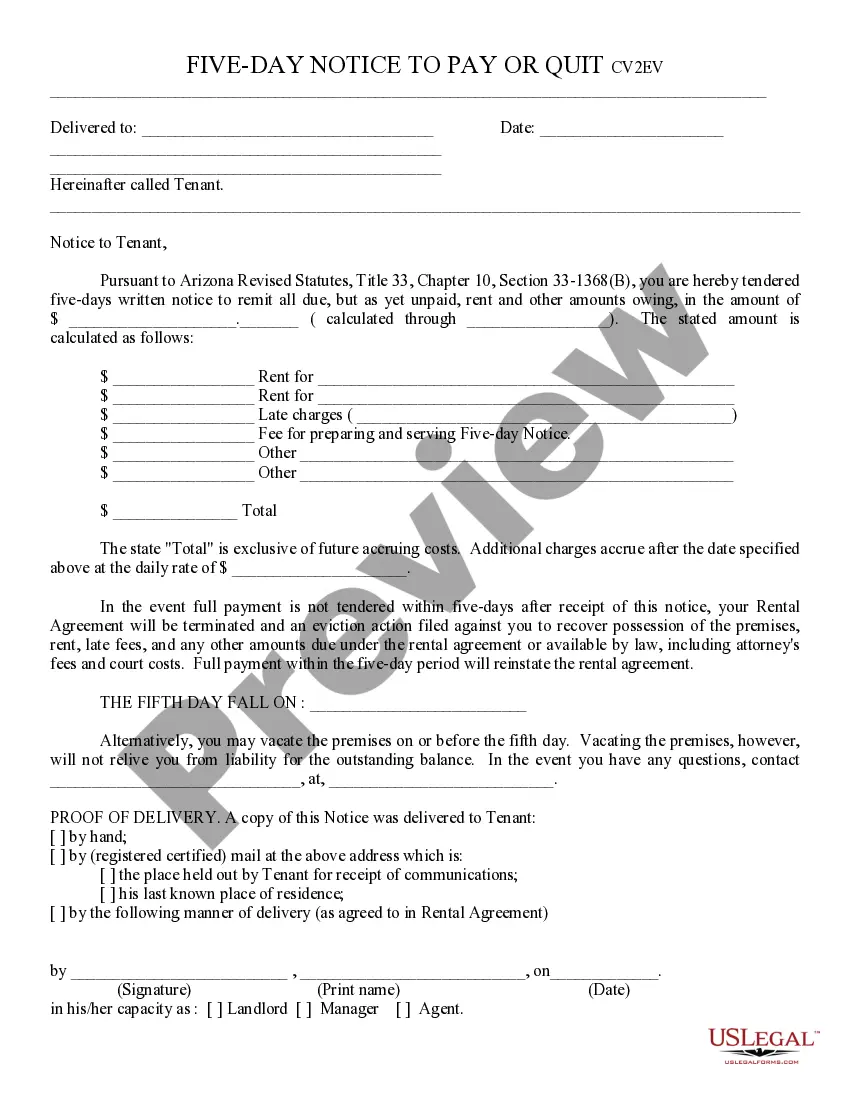

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Next, you can complete, edit, print, or sign the Alaska Leaseback Provision in Sales Agreement.

- Each valid document template you obtain belongs to you indefinitely.

- To acquire another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions outlined below.

- First, ensure you have selected the correct document template for your applicable region.

- Review the form description to confirm that you have chosen the right template.

Form popularity

FAQ

In a sale and leaseback transaction, the initial owner of the asset is the party selling the property. This entity sells the asset and becomes a tenant under the lease agreement. The buyer, usually an investor or financial institution, then owns the asset while providing the seller the right to continue using it. Utilizing an Alaska Leaseback Provision in Sales Agreement enables sellers to create beneficial arrangements that keep operations uninterrupted while managing asset ownership.

Leasebacks can have disadvantages, such as potential higher rental costs than expected, limiting the seller's control over the property. Additionally, market fluctuations may affect the property's value, which could lead to financial strain. Before entering into an Alaska Leaseback Provision in Sales Agreement, it is wise to weigh these risks to make an informed decision.

A leaseback provision outlines the terms under which the seller of a property can lease it back after the sale. This agreement typically specifies details like rental rates, duration, and maintenance responsibilities. Understanding the specific clauses of an Alaska Leaseback Provision in Sales Agreement is crucial for both parties to ensure a smooth transition and protect their interests.

A leaseback occurs when a company sells its office building to an investor and simultaneously leases it from them. For instance, a business may sell its headquarters for $3 million, and in return, it signs a long-term lease to continue operating from that location. This approach demonstrates the practicality of the Alaska Leaseback Provision in Sales Agreement for maintaining business operations while improving financial strategy.

A failed sale/leaseback occurs when the terms of the leaseback agreement do not align with the initial expectations of either party involved. This situation may arise if the asset’s value decreases significantly or if the lessee cannot meet ongoing lease payments. Understanding the terms of the Alaska Leaseback Provision in Sales Agreement can help minimize risks associated with such failures.

One significant downside of a sale/leaseback is the potential loss of asset ownership. Once the asset is sold, any appreciation in its value benefits the new owner, not the original seller. Furthermore, ongoing lease payments can become a financial burden, particularly if market conditions change unexpectedly during the lease term.

While a sale-leaseback arrangement offers liquidity, it also carries some disadvantages. Primarily, it may result in higher long-term costs due to ongoing lease payments. Additionally, the original owner may limit future operational flexibility regarding the leased asset, which could impact long-term business strategies involving the asset under the Alaska Leaseback Provision in Sales Agreement.

A sale and leaseback can be categorized as an operating lease under the Alaska Leaseback Provision in Sales Agreement. In this arrangement, the seller sells an asset and simultaneously leases it back from the buyer. This structure allows the original owner to retain the use of the asset while freeing up capital for other investments.

To confirm whether a sale and leaseback qualifies as a sale, assess if the buyer assumes the risks and rewards of ownership. The conditions set forth in the Alaska Leaseback Provision in Sales Agreement are essential in guiding this determination. An accurate analysis ensures compliance with accounting standards.

At the lease's inception, the sale portion must be recorded at fair value, reflecting what the buyer pays for the asset. Proper accounting ensures alignment with the Alaska Leaseback Provision in Sales Agreement, which guides the recognition of assets and liabilities. This process aids in maintaining transparency in financial statements.