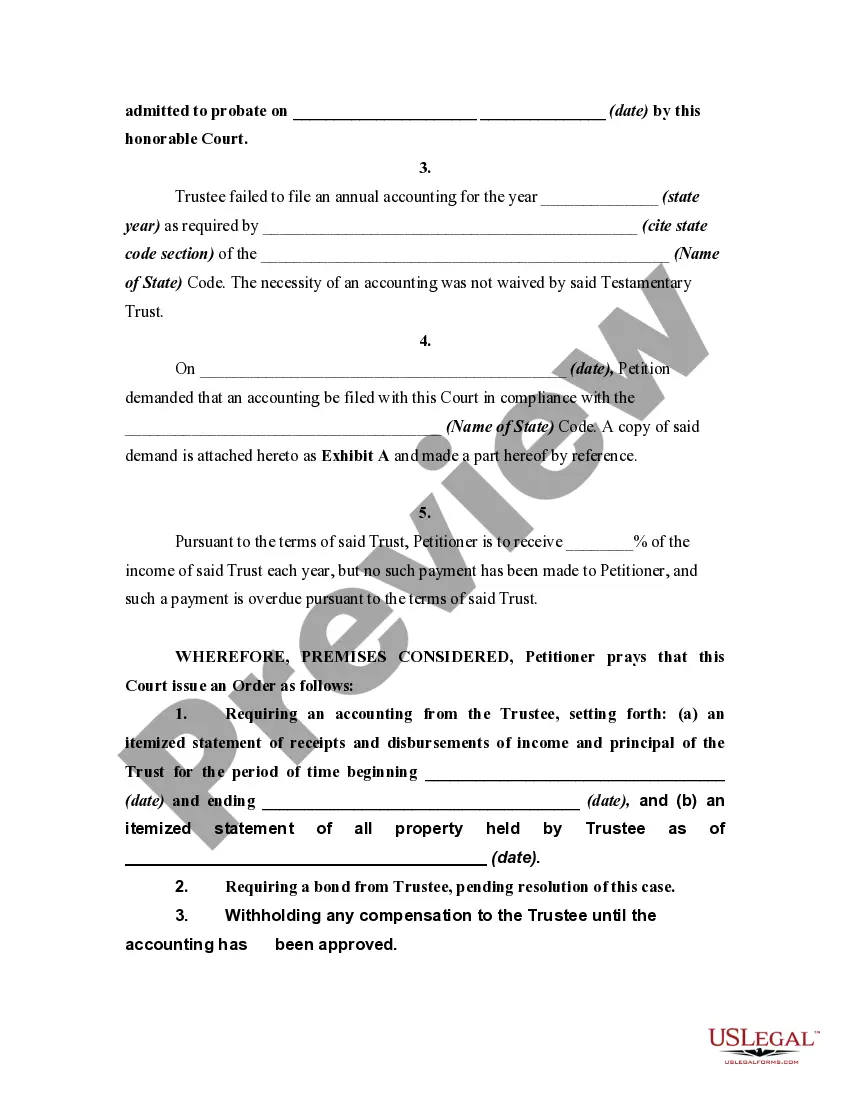

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Alaska Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

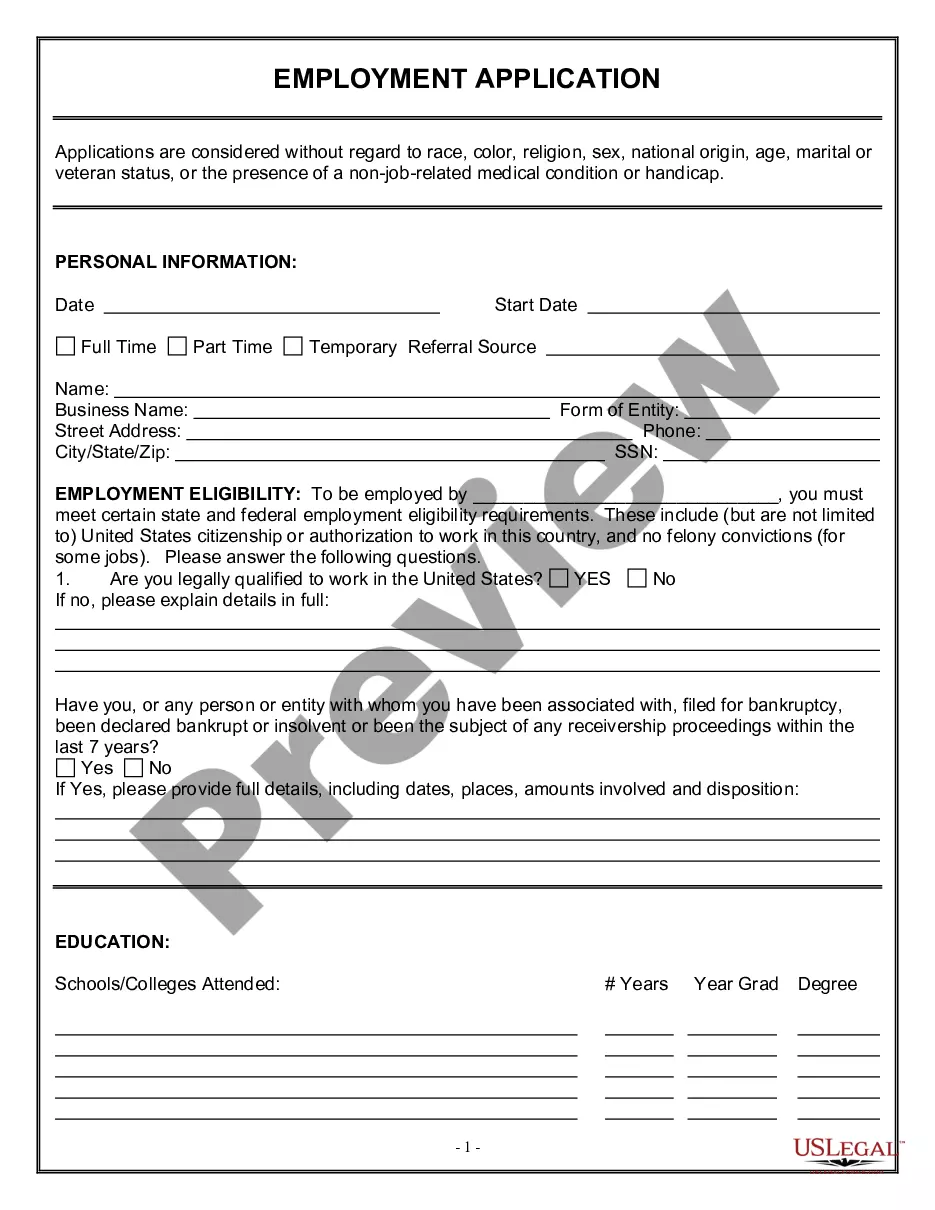

If you desire to finish, retrieve, or print authentic document templates, utilize US Legal Forms, the largest selection of authentic forms, which are accessible on the web.

Employ the site's straightforward and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to find the Alaska Petition to Require Accounting from Testamentary Trustee in just a few clicks.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the payment.

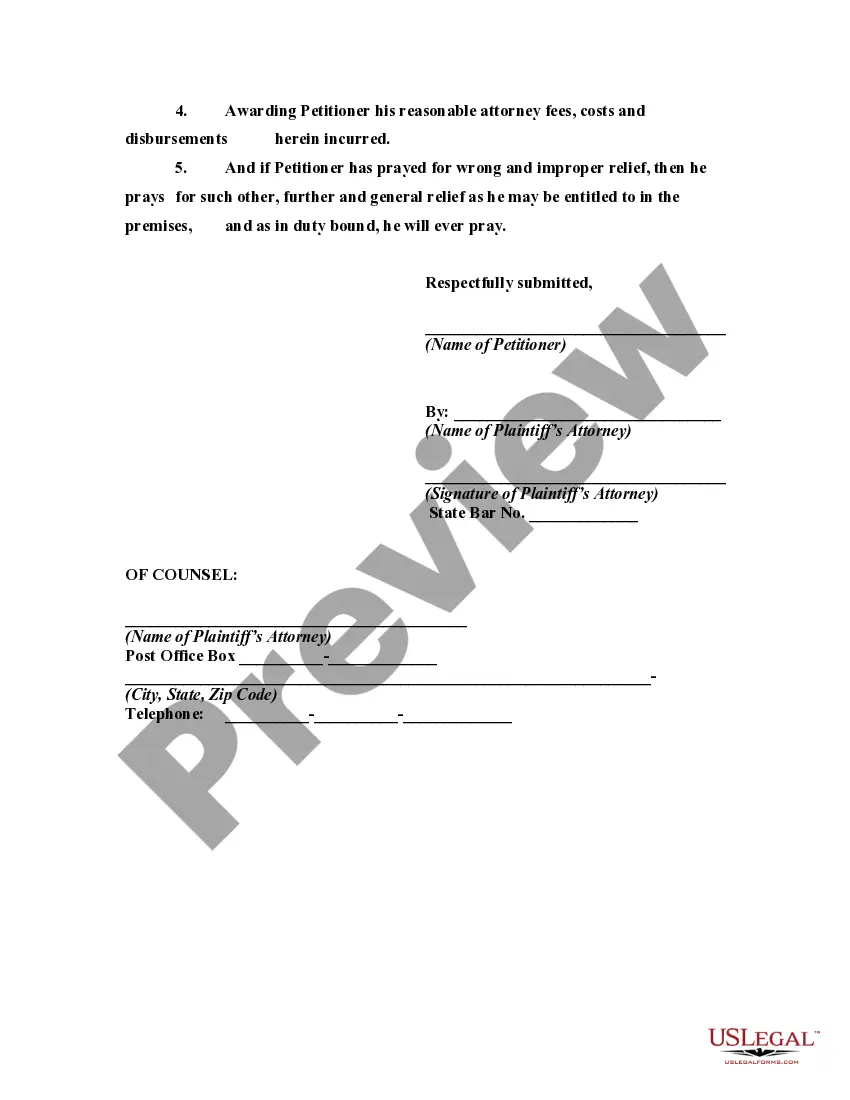

Step 6. Select the format of the authentic form and download it to your device. Step 7. Complete, edit, and print or sign the Alaska Petition to Require Accounting from Testamentary Trustee. Every authentic document template you obtain is yours forever. You have access to every type you downloaded within your account. Check the My documents section and select a form to print or download again. Be proactive and download, and print the Alaska Petition to Require Accounting from Testamentary Trustee with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to acquire the Alaska Petition to Require Accounting from Testamentary Trustee.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

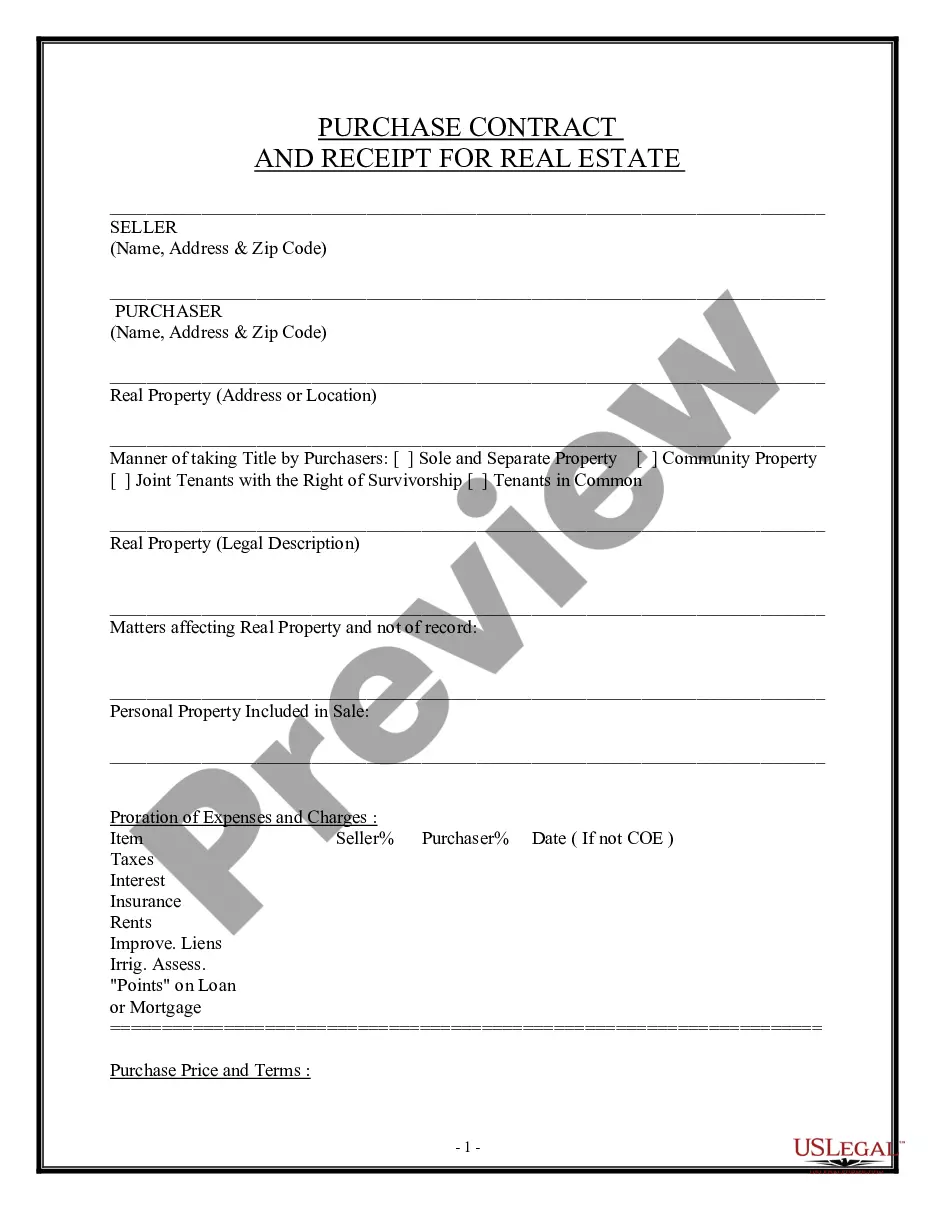

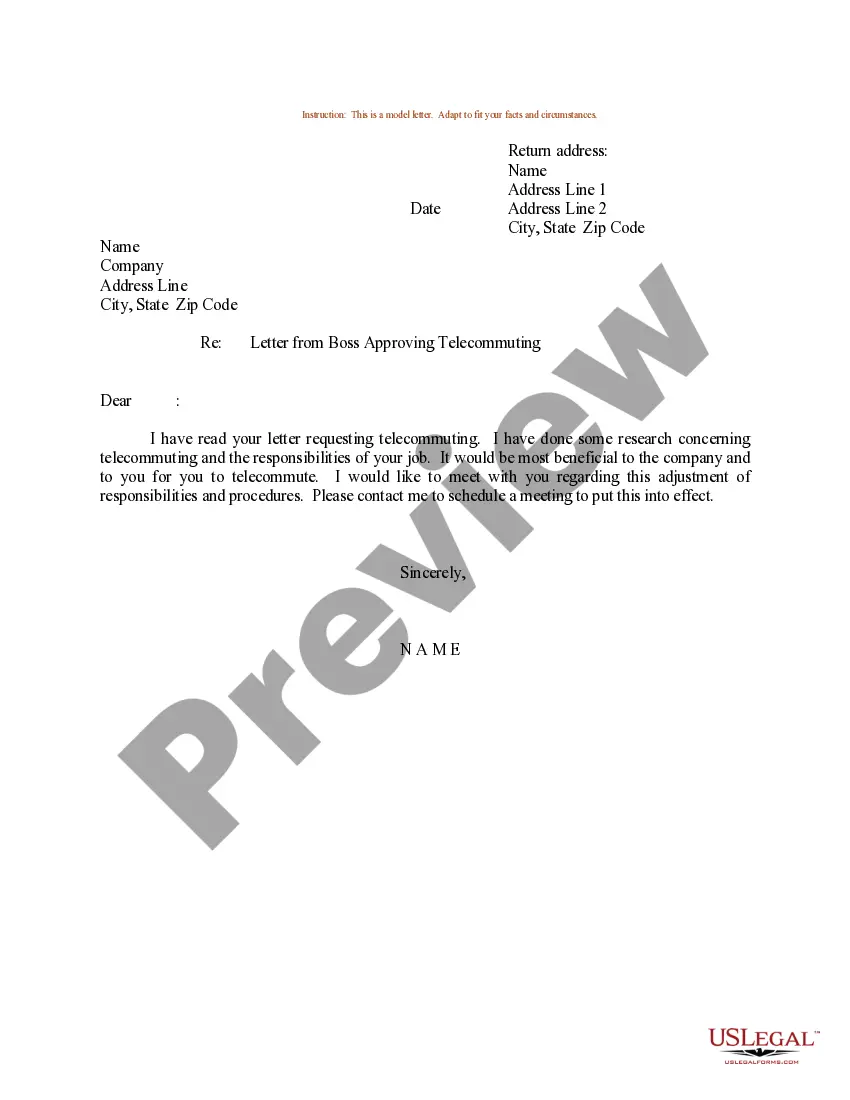

- Step 2. Use the Preview feature to review the form’s details. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the authentic form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

The court shall appoint counsel or a guardian ad litem only when the court specifically determines that the appointment is clearly authorized by law or rule, and that the person for whom the appointment is made is financially eligible for an appointment at public expense. (b)Appointments under AS 18.85.

A probate is required when a person dies and owns property that does not automatically pass to someone else, or the estate doesn't qualify to use the Affidavit for Collection of Personal Property procedure. A probate allows a Personal Representative to transfer legal title of that property to the proper persons.

After Filing the Petition If you are appointed the Personal Representative, the court will send you the Letters Testamentary (or Letters of Administration) once it is signed by the clerk or magistrate. This is the document that you will use to prove that you are authorized to act on behalf of the estate.

Rule 12. Closing Estates. (a) Duty to Close Estates. When a personal representative has completed administration of the estate, the personal representative either shall petition to close the estate by formal closing under AS 13.16. 620 or AS 13.16. 625 or file a sworn statement under AS 13.16.

Exempt property is personal property of the person who died, worth up to $10,000, that the Personal Representative must give to certain family members.

How Long Do You Have to File Probate After Death in Alaska? There is no limit to when you can file a will with probate court after the deceased passes in Alaska.

In fact, many estates can be settled without any court involvement at all. Estates valued at less than $50,000, plus $100,000 worth of motor vehicles, can often avoid the probate process in court, provided the estate contains no real property (land or a home).