Alaska Letter to Report Known Imposter Identity Theft to Postal Authorities

Description

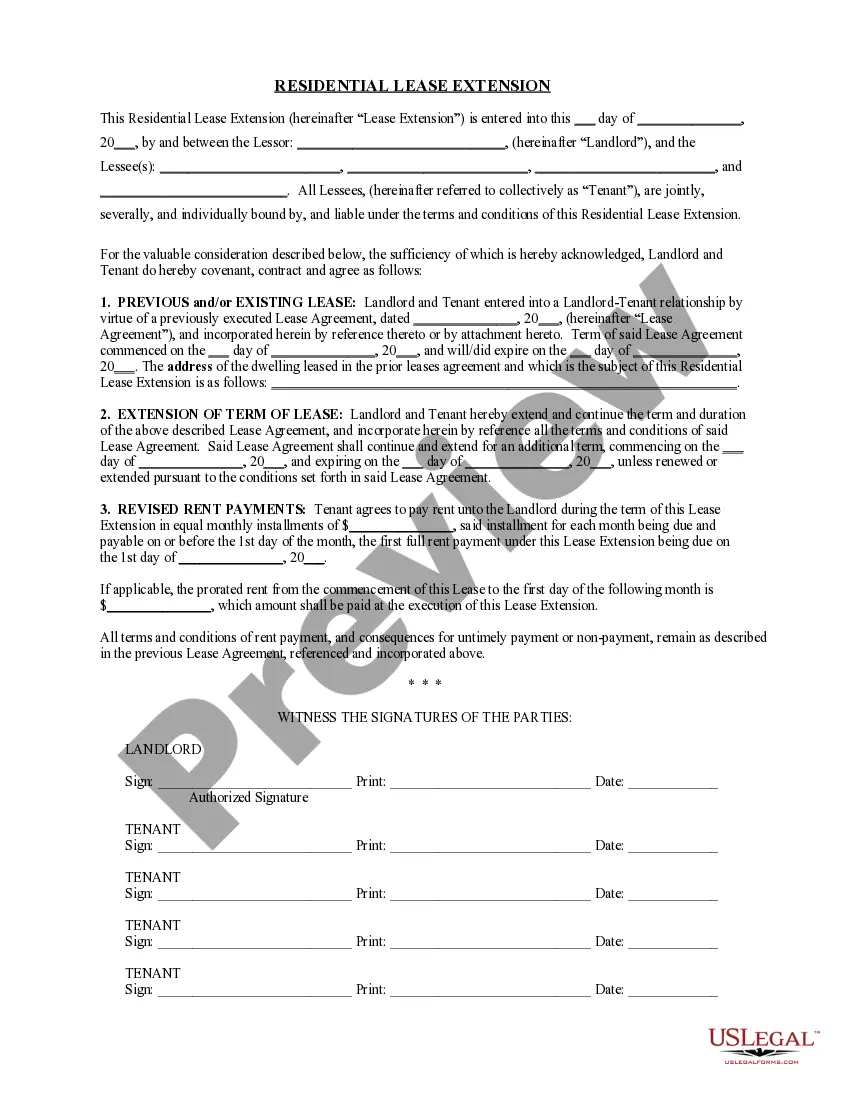

How to fill out Alaska Letter To Report Known Imposter Identity Theft To Postal Authorities?

It is possible to invest hrs on-line attempting to find the authorized file template which fits the federal and state demands you need. US Legal Forms provides 1000s of authorized forms which are reviewed by experts. You can actually down load or printing the Alaska Letter to Report Known Imposter Identity Theft to Postal Authorities from the service.

If you already have a US Legal Forms profile, you may log in and then click the Obtain key. Following that, you may full, edit, printing, or sign the Alaska Letter to Report Known Imposter Identity Theft to Postal Authorities. Every authorized file template you acquire is the one you have permanently. To have an additional backup of the bought form, visit the My Forms tab and then click the related key.

Should you use the US Legal Forms internet site for the first time, stick to the basic recommendations beneath:

- Initially, be sure that you have selected the proper file template for that area/town of your choice. Read the form outline to ensure you have chosen the correct form. If offered, take advantage of the Review key to check throughout the file template as well.

- If you wish to get an additional edition of your form, take advantage of the Research area to obtain the template that meets your needs and demands.

- When you have found the template you would like, click on Acquire now to carry on.

- Find the prices program you would like, enter your credentials, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal profile to pay for the authorized form.

- Find the file format of your file and down load it in your device.

- Make modifications in your file if necessary. It is possible to full, edit and sign and printing Alaska Letter to Report Known Imposter Identity Theft to Postal Authorities.

Obtain and printing 1000s of file web templates making use of the US Legal Forms website, that provides the greatest variety of authorized forms. Use skilled and express-certain web templates to tackle your company or person demands.

Form popularity

FAQ

The FTC's fraud reporting website, IdentityTheft.gov, is where you'll find detailed instructions on dealing with various forms of identity theft. To be safe, you'll also want to review your credit report for any information that's appearing as a result of fraud.

How To Know if Someone Stole Your Identity Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. ... Check your bank account statement. ... Get and review your credit reports.

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes. Order free credit reports annually from the three major credit bureaus (Equifax, Experian, and TransUnion).

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Conduct regular credit checks to verify whether someone has applied for credit using your personal information and if so, advise the credit grantor immediately. Investigate and register for credit related alerts offered by credit bureaus. Check your bank statements regularly.