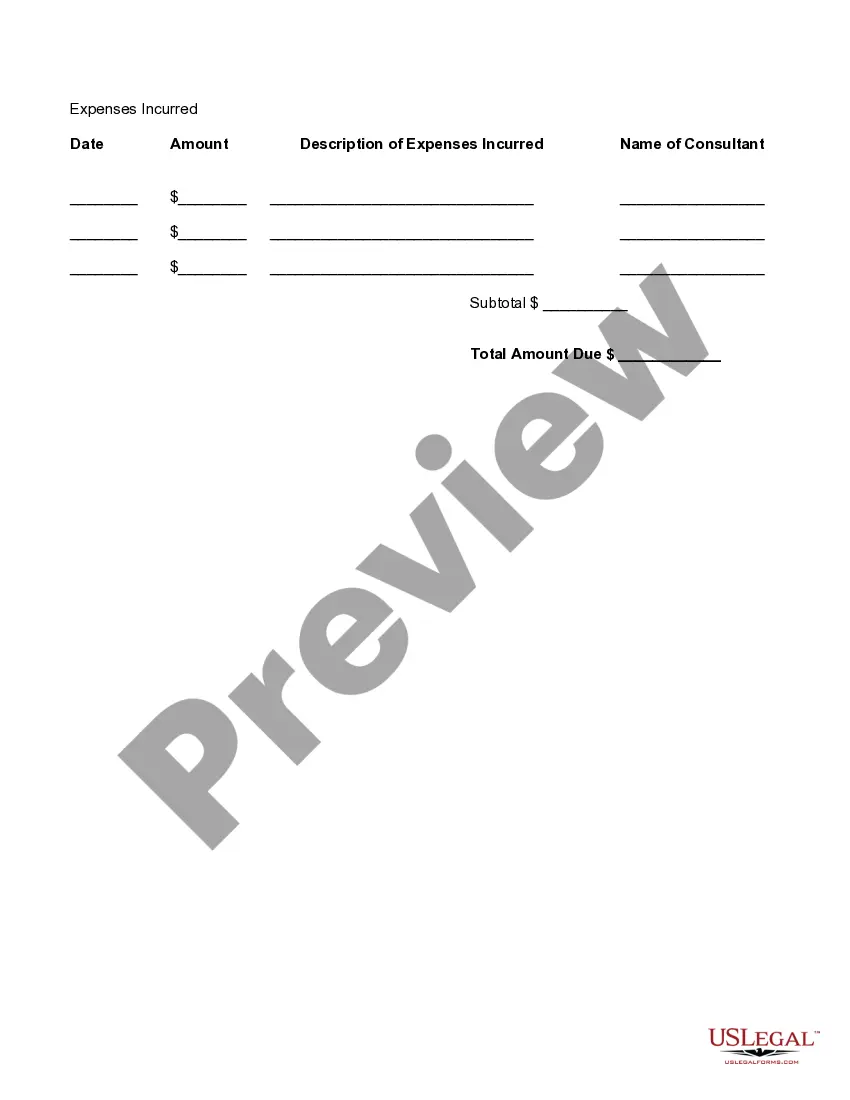

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Detailed Consultant Invoice

Description

How to fill out Detailed Consultant Invoice?

You can spend several hours online attempting to locate the official document format that meets the state and federal requirements you need.

US Legal Forms provides thousands of official templates that can be reviewed by professionals.

You can obtain or print the Alaska Detailed Consultant Invoice from this service.

If available, utilize the Preview button to view the document format at the same time.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Alaska Detailed Consultant Invoice.

- Every official document template you purchase is yours forever.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the region/area of your choice.

- Review the form details to make certain you have chosen the proper template.

Form popularity

FAQ

Consultants typically bill on an hourly, project-based, or retainer basis, depending on the service agreement with their clients. They often use detailed invoices to itemize their charges, making it easier for clients to see what they are paying for. Utilizing the Alaska Detailed Consultant Invoice format can help streamline your billing process while ensuring all services are documented.

Your invoice should include essential information like your details, client information, service descriptions, and payment terms. A good rule of thumb is to be as thorough as necessary for your client to understand the charges without confusion. A detailed invoice, like the Alaska Detailed Consultant Invoice, enhances professionalism and may expedite payment.

A detailed invoice is a comprehensive billing document that outlines the services provided, the time spent on each task, and the resulting charges. It provides transparency to your clients, ensuring they understand exactly what they are paying for. The Alaska Detailed Consultant Invoice template allows you to present all these elements clearly, which can build trust with your clients.

Invoicing as a consultant involves creating a professional document that lists your services, rates, and payment terms. Using an Alaska Detailed Consultant Invoice structure helps you include essential information, such as your business details and contact information. You can also customize the invoice to fit your brand and streamline your billing process.

To accept payments as a consultant, you can use various methods such as bank transfers, credit cards, or payment platforms like PayPal. Consider integrating your payment system with your invoicing methods for a smoother transaction process. By using the Alaska Detailed Consultant Invoice, you can easily outline payment terms and your preferred payment methods within your invoice.

To receive an invoice from Alaska Airlines, log into your account on their website or app. You can find and download your travel receipts, which include the Alaska Detailed Consultant Invoice, for your records. If you booked via a third party, reach out to them to obtain the necessary documentation.

Yes, you generally need a contractor's license in Alaska if your construction projects exceed $1,000. The licensing process ensures that you meet the necessary regulations to operate safely and legally. Using an Alaska Detailed Consultant Invoice will assist you in keeping detailed financial records throughout this process.

Yes, Alaska requires a contractor's license if you plan to undertake projects that exceed specific monetary limits. For projects under $1,000, a license is not mandatory. However, documenting all transactions, such as through an Alaska Detailed Consultant Invoice, is essential to maintain clarity and compliance in your business practices.

To initiate a small handyman business, develop a solid business plan that outlines your services and target market. Register your business, acquire any necessary licenses, and create a marketing strategy to attract customers. Utilizing an Alaska Detailed Consultant Invoice can help you keep track of your income, expenses, and customer payments.

Starting a handyman business in Alaska involves registering your business, obtaining the necessary licenses, and determining your service offerings. It's essential to set up a business bank account and use tools like an Alaska Detailed Consultant Invoice to manage your finances effectively. This approach simplifies bookkeeping and showcases your professionalism.