An Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering is a legally binding document in the state of Alaska that provides assurances that a particular investment offering will not violate the exemption regulations set forth by the Alaska Division of Banking and Securities for intrastate offerings. This letter is often required by the Division of Banking and Securities as part of the process of obtaining an exemption from certain securities' registration requirements. The purpose of this letter is to demonstrate to the Division of Banking and Securities that the issuer of the investment offering understands and will comply with the specific regulations governing the exemption for intrastate offerings. By signing this letter, the issuer acknowledges their understanding of these regulations and agrees to adhere to them, thereby ensuring that the offering remains within the confines of the exemption and does not trigger associated registration requirements. The letter will typically include detailed information about the investment offering itself, such as the type of security being offered, the intended use of the funds, and the target investor demographic. It will also provide a comprehensive overview of the intrastate exemption requirements and explain how the offering meets each of these criteria. Different types of Alaska Investment Letters Promising not to Violate Exemption of Intrastate Offering may be categorized based on the specific exemption rules they are designed to comply with. Some common types of these letters include: 1. Limited Offering Exemption: This type of letter assures compliance with the exemption regulations for offerings that meet certain criteria, such as offering securities to accredited investors only, a limited number of offerees, or a maximum offering amount. 2. Section 3(a)(11) Exemption: This letter guarantees compliance with the exemption provided by Section 3(a)(11) of the Securities Act of Alaska, which permits intrastate offerings where the entire offering and all purchasers are within the boundaries of Alaska. 3. Rule 147 Exemption: This letter ensures adherence to the requirements of Rule 147 under the Securities Act of Alaska, which establishes a safe harbor for intrastate offerings where the issuer and all offerees are residents of Alaska. In conclusion, an Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering is a critical document for issuers seeking to comply with the securities regulations in Alaska. By providing detailed information about the offering and affirming compliance with the specific exemption rules, this letter demonstrates the intention to conduct the offering in accordance with the law.

Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering

Description

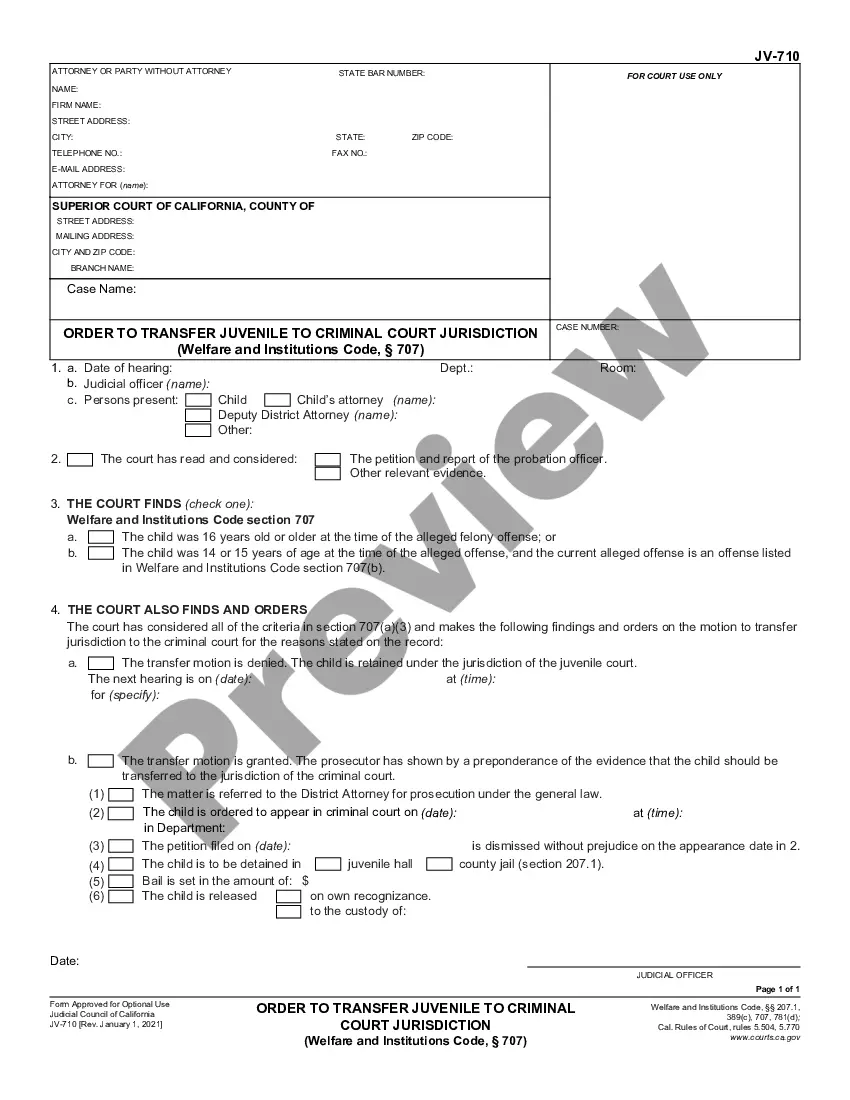

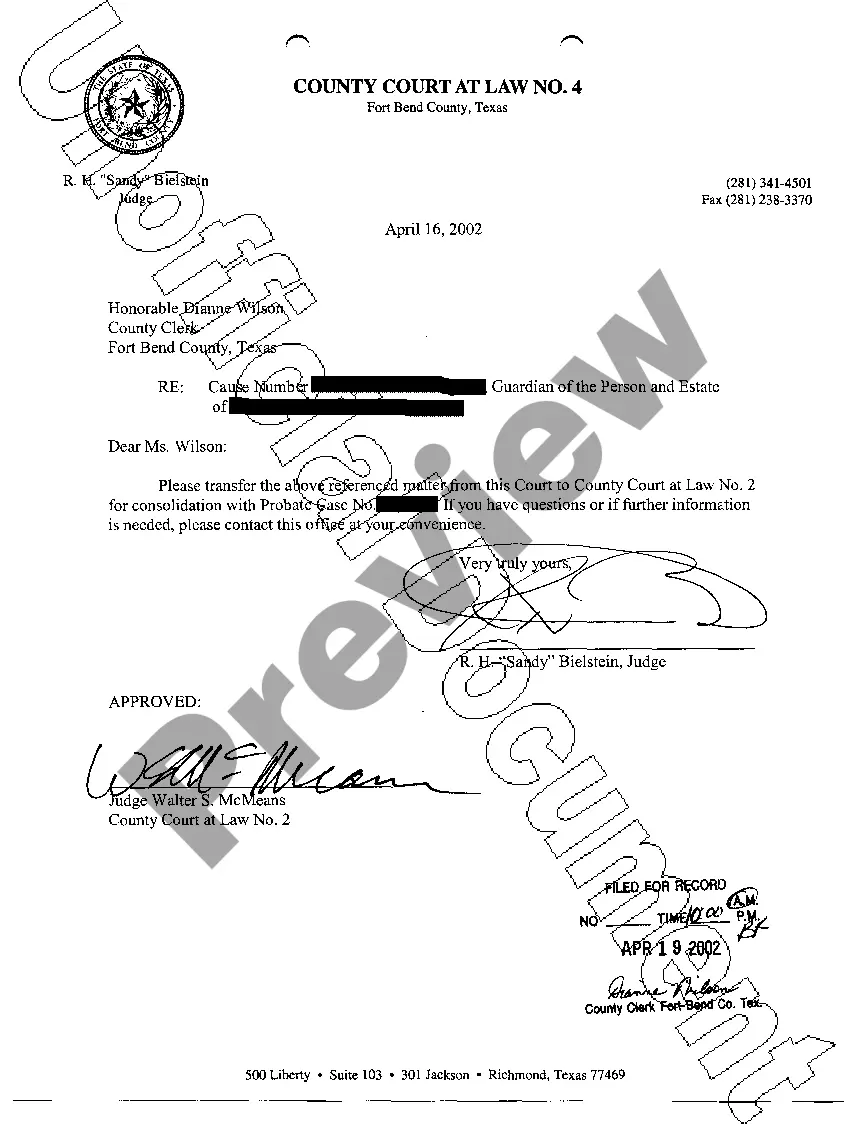

How to fill out Alaska Investment Letter Promising Not To Violate Exemption Of Intrastate Offering?

You can invest multiple hours online trying to discover the legal document template that fulfills the state and federal requirements you seek.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

It is easy to acquire or create the Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering from my service.

Firstly, ensure that you have selected the correct document template for the state/town of your choice. Review the form description to confirm you have chosen the right form. If available, utilize the Review button to examine the document template as well. If you wish to find another version of the form, use the Search field to locate the template that suits your needs.

- If you already have a US Legal Forms account, you can sign in and then click the Acquire button.

- Then, you can complete, edit, create, or sign the Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering.

- Every legal document template you receive is your possession permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

The Regulation A exemption, specifically Tier 2, allows for offerings up to $5 million in a 12-month period without the full registration process. This regulatory pathway provides emerging businesses with a valuable opportunity to raise capital. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering is instrumental in guiding businesses through such exemptions, ensuring compliance while fostering local investment.

Certain securities like municipal securities, small offerings under Regulation D, and intrastate offerings are typically exempt from the registration requirements of the Securities Act of 1933. These exemptions are crucial for fostering local investment and supporting regional economies. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering is an essential tool for issuers looking to understand and utilize these exemptions effectively.

An exemption from registration represents a legal allowance for securities to be sold without the issuer undergoing the full registration process with the SEC. This concept helps streamline the capital-raising process for local businesses, enabling them to connect with local investors efficiently. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering provides specific guidance on how to safely navigate these exemptions.

Yes, Regulation A can qualify as a public offering and is technically an exemption from SEC registration. It allows companies to publicly solicit investments while still enjoying some ease of regulatory compliance. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering aligns with regulatory frameworks that support such public offerings, making it easier for community-focused businesses to thrive.

Generally, securities that qualify for exemptions, such as those under Regulation D or certain intrastate offerings, are not subject to the same disclosure rules as registered securities. This is beneficial for local businesses, enabling them to attract capital without extensive paperwork. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering is a vital document that helps clarify these exemptions.

Yes, intrastate securities can be exempt under certain regulations, specifically Regulation D and Rule 147. These exemptions promote local investment and help businesses raise funds within their state without the need for federal registration. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering supports this idea by framing a clear guideline for local offerings.

A regulation exemption allows certain offerings of securities to bypass full registration with the SEC. This means that issuers can present securities to the public without enduring the lengthy and complex registration process. The Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering illustrates how specific exemptions facilitate local fundraising efforts, enabling businesses to attract investors without extensive regulatory hurdles.

The intrastate exemption quizlet serves as an educational tool, summarizing key points about the intrastate exemption. It often highlights the requirements and benefits of conducting securities offerings within a single state. Understanding this exemption can help you leverage the Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering effectively and responsibly.

The intrastate exemption protects businesses from federal securities regulations when they offer securities solely to state residents. This exemption simplifies the fundraising process for local companies, reducing regulatory burdens. By utilizing an Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering, businesses can confidently navigate their financing options while remaining compliant.

An intrastate offering refers to a method of raising capital within a single state. This allows businesses to offer and sell securities to residents of that state without registering with the federal SEC. Such offerings are essential for local entrepreneurs aiming to fund their projects while ensuring compliance with the Alaska Investment Letter Promising not to Violate Exemption of Intrastate Offering.

Interesting Questions

More info

Further, they will seek to address emerging issues in areas such as asset-backed securities, securities lending, derivatives, corporate governance, corporate finance, and tax. Finally, they will provide new alternatives for the existing offering rules to address issues related to the new rules offered through the solicitation. Additional Information for this Area: The state securities laws and rules for investment companies and related entities are not the same everywhere. The AICPA's investment company and related entity investment company regulations define in different ways each of the state financial statutes and rules and the standards applicable to them; each of these is different from the others and is addressed below. State securities laws and rules are summarized here and detailed at ; a link to the state statutes relevant to the current solicitation has been included at the foot of this page. Also, see the AICPA Rules, Rules Summary, and State Practice Guide.