Title: Detailed Description of Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft Introduction: Experiencing identity theft can be a distressing ordeal, negatively impacting your financial wellbeing and personal security. This is why it is crucial to promptly address the issue by sending a letter to the credit reporting company or bureau, notifying them about the identity theft incident. In Alaska, certain types of letters exist to cater to different circumstances. In this comprehensive guide, we will delve into the process and structure of an Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft, while incorporating relevant keywords for better understanding. 1. Types of Alaska Letters to Credit Reporting Company or Bureau regarding Identity Theft: a. Initial Fraud Alert Request: An initial fraud alert is the first line of defense against identity theft. This letter highlights suspicious activities, such as unauthorized credit applications, and requests the credit reporting company or bureau to place a fraud alert on your credit file. b. Extended Fraud Alert Request: If you believe your identity theft situation requires additional protection, an extended fraud alert may be necessary. This letter outlines your situation, provides supporting evidence, and requests an extended alert on your credit report, which lasts for seven years. c. Dispute Letter: If you detect fraudulent or inaccurate information on your credit report due to identity theft, this letter enables you to dispute those items. Replete with details regarding the fraudulent activity and supporting evidence, it empowers you to challenge the entries and request their removal. d. Identity Theft Report: In cases where you possess substantial evidence of identity theft, an identity theft report should be filed with the credit reporting company or bureau. This detailed letter includes the police report number, explanation of fraudulent activities, and request for complete removal of false information from your credit report. 2. Key Elements of an Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft: a. Contact Information: Begin the letter with your full name, current address, phone number, and email address, ensuring the credit reporting company or bureau can reach you easily. b. Statement of Identity Theft: Clearly state that you are a victim of identity theft in Alaska, explicitly naming the fraudulent activity and fraudulent accounts. c. Supporting Documentation: Attach relevant evidence, such as police reports, identity theft affidavits, and any other documents substantiating your claims. Highlight the attached paperwork in the body of the letter for their attention and swift action. d. Request for Action: Clearly indicate your expectations by requesting immediate action, including removing fraudulent items, closing fraudulent accounts, and placing a fraud alert on your credit file. e. Closing: Offer appreciation for their assistance and attention while requesting confirmation of desired actions taken by a specific date. Include your contact information for further communication and follow-up. Conclusion: Taking swift action when dealing with identity theft in Alaska is crucial to protecting your financial standing and reputation. Utilizing the relevant types of Alaska letters to credit reporting companies or bureaus regarding identity theft can immensely aid in rectifying the situation. By following the structure and incorporating the relevant elements discussed above, you can effectively communicate the gravity of the issue and ensure a resolution to the identity theft incident.

Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft

Description

How to fill out Alaska Letter To Credit Reporting Company Or Bureau Regarding Identity Theft?

Discovering the right legitimate file design could be a struggle. Of course, there are tons of themes available on the Internet, but how would you obtain the legitimate develop you require? Take advantage of the US Legal Forms internet site. The assistance offers 1000s of themes, such as the Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft, that you can use for company and personal needs. Every one of the varieties are inspected by pros and meet up with federal and state needs.

If you are already authorized, log in in your accounts and then click the Download key to obtain the Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft. Use your accounts to check with the legitimate varieties you may have purchased previously. Proceed to the My Forms tab of your accounts and get an additional version in the file you require.

If you are a fresh customer of US Legal Forms, listed below are basic guidelines so that you can follow:

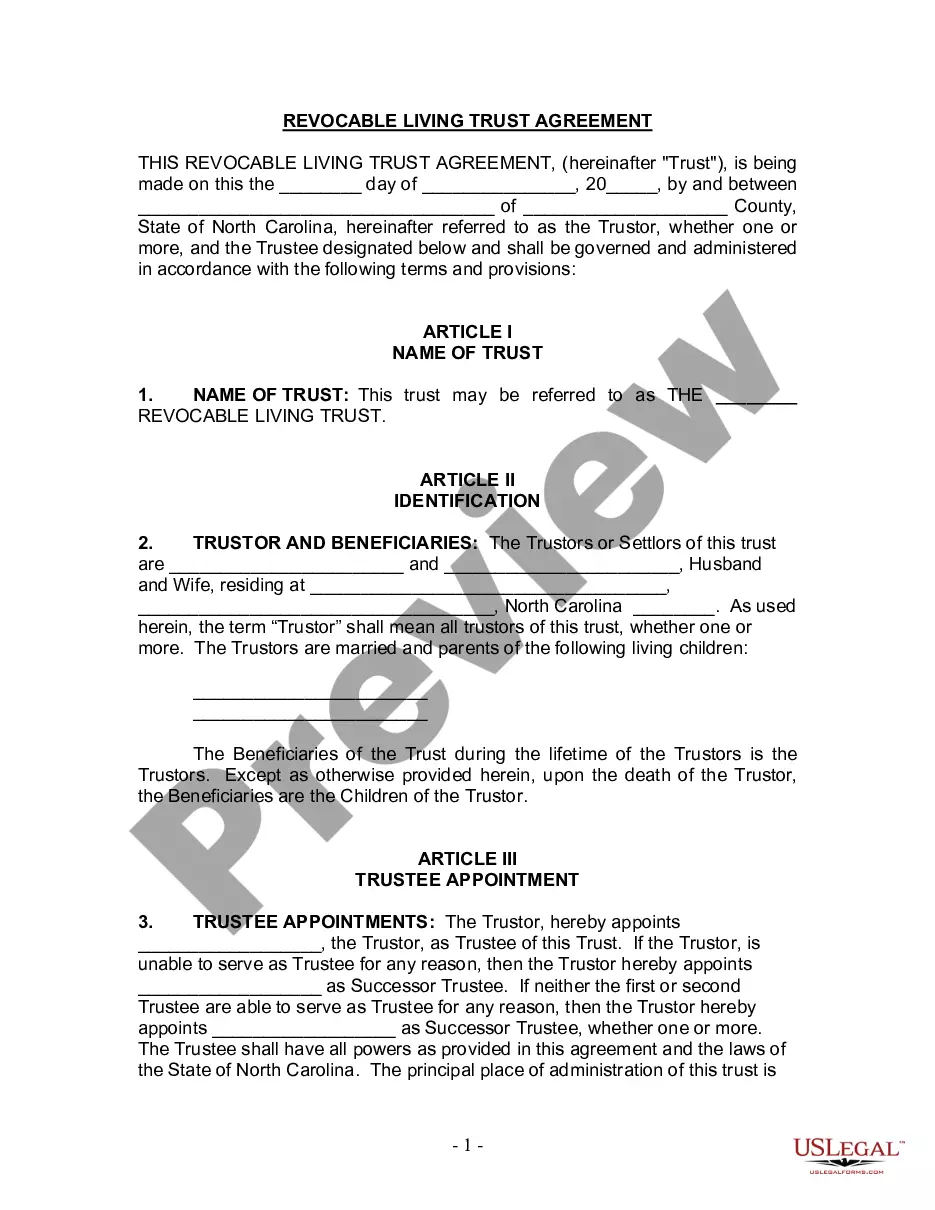

- Initial, be sure you have selected the proper develop for your area/county. It is possible to check out the form using the Preview key and look at the form outline to make certain it will be the right one for you.

- In case the develop is not going to meet up with your expectations, make use of the Seach field to find the right develop.

- Once you are certain the form would work, select the Acquire now key to obtain the develop.

- Select the rates strategy you would like and enter the essential details. Design your accounts and pay money for the transaction making use of your PayPal accounts or bank card.

- Pick the data file format and download the legitimate file design in your gadget.

- Total, change and print and signal the attained Alaska Letter to Credit Reporting Company or Bureau regarding Identity Theft.

US Legal Forms will be the greatest collection of legitimate varieties where you can discover numerous file themes. Take advantage of the service to download skillfully-created files that follow status needs.