Title: The Alaska Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft: A Comprehensive Guide Introduction: In Alaska, writing a letter to a credit reporting company or bureau regarding known imposter identity theft is an essential step to protect yourself against fraudulent activities. This detailed guide will provide you with relevant information and keywords to help you craft an effective letter that will assist in resolving imposter identity theft issues. Key Phrases/Keywords: 1. Identity Theft: The fraudulent acquisition and use of someone else's personal information for unlawful purposes. 2. Imposter Identity Theft: A specific type of identity theft where an imposter uses another person's personal details to engage in fraudulent activities. 3. Credit Reporting Company: Organizations that collect, maintain, and generate credit reports for individuals based on their financial history. 4. Credit Reporting Bureau: An agency that gathers and analyzes financial data to produce credit reports for individuals. 5. Fraud Alert: A notice placed on an individual's credit report to inform potential lenders about possible fraudulent activities. 6. Security Freeze: A restriction placed on a credit report, making it inaccessible to lenders or creditors without explicit authorization from the individual. 7. Dispute: The act of formally challenging inaccurate or fraudulent information on a credit report. 8. Victim Statement: A statement provided by the victim of identity theft, explaining the circumstances and impact of the fraudulent activity. Types of Letters to Credit Reporting Companies or Bureaus: 1. Initial Imposter Identity Theft Report Letter: This letter is the first step in notifying credit reporting companies about the incident of imposter identity theft. It includes detailed information about the fraudulent activities, such as unauthorized accounts or transactions. 2. Fraud Alert Request Letter: If you suspect or have evidence of imposter identity theft, this letter requests the credit reporting companies to place a fraud alert on your credit files. It is crucial in notifying potential lenders to take additional steps in verifying your identity before extending any credit. 3. Security Freeze Request Letter: This type of letter is used to request a security freeze on your credit report. A security freeze restricts any access to your credit report, providing an extra layer of protection against further fraudulent activity. 4. Dispute Resolution Letter: Once imposter identity theft is confirmed, writing a dispute letter is necessary for challenging any inaccurate or fraudulent information on your credit report. This letter urges the credit reporting company to conduct an investigation and remove such false data. 5. Victim Statement Letter: This letter allows the victim to provide a detailed account of the imposter identity theft incident's impact on their life. The victim's statement can help investigators and credit reporting agencies comprehend the severity of the crime when reviewing credit reports. Conclusion: Alaska victims of imposter identity theft must utilize the appropriate letters to credit reporting companies or bureaus to protect their financial well-being. By including the relevant keywords and using the various types of letters described above, individuals can effectively communicate their situation and seek resolution regarding known imposter identity theft incidents. It is crucial to act swiftly, cooperating with credit reporting agencies to mitigate the damage caused by such fraudulent activities.

Alaska Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

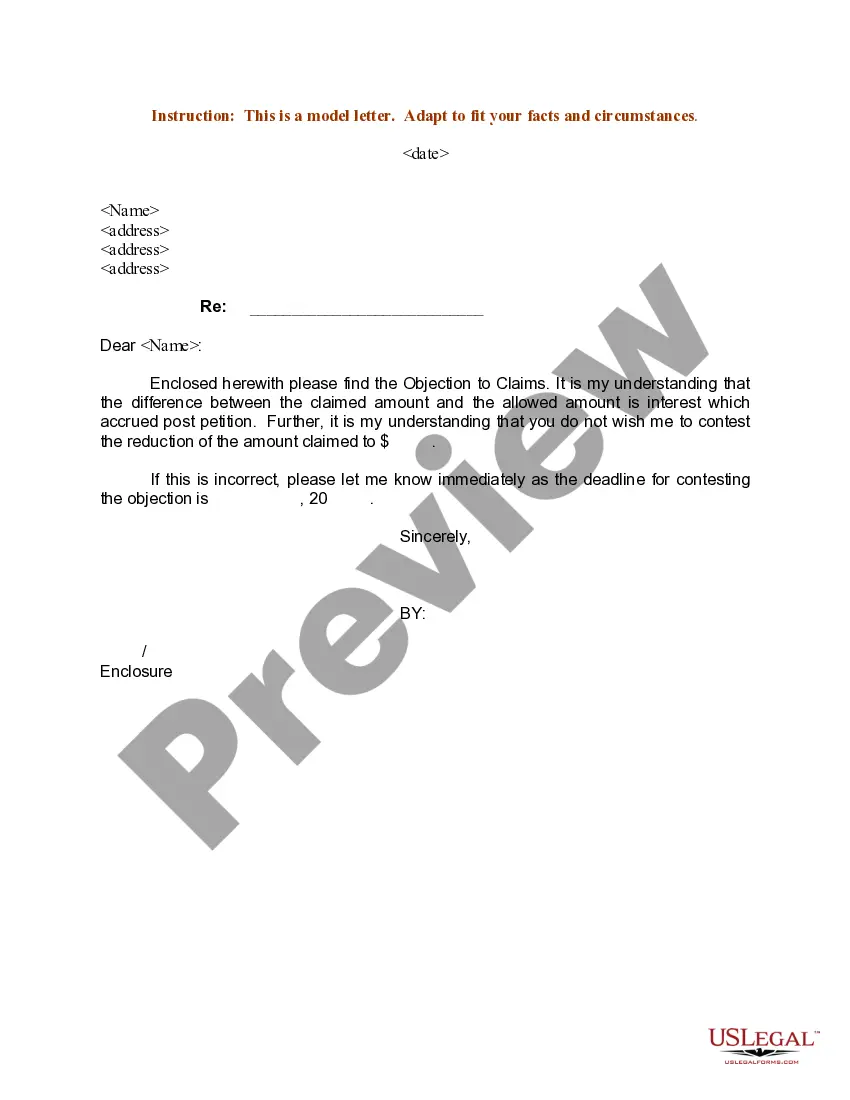

Description

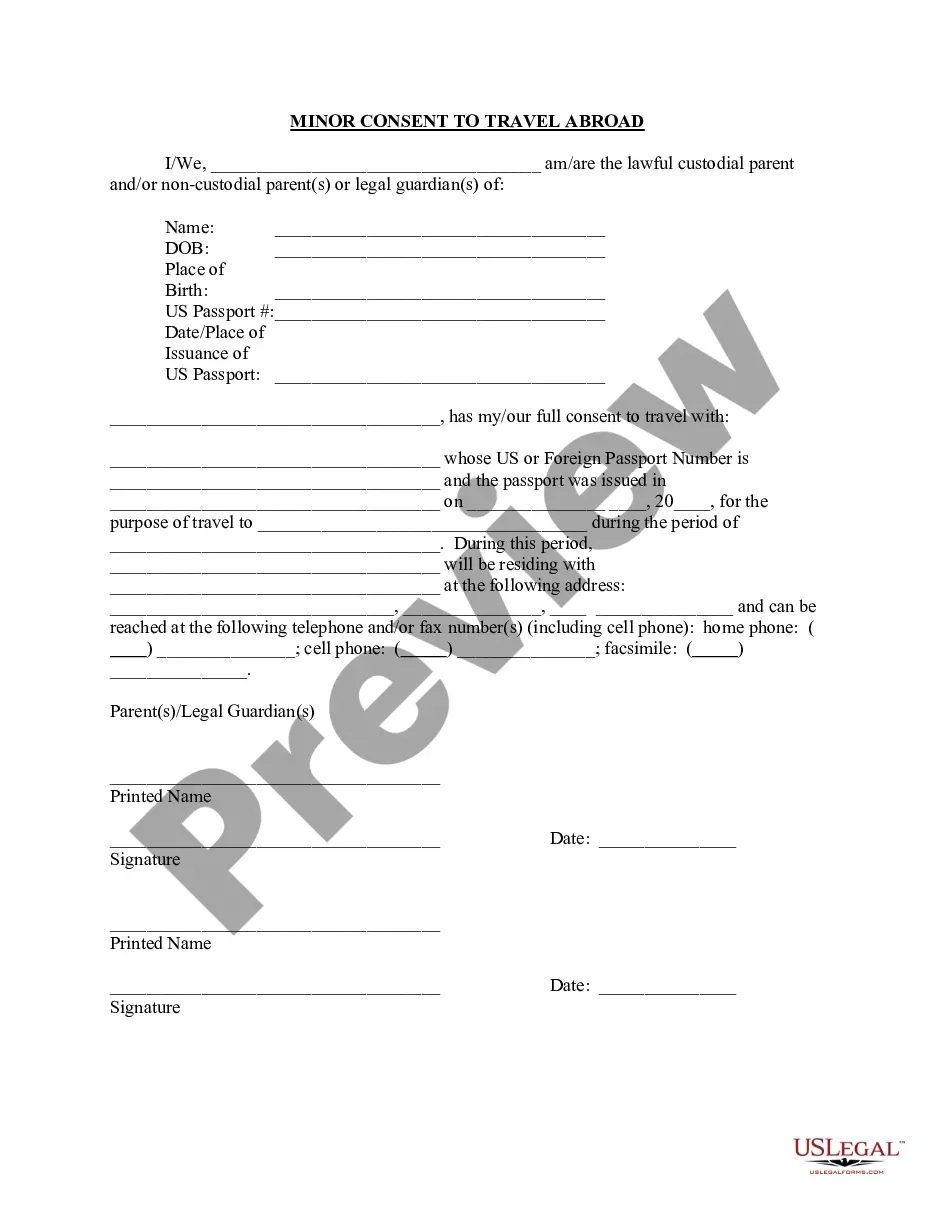

How to fill out Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

If you need to full, obtain, or print out lawful papers web templates, use US Legal Forms, the greatest variety of lawful types, which can be found on-line. Use the site`s easy and practical search to find the files you will need. Numerous web templates for enterprise and personal uses are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the Alaska Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft in a few mouse clicks.

When you are previously a US Legal Forms consumer, log in to the profile and click on the Down load button to have the Alaska Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. Also you can access types you earlier acquired inside the My Forms tab of the profile.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that appropriate city/region.

- Step 2. Make use of the Preview choice to examine the form`s articles. Never forget about to read through the description.

- Step 3. When you are unsatisfied together with the form, use the Research discipline at the top of the screen to get other models from the lawful form template.

- Step 4. When you have found the shape you will need, click on the Get now button. Select the prices strategy you favor and put your references to register for the profile.

- Step 5. Method the purchase. You can utilize your credit card or PayPal profile to perform the purchase.

- Step 6. Choose the file format from the lawful form and obtain it on your own gadget.

- Step 7. Full, modify and print out or signal the Alaska Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.

Every lawful papers template you buy is yours permanently. You possess acces to each and every form you acquired in your acccount. Click on the My Forms segment and pick a form to print out or obtain once again.

Contend and obtain, and print out the Alaska Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft with US Legal Forms. There are millions of skilled and express-particular types you can use for the enterprise or personal requires.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

First, contact the companies or banks where you know the fraudulent activity occurred. Stop any accounts that have been opened without your permission or tampered with. Then, file a report with the Federal Trade Commission (FTC).

The law requires businesses and government agencies to notify you if your personal information has been compromised, restricts the use of social security numbers, and requires records containing your personal information to be destroyed as soon as it is no longer needed.