Alaska Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support

Description

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Decrease In Amount Of Child Support?

Are you currently in a location where you frequently require documents for business or specific purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers a vast selection of template forms, including the Alaska Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support, designed to meet state and federal requirements.

Once you locate the correct form, simply click Purchase now.

Choose the pricing plan you want, fill in the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Alaska Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

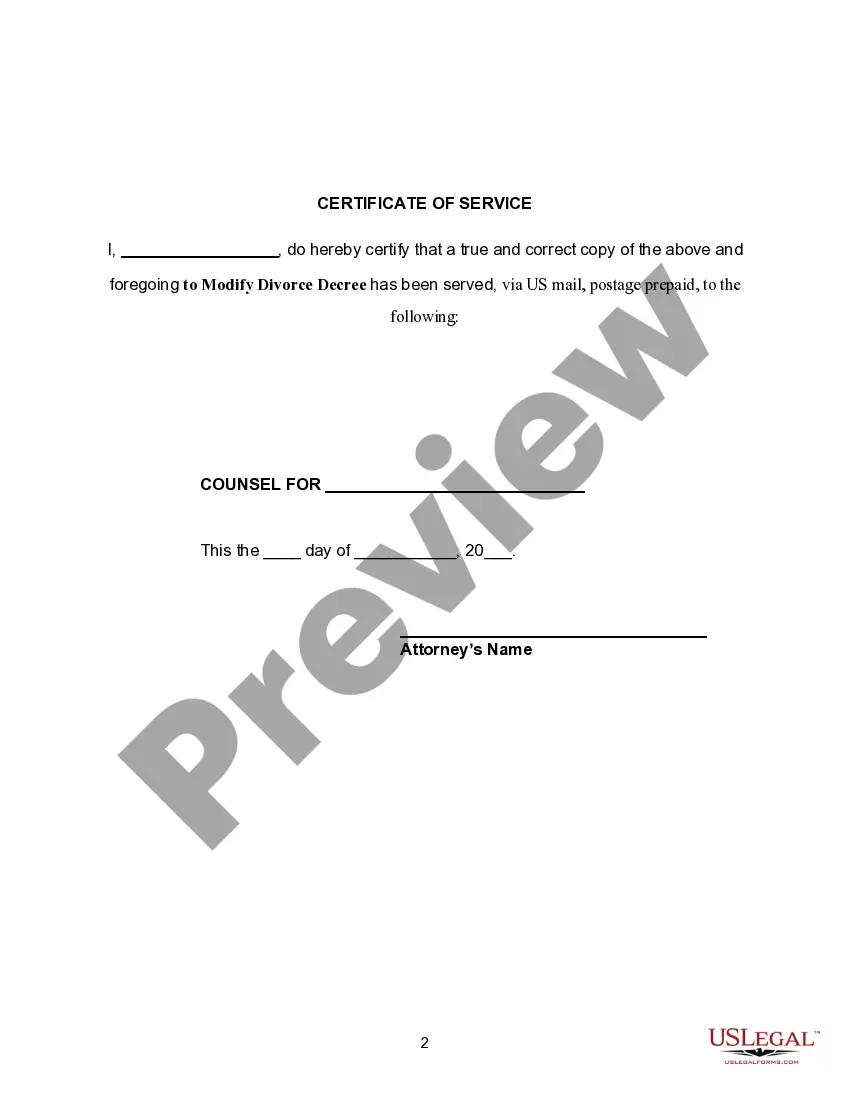

- Use the Review button to view the form.

- Check the outline to ensure you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

There is no fixed maximum amount for child support in California, as the state uses a guideline formula to determine support payments on a case-by-case basis. The formula factors in both parents' incomes, the amount of time each parent spends with the child, and the specific needs of the child.

Massachusetts parents are paying the most in child support The app reports that the average parent in Massachusetts pays $1,187 per month for child support. For comparison, New Jersey parents pay just $424. New Jersey ranks at 47th in the country when it comes to payment averages.

That court rule says that the noncustodial parent of one child should pay 20% of his or her adjusted income to support one child. Adjusted income means earning after deductions for taxes, union dues, retirement deductions and other mandatory deductions.

Rule 90.3 says that the portion of an adjusted annual income over $126,000 will not be used in calculating the child support amount, unless the other parent presents evidence showing the higher income should be used in the calculation. If the cap is used, the AI will be $126,000 for the calculation.

The law says that parents must support their child from the time the child is born until the child turns 18. If you have a child?even if you didn't know about a child that you fathered?you can be required to pay child support from the time of the child's birth.

Yes, it is a federal crime to willfully fail to pay support if the child and noncustodial parent live in different states. The parent can be charged with a felony if the past-due child support exceeds $5,000, or is more than one year delinquent.

You can request a modification by calling, emailing or writing to CSED. Include your federal income tax returns for the past two years, W-2's (annual wage statements you receive from your employer), pay stubs for the past three months, and proof of health insurance coverage.