A common-law lien is the right of one person to retain in his possession property that belongs to another until a debt or claim secured by that property is satisfied. It pertains exclusively to personal property. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien

Description

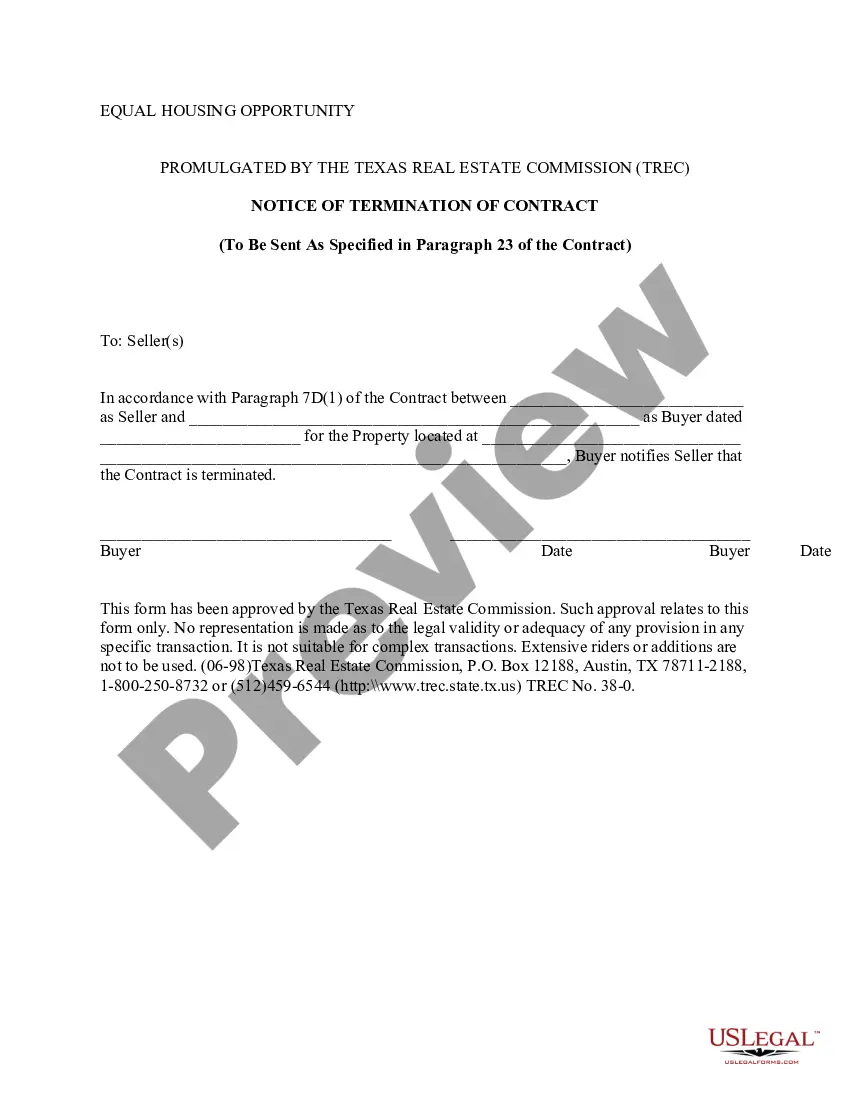

How to fill out Notice Of Lien And Of Sale Of Personal Property Pursuant To Non-Statutory Lien?

If you have to full, download, or print out legal document layouts, use US Legal Forms, the most important collection of legal forms, that can be found on-line. Make use of the site`s simple and easy handy search to find the documents you will need. Various layouts for enterprise and individual reasons are sorted by groups and says, or keywords. Use US Legal Forms to find the Alaska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien in just a couple of clicks.

If you are already a US Legal Forms buyer, log in to your bank account and click the Acquire key to get the Alaska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien. You can even access forms you in the past acquired in the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that right area/nation.

- Step 2. Make use of the Preview method to look through the form`s content. Do not overlook to learn the information.

- Step 3. If you are not happy using the form, use the Research industry near the top of the display to find other models of your legal form web template.

- Step 4. Once you have discovered the form you will need, go through the Purchase now key. Choose the pricing strategy you prefer and include your references to sign up on an bank account.

- Step 5. Procedure the deal. You may use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Select the file format of your legal form and download it on your product.

- Step 7. Complete, change and print out or signal the Alaska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien.

Every legal document web template you acquire is your own forever. You might have acces to each form you acquired in your acccount. Click the My Forms section and pick a form to print out or download once more.

Contend and download, and print out the Alaska Notice of Lien and of Sale of Personal Property Pursuant to Non-Statutory Lien with US Legal Forms. There are millions of skilled and condition-distinct forms you can use for your personal enterprise or individual demands.

Form popularity

FAQ

The state offers debt forgiveness for noncustodial parents who have accrued at least $1,500 in state-owed child support arrears and meets other eligibility criteria. If the parent complies with the arrears forgiveness agreement, state-owed debt will be forgiven in stages over a 6-year period.

How does the Alaska child support agency enforce support orders? We collect child support as ordered. There are two types of orders. To collect support payments, we are federally mandated to send withholding orders for property and wages.

In Alaska in situations where one parent has primary custody, child support is based upon the earnings of the noncustodial parent. If there is shared or divided custody, the child support is based on the income of both parties.

Ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.

You can request a modification by calling, emailing or writing to CSED. Include your federal income tax returns for the past two years, W-2's (annual wage statements you receive from your employer), pay stubs for the past three months, and proof of health insurance coverage.

If you sign a Power of Attorney, you give another person (your agent) the right to make decisions for you and you give them the authority to carry the decisions out. The form provided here is based upon the Alaska Statutes (AS 13.26. 600-965) and it can be tailored to meet your specific needs.

When the court issues a parenting plan or a custody and visitation order, it must issue a child support order based on Civil Rule 90.3. The parents cannot agree to waive child support or to have a specific amount that is lower than the calculated amount.