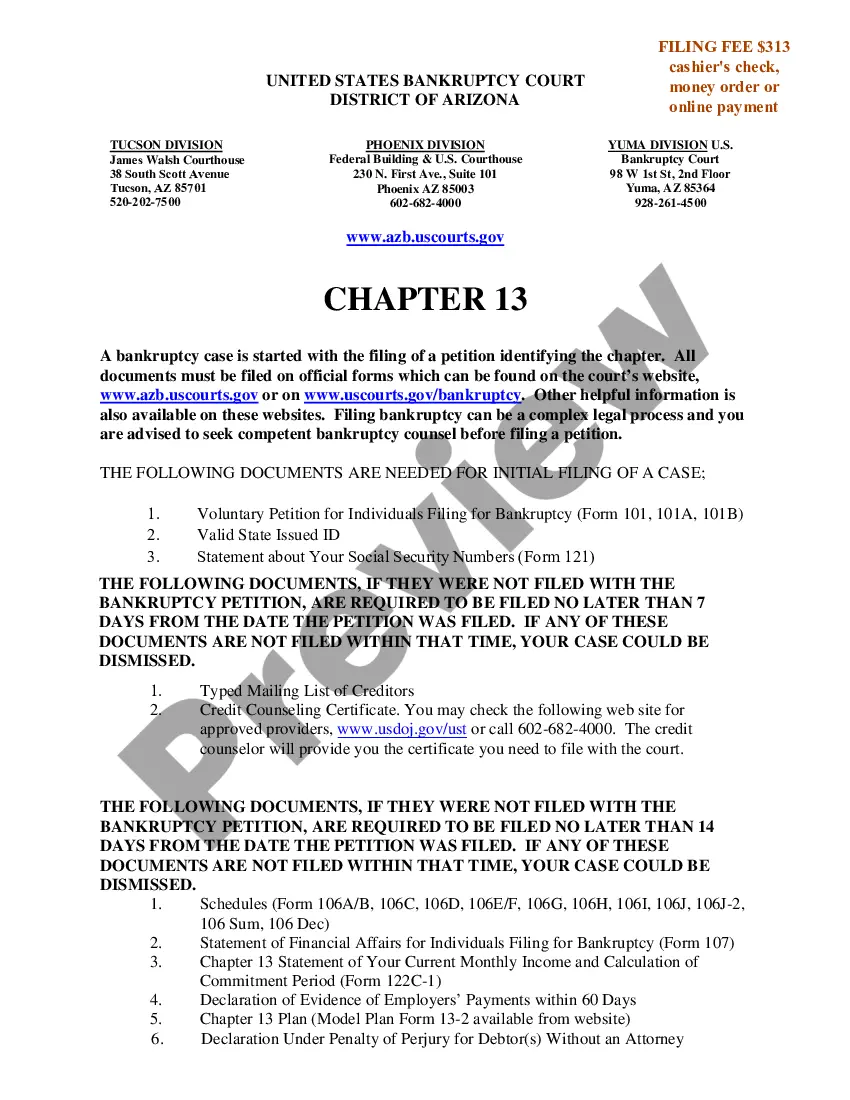

Alaska Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Are you currently in a position where you require papers for possibly organization or personal reasons nearly every working day? There are tons of legitimate file layouts available on the Internet, but discovering types you can rely on isn`t simple. US Legal Forms delivers 1000s of type layouts, just like the Alaska Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, that happen to be written to fulfill federal and state demands.

If you are presently informed about US Legal Forms site and have an account, simply log in. Next, you are able to obtain the Alaska Sample Letter to City Clerk regarding Ad Valorem Tax Exemption template.

If you do not offer an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the type you want and make sure it is for that proper metropolis/state.

- Make use of the Review switch to check the shape.

- Read the description to ensure that you have chosen the proper type.

- If the type isn`t what you are searching for, use the Research area to obtain the type that meets your needs and demands.

- When you obtain the proper type, click on Acquire now.

- Pick the pricing program you would like, fill out the required info to produce your account, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Choose a practical data file format and obtain your backup.

Get each of the file layouts you have purchased in the My Forms food list. You can aquire a extra backup of Alaska Sample Letter to City Clerk regarding Ad Valorem Tax Exemption whenever, if possible. Just click on the essential type to obtain or produce the file template.

Use US Legal Forms, one of the most substantial collection of legitimate forms, in order to save time and stay away from faults. The assistance delivers skillfully made legitimate file layouts that can be used for an array of reasons. Generate an account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

Laws, Regulations, Policies The state of Alaska does not have a sales tax. Municipal, county, and local governments have the ability to assess other taxes and may have separate tax exemption forms and requirements.

Just about all businesses that operate in Alaska must obtain an Alaska resale certificate. As a business owner, it is your responsibility to collect sales taxes or provide exemptions when appropriate.

Under AS 29.45. 030(e), there is a mandatory exemption up to the first $150,000 of assessed value for the primary residence of a senior citizen, age 65 years and older, or a disabled veteran with a service connected disability of 50% or more.

The State of Alaska does not have a tax exemption certificate, as it is not necessary to have one. The Alaska Constitution provides that the State of Alaska is exempt from all taxes emanating from within Alaska.

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Alaska is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase. Sales tax is not used on these purchases because the applicable sales tax will be used on the final sale of the exchanged tangible property.

Alaska does not impose a statewide sales tax and therefore does not have any statewide sales tax exemptions. Cities and boroughs are authorized to levy a sales and use tax on sales, rents, or services made within the boroughs or city.

Applications for exemptions MUST BE received in office, submitted online, or postmarked by March 15th of the tax year in which the exemption is sought.. It is the property owner's responsibility to ensure receipt of the application by the MOA. Exemptions do NOT automatically transfer.