An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Are you presently in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but locating trustworthy ones isn't straightforward.

US Legal Forms offers thousands of form templates, similar to the Alaska Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of Beneficiary, that are designed to meet federal and state requirements.

If you find the right form, click Get now.

Select the pricing plan you want, submit the required information to create your account, and process your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply sign in.

- After that, you can download the Alaska Assignment by Beneficiary of an Interest in the Trust Created for the Benefit of Beneficiary form.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct region/state.

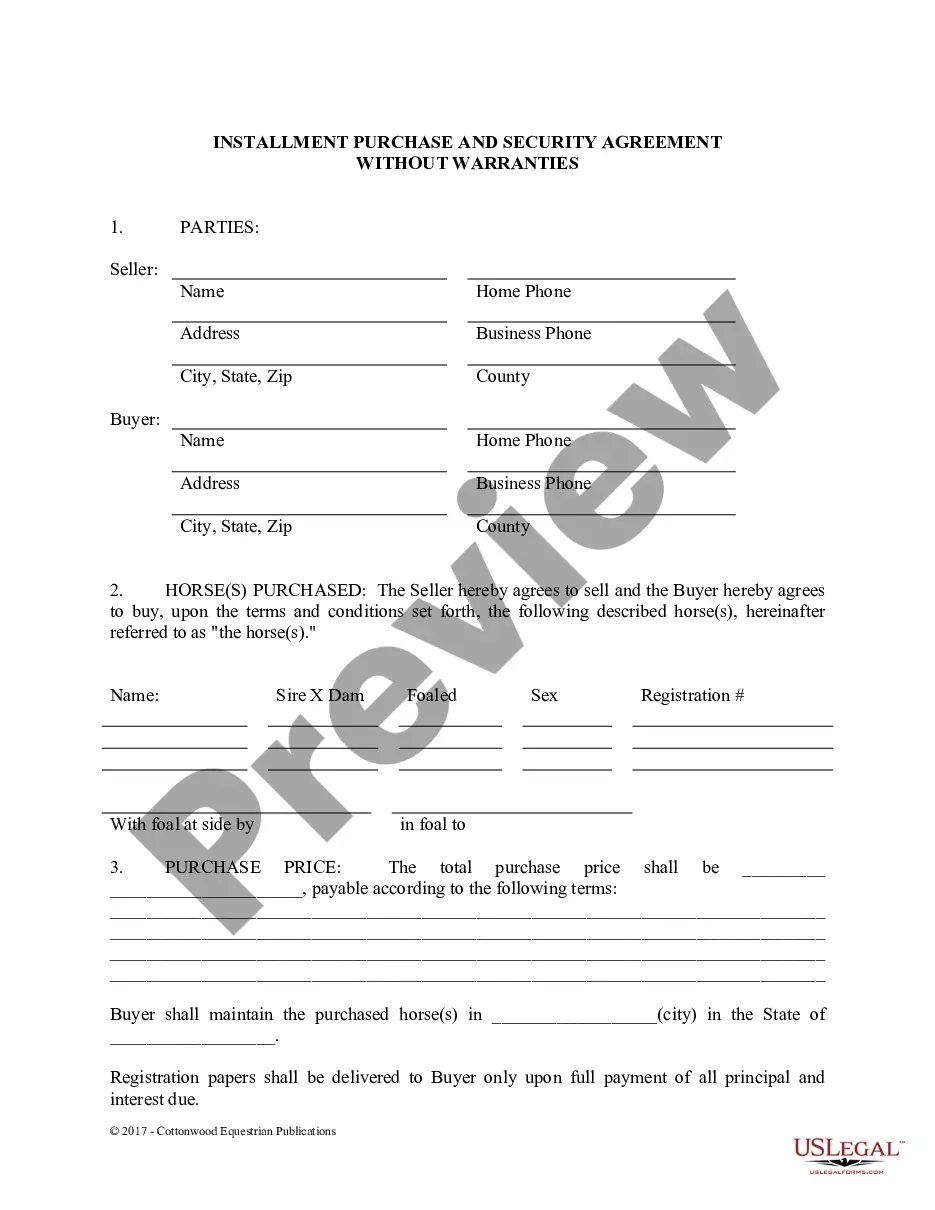

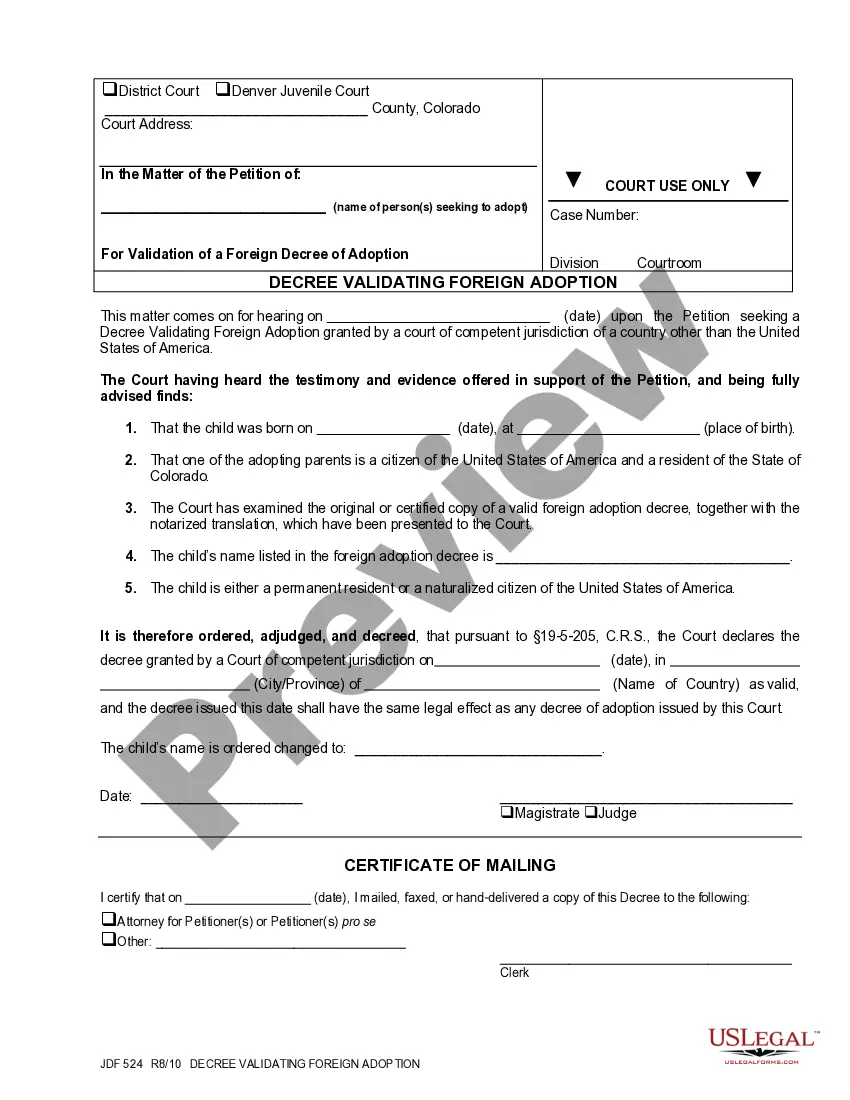

- Utilize the Preview button to review the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

To list someone as a beneficiary, you begin by accessing the appropriate beneficiary designation form. In the case of the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, include their full name and contact information. It’s important to have their consent and accurately represent their relationship to the trust.

To fill beneficiary details, gather all necessary information such as name, contact information, and Social Security number. Ensure that the details align with the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary so that there is no discrepancy. Review each entry for accuracy and completeness before submitting the form.

In a beneficiary type, specify whether the beneficiary is an individual or an entity like a trust or foundation. In the context of the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, choosing the right designation is essential for clarity. This designation affects how the benefits will be administered and what documentation is needed.

Filling out a beneficiary form requires you to input personal details accurately and specify the type of benefit you expect. Follow the guidelines provided with the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Double-check your input, especially on names and dates, to prevent future issues.

Beneficiaries' interest in a trust refers to the rights to receive a portion of the trust's assets or income. In the context of an Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, this means understanding what benefits you may receive and under what terms. Awareness of this interest helps ensure beneficiaries are informed and prepared for future financial distributions.

Listing a trust as a beneficiary involves filling out a specific form which details the trust’s name and tax identification number. Ensure to reference the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary correctly. Consult the trust document for accuracy, and provide additional details as required by the financial institution.

To fill out a beneficiary form, start by obtaining the correct form for the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. Ensure you read the instructions carefully. Enter your personal information, and clearly state the interest being assigned. Finally, review your entries for accuracy before submission.

Assignment of beneficial interest is the legal process by which a beneficiary transfers their rights and benefits from a trust to another party. This process allows the new party to take over those rights, often requiring proper documentation. For those interested, the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary provides a structured approach to manage these assignments effectively.

Yes, a beneficiary can transfer their interest in a trust under specific conditions. This transfer often requires a formal agreement and may involve the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to ensure all legalities are properly followed. Understanding the implications of such a transfer can help maintain the integrity of the trust.

To establish a trust in Alaska, you must have a clear trust document detailing the terms and assets involved. The trust must have a designated trustee responsible for managing the trust according to its terms. When utilizing the Alaska Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is crucial to comply with these requirements to ensure the trust's validity.