Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a legal agreement that outlines the process of liquidating a debtor's collateral as a means to satisfy their outstanding debt. This agreement is commonly used in financial transactions where a debtor has defaulted on their loan or is unable to repay their debts. The purpose of the Alaska Liquidation Agreement is to establish a clear and organized process through which the debtor's collateral, such as property, vehicles, or inventory, can be sold or otherwise converted into funds to satisfy the outstanding loan amount. It provides a framework for the lender or creditor to legally take possession of the collateral and sell it through an agreed-upon method, such as a public auction or private sale. The agreement typically includes crucial details, such as a description of the collateral, its estimated value, and any liens or encumbrances attached to it. It specifies the creditor's rights and remedies in case of default, including the ability to take possession of the collateral, advertise its sale, and use the proceeds to reduce or eliminate the debtor's indebtedness. Different types of Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness may include: 1. Secured Liquidation Agreement: This type of agreement is used when the debtor has provided collateral to secure the loan. The creditor holds a security interest in the collateral and has the right to liquidate it if the debtor fails to repay the loan. 2. Foreclosure Agreement: In situations where the collateral is real estate, a foreclosure agreement may be used. This agreement outlines the process for the creditor to seize the property, sell it through a foreclosure sale, and apply the proceeds towards the outstanding debt. 3. Repossession Agreement: If the collateral consists of movable assets, such as vehicles or equipment, a repossession agreement may be utilized. This agreement allows the creditor to repossess the collateral and sell it to recover the outstanding debt. In conclusion, Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness is a legal document that facilitates the orderly liquidation of a debtor's collateral to satisfy their outstanding debt. It ensures that the rights and responsibilities of both the debtor and the creditor are clearly defined, resulting in a fair and transparent process.

Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

How to fill out Alaska Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

Are you presently within a situation in which you require paperwork for possibly enterprise or personal functions almost every working day? There are tons of legitimate papers templates accessible on the Internet, but getting kinds you can rely is not easy. US Legal Forms delivers 1000s of form templates, just like the Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness, which are written to meet federal and state demands.

In case you are previously acquainted with US Legal Forms website and possess a free account, simply log in. Afterward, you can down load the Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness template.

Should you not have an bank account and want to begin using US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for the right town/region.

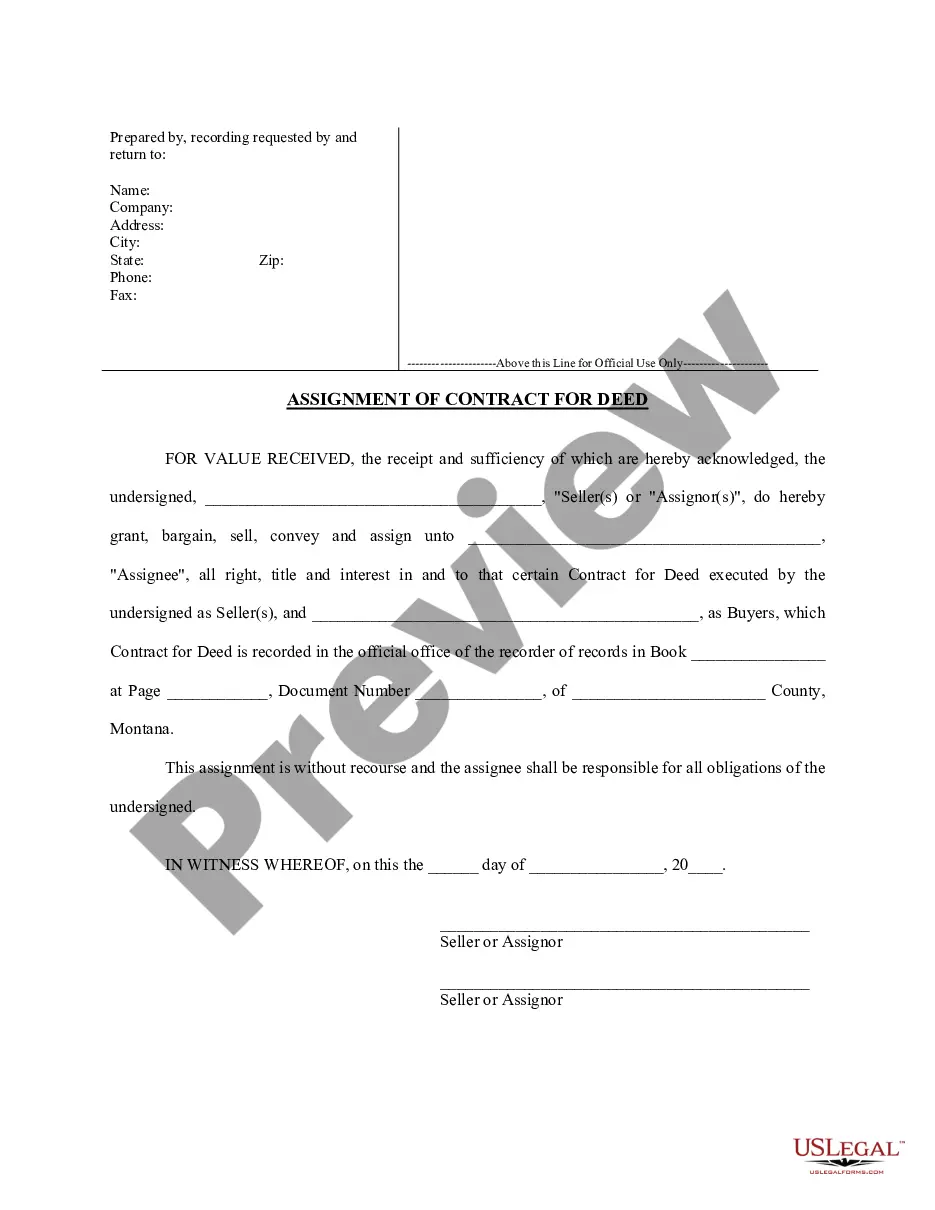

- Take advantage of the Review option to analyze the form.

- Read the description to actually have selected the appropriate form.

- When the form is not what you are trying to find, make use of the Search area to obtain the form that meets your needs and demands.

- If you discover the right form, click on Purchase now.

- Select the rates program you desire, submit the specified information to produce your bank account, and purchase the order with your PayPal or Visa or Mastercard.

- Pick a hassle-free data file format and down load your duplicate.

Get all the papers templates you might have bought in the My Forms food selection. You can obtain a additional duplicate of Alaska Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness anytime, if needed. Just go through the necessary form to down load or printing the papers template.

Use US Legal Forms, by far the most comprehensive collection of legitimate forms, in order to save some time and prevent errors. The service delivers appropriately produced legitimate papers templates that can be used for a range of functions. Produce a free account on US Legal Forms and initiate creating your daily life a little easier.