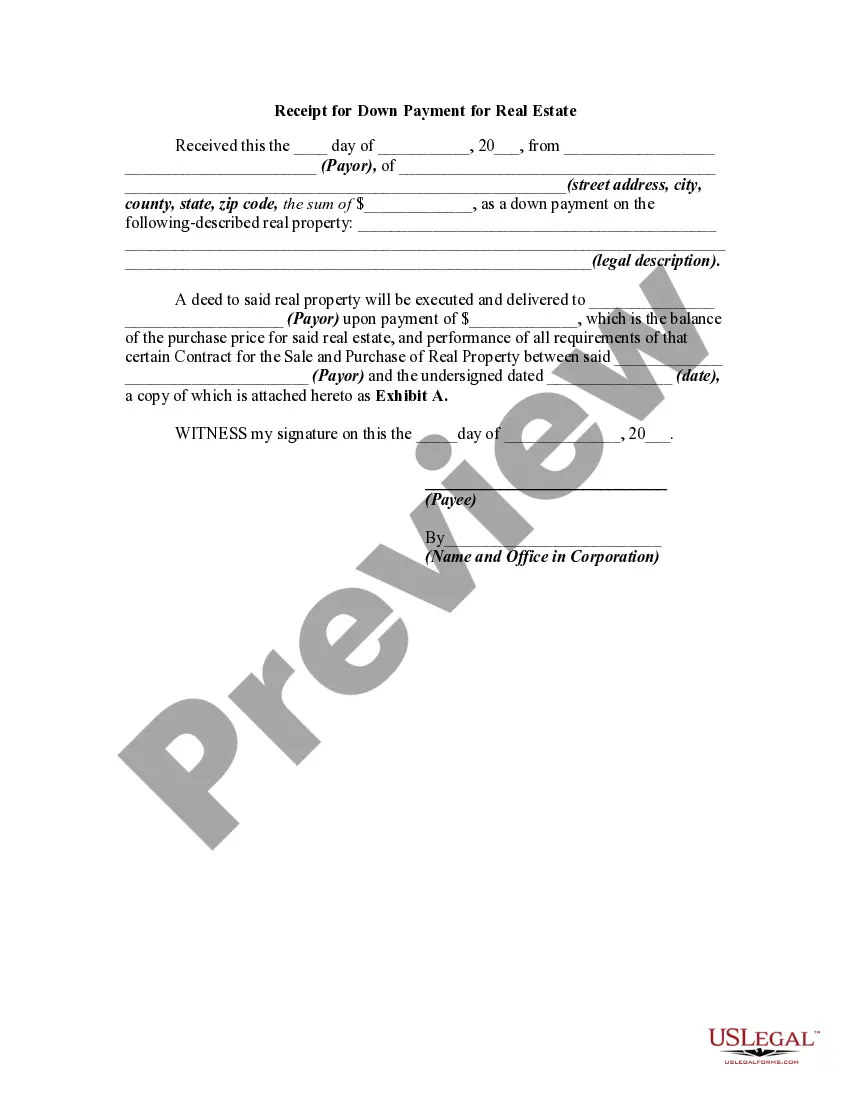

Alaska Receipt for Down Payment for Real Estate

Description

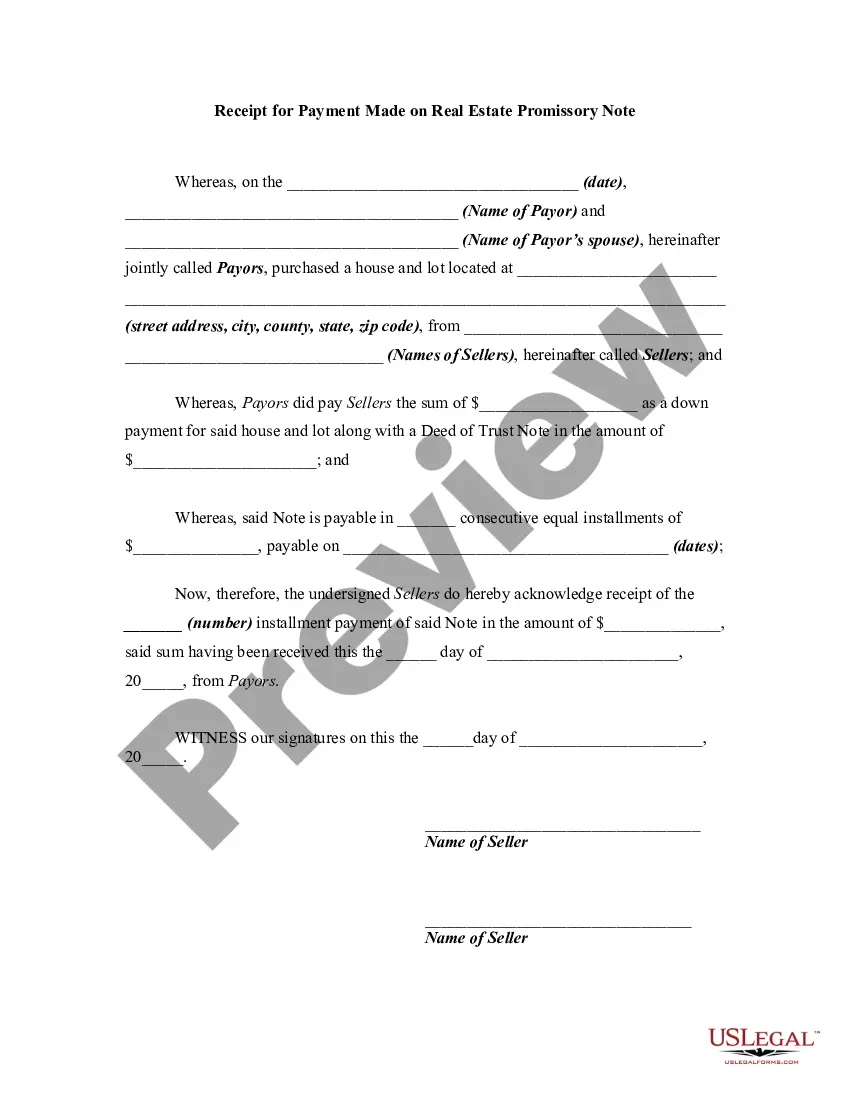

How to fill out Receipt For Down Payment For Real Estate?

You can spend hours online attempting to locate the legal document template that meets the state and federal regulations you will require.

US Legal Forms offers a vast array of legal documents which are evaluated by experts.

You can effortlessly download or print the Alaska Receipt for Down Payment for Real Estate from my service.

If available, take advantage of the Preview option to examine the document template concurrently.

- If you possess a US Legal Forms account, you can Log In and select the Obtain option.

- Following that, you can complete, modify, print, or sign the Alaska Receipt for Down Payment for Real Estate.

- Every legal document template you buy is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click on the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have chosen the suitable form.

Form popularity

FAQ

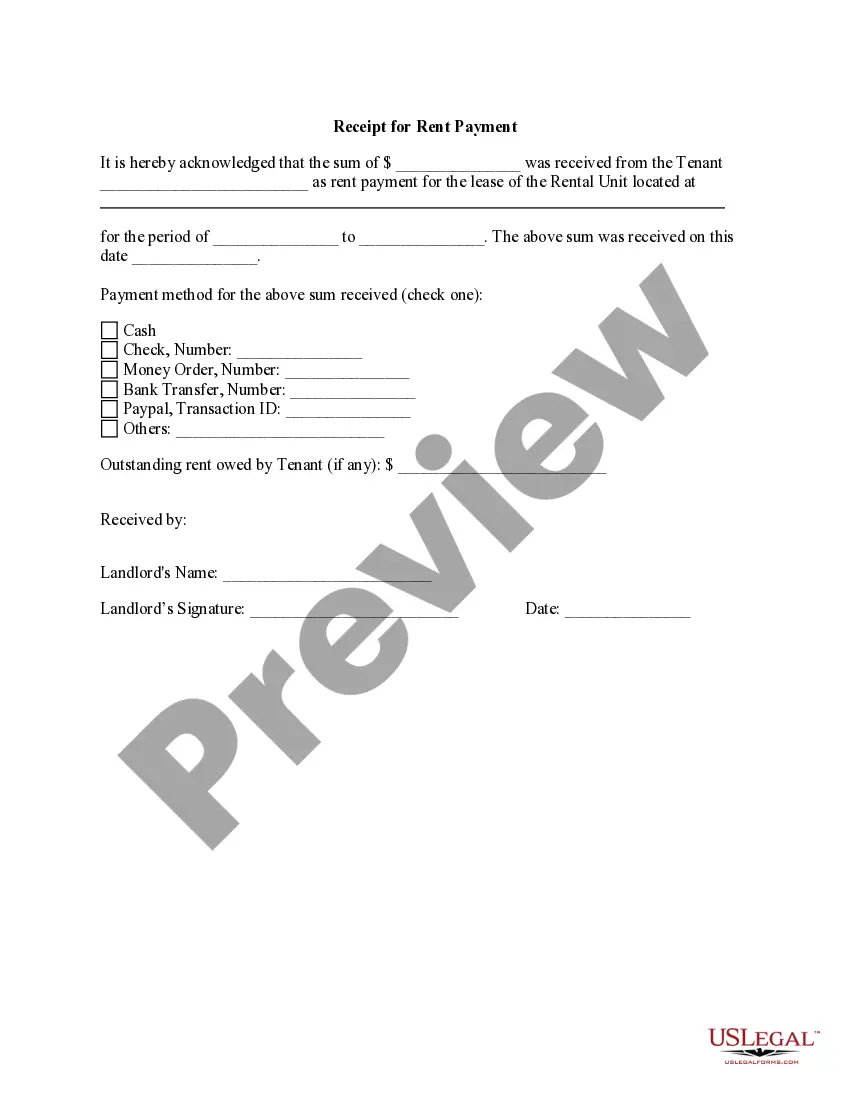

Writing a receipt for a down payment is straightforward. Start by including your name and contact information, the buyer’s name, and the property details. Clearly state the amount received, along with a note indicating that it is an Alaska Receipt for Down Payment for Real Estate. This clarity helps both parties maintain accurate records and reduces potential disputes in the future.

Alaska does not impose a state real estate transfer tax, which makes it attractive for buyers and sellers in the market. However, individual municipalities may have their own transfer fees, so it is vital to verify local regulations. In the context of a real estate transaction, having an Alaska Receipt for Down Payment for Real Estate will ensure all key aspects of the sale are documented properly. This proactive approach safeguards both buyers and sellers against unexpected fees.

While Alaska has certain areas without property taxes, there are other states like Delaware and New Hampshire where property taxes are very low or non-existent for specific circumstances. It's crucial to research individual circumstances, as local laws and exemptions apply. If you plan on buying real estate in these states, consider using an Alaska Receipt for Down Payment for Real Estate as part of your purchasing strategy. This document can streamline your buying process while maximizing your potential benefits from local tax laws.

Alaska does not have a state estate tax, which can be advantageous for residents and real estate investors. The absence of this tax allows individuals to transfer more wealth to their heirs without the burden of state taxation. When dealing with real estate in Alaska, an Alaska Receipt for Down Payment for Real Estate is an important document that can serve to simplify transactions without the additional concern of estate taxes. Always consult a financial advisor for estate planning strategies.

In Alaska, a few areas, such as the city of Anchorage, have no property tax on certain classifications of properties. However, it is essential to note that while some jurisdictions may not impose property taxes, others do have local taxes or levies in place. For individuals considering purchasing real estate, an Alaska Receipt for Down Payment for Real Estate can help in navigating local tax obligations. Always check local regulations to confirm property tax rules before making a decision.

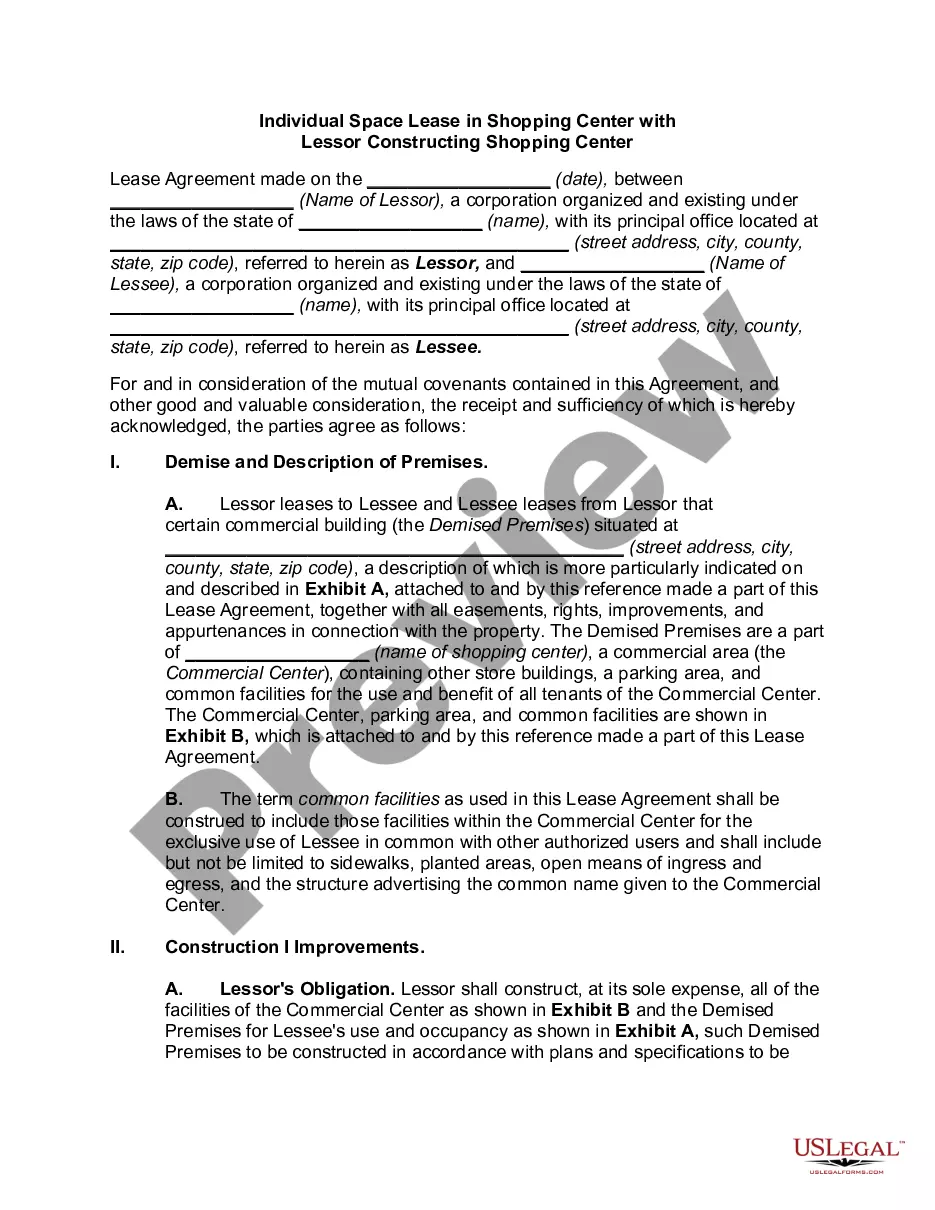

What is the process to make changes to a listing agreement contract? All parties must agree to in writing to any changes.

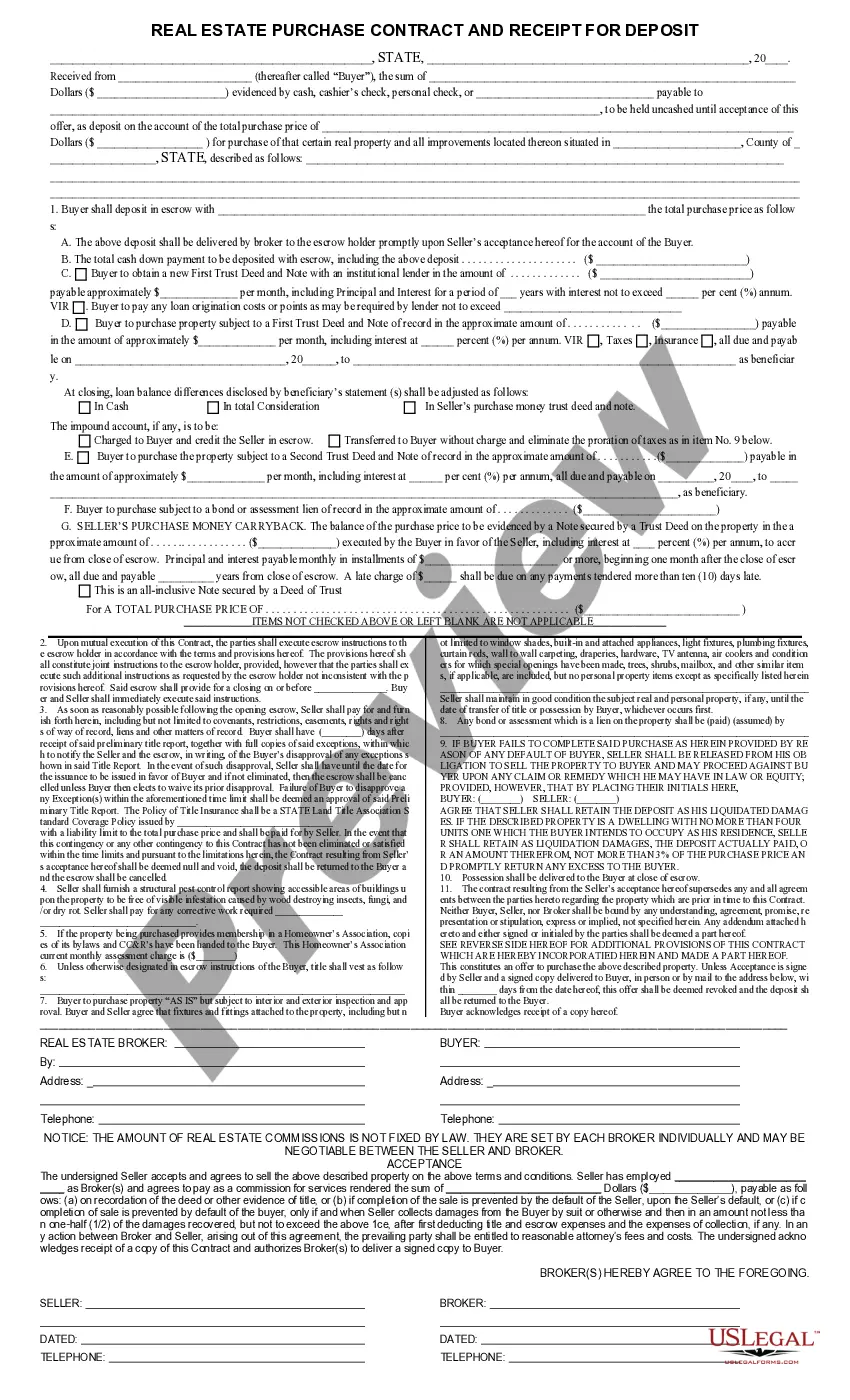

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

Down Payment Invoice. Down Payment Invoice is used when the vendor sends or when the customer requests a bill for a down payment. When the A/R Down Payment Invoice or A/P Down Payment Invoice is created, SAP Business One will post the journal for the down payment but will not affect the value of the inventory.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

A payment receipt is a document given to a customer as proof of full or partial payment for a product or service. Start invoicing for free. A payment receipt is also referred to as a 'receipt for payment'. It's created after payment has been entered on a given sale.