Alaska Owner Financing Contract for Car: A Comprehensive Guide for Buyers and Sellers Introduction: In the vast expanse of Alaska with its rugged terrains and far-flung communities, owning a car becomes a necessity. However, purchasing a vehicle through traditional means might not always be feasible for some individuals due to various financial constraints. In such cases, an Alaska Owner Financing Contract for Car offers an attractive alternative, providing a pathway to car ownership through customized financing arrangements. This detailed description aims to explain the concept of owner financing and shed light on various types of contracts specific to Alaska. What is an Alaska Owner Financing Contract for Car? An Alaska Owner Financing Contract for Car, also referred to as a "seller-financed car deal" or "buy here, pay here" agreement, is a legally binding contract that allows a car buyer to acquire a vehicle directly from the seller without relying on a third-party lender or traditional financing sources. In this arrangement, the seller acts both as the vehicle seller and the financier, setting up a mutually agreed-upon payment plan in which the buyer makes installment payments directly to the seller over an agreed period. Types of Alaska Owner Financing Contracts for Car: 1. Full Purchase Price Installment Contract: This is the most common type of owner financing contract, where the buyer agrees to make regular payments to the seller to cover the full purchase price of the vehicle. This contract typically includes details such as the sale price, interest rate (if any), down payment requirement, payment schedule, and consequences of default. 2. Lease-to-Own Contract: In this type of contract, the buyer initially enters into a lease agreement with the seller, paying monthly lease payments for a specified period. At the end of the lease term, the buyer gains ownership of the vehicle by paying an additional predetermined amount or financing the remaining balance. 3. Rent-to-Own Contract: A rent-to-own contract allows the buyer to rent the vehicle from the seller for an agreed-upon period while making regular payments. Unlike a lease, this contract typically does not offer an automatic ownership transfer at the end. However, the buyer may have the option to purchase the vehicle at a predetermined price or apply the rent payments towards the purchase price. 4. Balloon Payment Contract: A balloon payment contract involves regular payments over a fixed period, with a substantial final payment, known as a balloon payment, due at the end. The buyer makes smaller monthly payments during the contract, and upon completion, either pays the balloon payment in full or arranges refinancing options. Key Considerations: 1. Terms and Conditions: It is crucial for both parties in an Alaska Owner Financing Contract for Car to clearly document all terms and conditions, including payment amounts, interest rates (if applicable), late payment penalties, default conditions, and any warranties or guarantees provided. 2. Legal Compliance: Sellers must ensure compliance with Alaska's legal requirements, such as providing proper disclosures about the vehicle's condition and history, adhering to applicable vehicle inspection laws, and disclosing any liens or encumbrances on the vehicle. 3. Financing Options: Buyers should carefully evaluate the payment terms offered by the seller, including interest rates, down payment requirements, and total cost of financing, to ensure they understand the financial implications and can fulfill their obligations. Conclusion: An Alaska Owner Financing Contract for Car can be an advantageous solution for buyers who struggle to secure conventional financing or prefer a more flexible payment arrangement. By understanding the different types of contracts available and considering the key factors mentioned, buyers and sellers can establish a mutually beneficial agreement that enables car ownership while meeting their respective needs and circumstances.

Owner Finance Vehicles

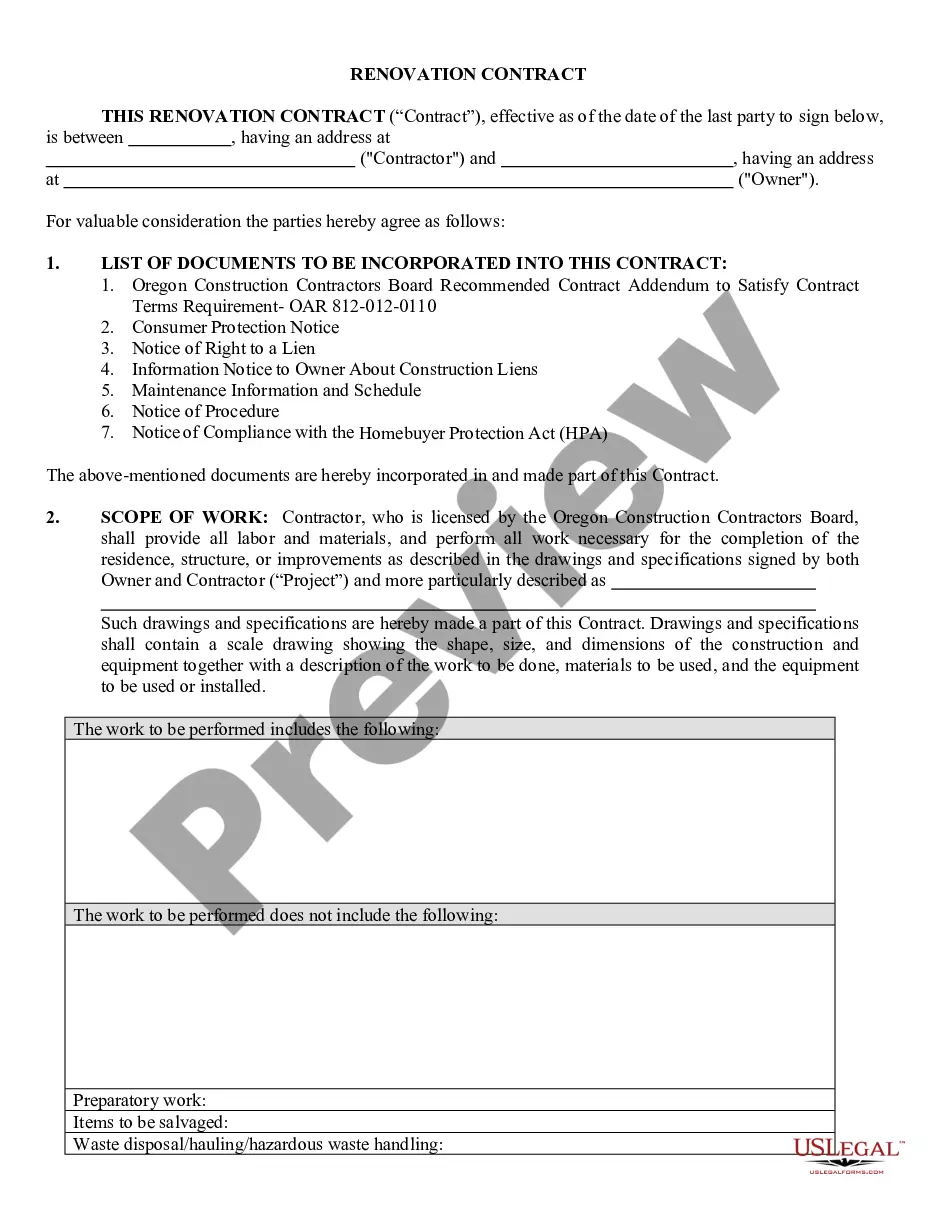

Description

How to fill out Alaska Owner Financing Contract For Car?

If you have to total, download, or produce legitimate file templates, use US Legal Forms, the biggest collection of legitimate varieties, that can be found online. Utilize the site`s easy and convenient research to obtain the paperwork you need. A variety of templates for enterprise and person reasons are sorted by groups and says, or key phrases. Use US Legal Forms to obtain the Alaska Owner Financing Contract for Car in a few click throughs.

If you are already a US Legal Forms buyer, log in to the account and click on the Acquire switch to get the Alaska Owner Financing Contract for Car. You can even entry varieties you earlier saved from the My Forms tab of your own account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your right town/country.

- Step 2. Utilize the Review option to look over the form`s information. Do not overlook to read the information.

- Step 3. If you are unhappy with all the kind, take advantage of the Research industry at the top of the display screen to find other models of your legitimate kind web template.

- Step 4. Once you have identified the form you need, go through the Buy now switch. Select the prices prepare you favor and include your references to register for the account.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Select the formatting of your legitimate kind and download it in your device.

- Step 7. Full, modify and produce or indication the Alaska Owner Financing Contract for Car.

Every legitimate file web template you acquire is the one you have permanently. You might have acces to each kind you saved inside your acccount. Go through the My Forms area and choose a kind to produce or download yet again.

Compete and download, and produce the Alaska Owner Financing Contract for Car with US Legal Forms. There are thousands of professional and condition-distinct varieties you can utilize for the enterprise or person requirements.

Form popularity

FAQ

To create a payment agreement for a car, start by specifying the total amount owed, payment schedule, and accepted payment methods. Clearly define both parties' obligations and any penalties for late payments. Using uslegalforms can simplify this process, especially with the options available for an Alaska Owner Financing Contract for Car, ensuring your agreement meets legal standards.

In Texas, it is not mandatory for both parties to be present to transfer a title. The seller can sign the title over to the buyer, and if the buyer completes the process, the transfer can happen smoothly. However, it is recommended for both parties to be involved to ensure clarity and avoid any future disputes, especially in transactions involving an Alaska Owner Financing Contract for Car.

Owner financing can be beneficial for both parties involved in the transaction. For buyers, it often provides easier access to a vehicle without the need for bank involvement or high-interest rates. For sellers, it opens up the market to more potential buyers who may face challenges obtaining traditional financing. If approached correctly with an Alaska Owner Financing Contract for Car, it can create a win-win situation and foster long-term relationships.

In owner financing arrangements, the seller generally holds the deed until the buyer pays off the financing agreement. This arrangement allows the seller to secure their investment while giving the buyer access to the property. Be sure to outline this process in the Alaska Owner Financing Contract for Car for clarity.

If the buyer defaults on owner financing, the seller has the right to reclaim the property through foreclosure. The terms of the Alaska Owner Financing Contract for Car should specify the default conditions and the process for the seller to recover the property. It's crucial to understand these terms before entering into an agreement.

Example of owner financing The buyer and seller agree to a purchase price of $175,000. The seller requires a down payment of 15 percent $26,250. The seller agrees to finance the outstanding $148,750 at an 8 percent fixed interest rate over a 30-year amortization, with a balloon payment due after five years.

Write the terms of payment. Include the full amount, any deposit amount, the date or dates of payments and what types of payment were agreed upon. If you give a deposit or down payment for the car, ask the seller to provide you with a receipt. Some private sellers accept only cash.

For sellers, owner financing provides a faster way to close because buyers can skip the lengthy mortgage process. Another perk for sellers is that they may be able to sell the home as-is, which allows them to pocket more money from the sale.

Average auto loan terms Most auto loans are available in 12-month increments. The most common terms are 24, 36, 48, 60, 72 and 84 months. There is no perfect term and it is instead specific to your budget and needs. A longer term means lower monthly payments, but a higher cost overall.

How to Write a Payment Plan Agreement?Step 1 The debt amount.Step 1 The debt amount.Step 2 The deferral.Step 2 The deferral.Step 3 Payment and payment method.Step 3 Payment and payment method.Step 4 Further terms.Step 4 Further terms.More items...

Interesting Questions

More info

Finance Contract Budgeting Money Nest Budgeting Buy/Sell Buying/Selling Stock Buy/Selling Stock Credit Debt Insurance Investing Mortgages Remodeling Purchasing Purchasing Purchasing House Retirement Saving Spending Less Taxes Buyers & Sellers Selling Works: Selling This is the most important step of the entire buying and selling process. Without a good sale, everything else will fall to pieces. It is your job to find the right people to sell your used car. However, there is a lot to make your own decision. This guide will give you all the tips to help you find the right people for selling your car. So, let's get started… Buying Your buyers have to understand the buying process to succeed in this business. So, you should make your job to find the right potential buyer for your car as well. Make sure your buyers get all the information that you need to find the right buyer. Selling A Used Car You have to be careful when selling your car.