Alaska Sample Letter for Employees Unqualified for Christmas Bonus

Description

How to fill out Sample Letter For Employees Unqualified For Christmas Bonus?

If you need to obtain, acquire, or print authentic document templates, utilize US Legal Forms, the largest assortment of legitimate templates, available online.

Take advantage of the site’s user-friendly search feature to locate the forms you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legitimate form template.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account.

- Use US Legal Forms to find the Alaska Sample Letter for Employees Ineligible for Christmas Bonus in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to acquire the Alaska Sample Letter for Employees Ineligible for Christmas Bonus.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

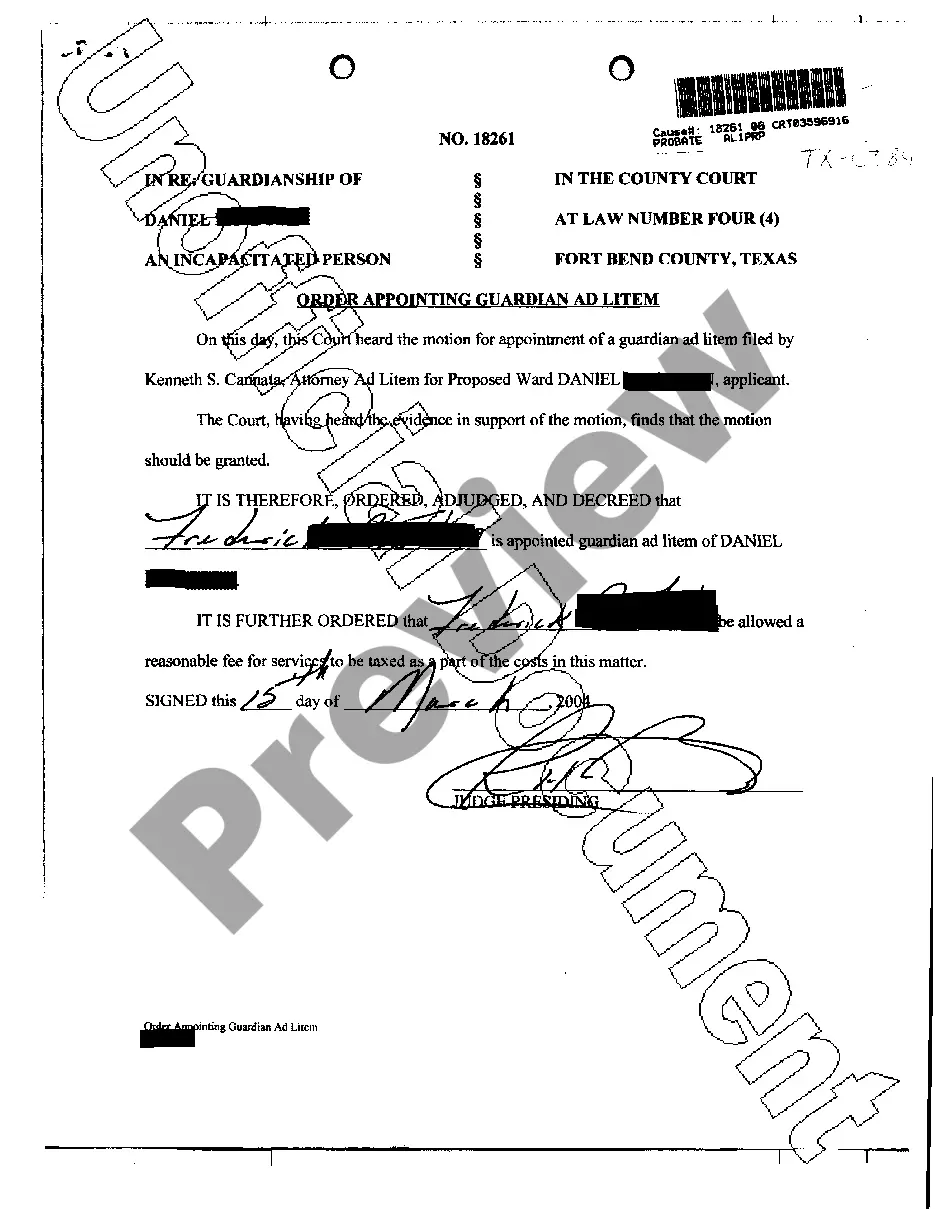

- Step 2. Utilize the Preview feature to review the content of the form. Remember to read the description.

Form popularity

FAQ

To politely ask for a Christmas bonus, consider scheduling a brief chat with your supervisor to express your appreciation for any bonuses received in the past. It helps to emphasize your commitment to the company and your contributions throughout the year. Many find using resources like the Alaska Sample Letter for Employees Unqualified for Christmas Bonus helpful in drafting a respectful request.

You may write off employee Christmas gifts, particularly if they serve as a part of your employee appreciation program. However, the IRS has limits on the amount that can be deducted. To properly address nuances with your employees, consider using the Alaska Sample Letter for Employees Unqualified for Christmas Bonus to provide clear explanations.

Yes, a company can write off employee bonuses as part of its operational expenses. Writing off bonuses can be beneficial for both the employer and employees. Should you find yourself in need of a formal method to communicate unqualified bonuses, the Alaska Sample Letter for Employees Unqualified for Christmas Bonus is a useful resource.

An employer can write off Christmas bonuses as a business expense on their taxes. This practice can help improve employee morale and retention. For specific cases, such as when certain employees may not qualify for a bonus, an Alaska Sample Letter for Employees Unqualified for Christmas Bonus can aid communication and clarity.

Yes, employers can generally write off Christmas bonuses, as they are considered a business expense. When providing bonuses, companies need to follow appropriate accounting practices. For guidance, the Alaska Sample Letter for Employees Unqualified for Christmas Bonus details how to responsibly communicate these matters with staff.

A bonus letter typically includes the employee's name, the company name, and details about the bonus amount and reasoning. It may also express appreciation for the employee's contributions. For those unqualified for a bonus, using an Alaska Sample Letter for Employees Unqualified for Christmas Bonus can provide a clear and professional approach.

When writing a request for a bonus, start by expressing gratitude for your job and the opportunities provided. Clearly outline your contributions over the past year and why you believe a bonus would be appropriate. If you are addressing the lack of a bonus, mention the Alaska Sample Letter for Employees Unqualified for Christmas Bonus as a reference for clarity.

Generally, a boss is not required to give a Christmas bonus unless it is stipulated in an employment agreement. Bonuses are often at the discretion of the employer and depend on company performance. If you face a situation without a bonus, consider requesting clarity with an Alaska Sample Letter for Employees Unqualified for Christmas Bonus.

Employees may or may not be entitled to a Christmas bonus based on company policy or individual employment agreements. It's essential to review your employment contract to understand your rights. If you find yourself unqualified for a bonus, an Alaska Sample Letter for Employees Unqualified for Christmas Bonus can help you understand your position.

You should record a Christmas bonus as a payroll expense at the time of payment. Maintain accurate records of all bonuses issued, including dates and amounts. If an employee does not qualify for a bonus, an Alaska Sample Letter for Employees Unqualified for Christmas Bonus can help document the reasoning behind your decision.