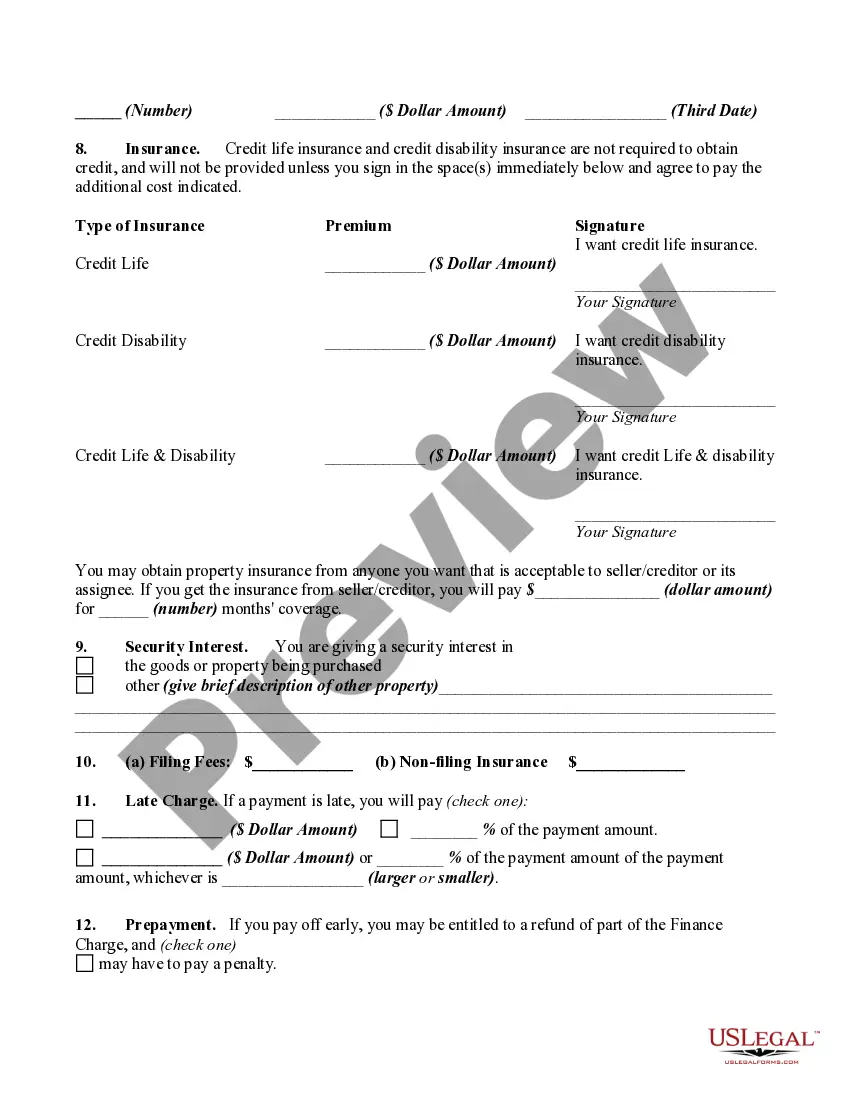

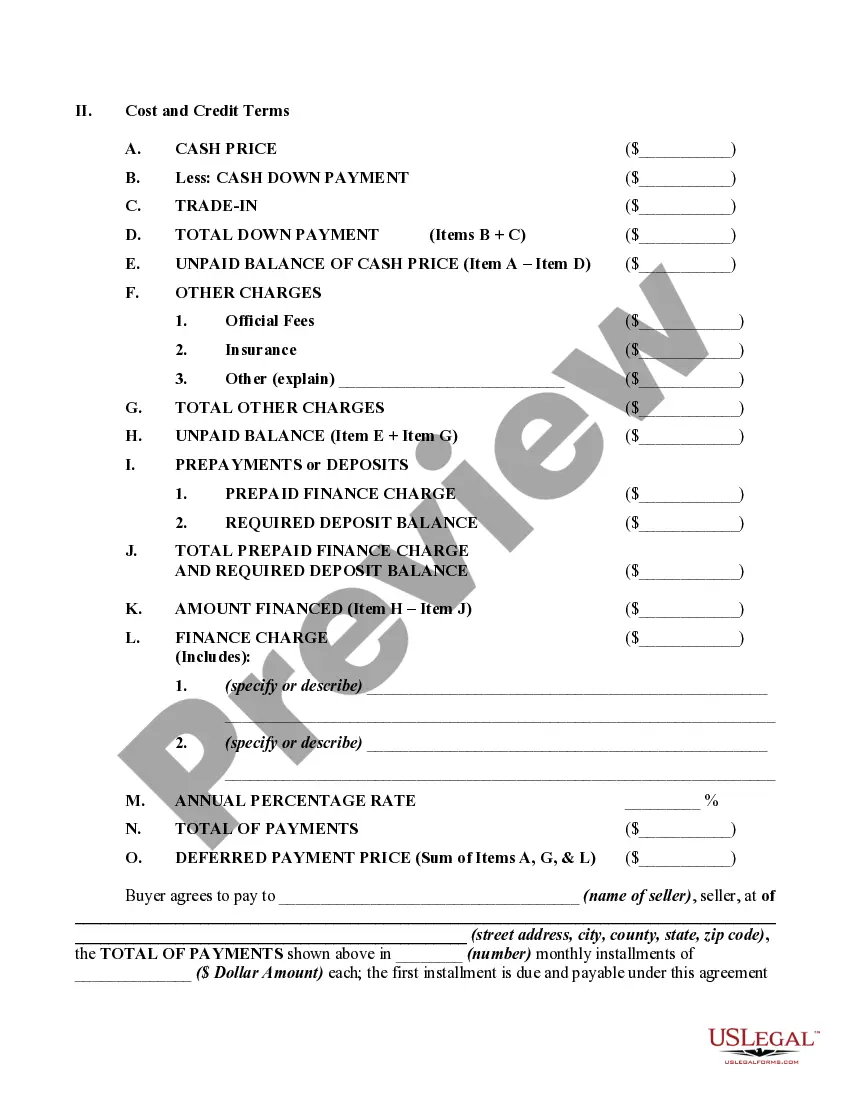

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is

required on all consumer credit contracts by Federal Trade Commission regulation. 16

C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and

must be worded as shown if the form.

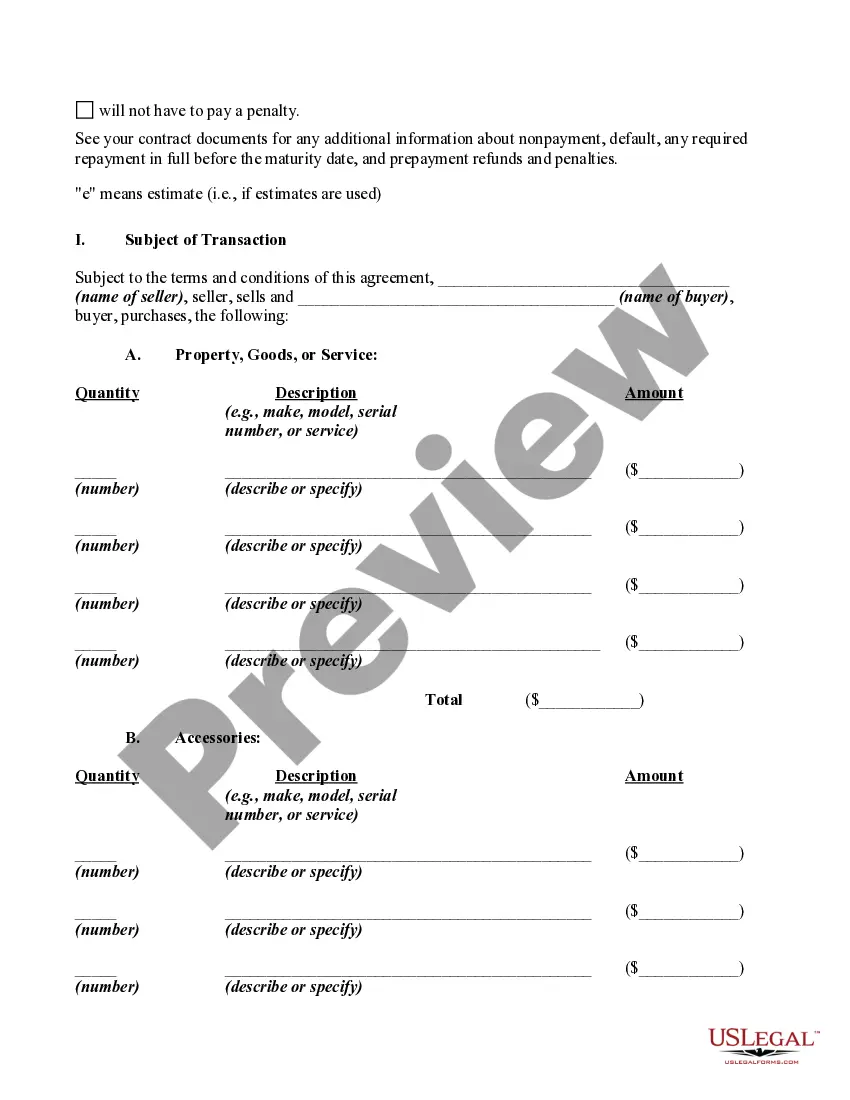

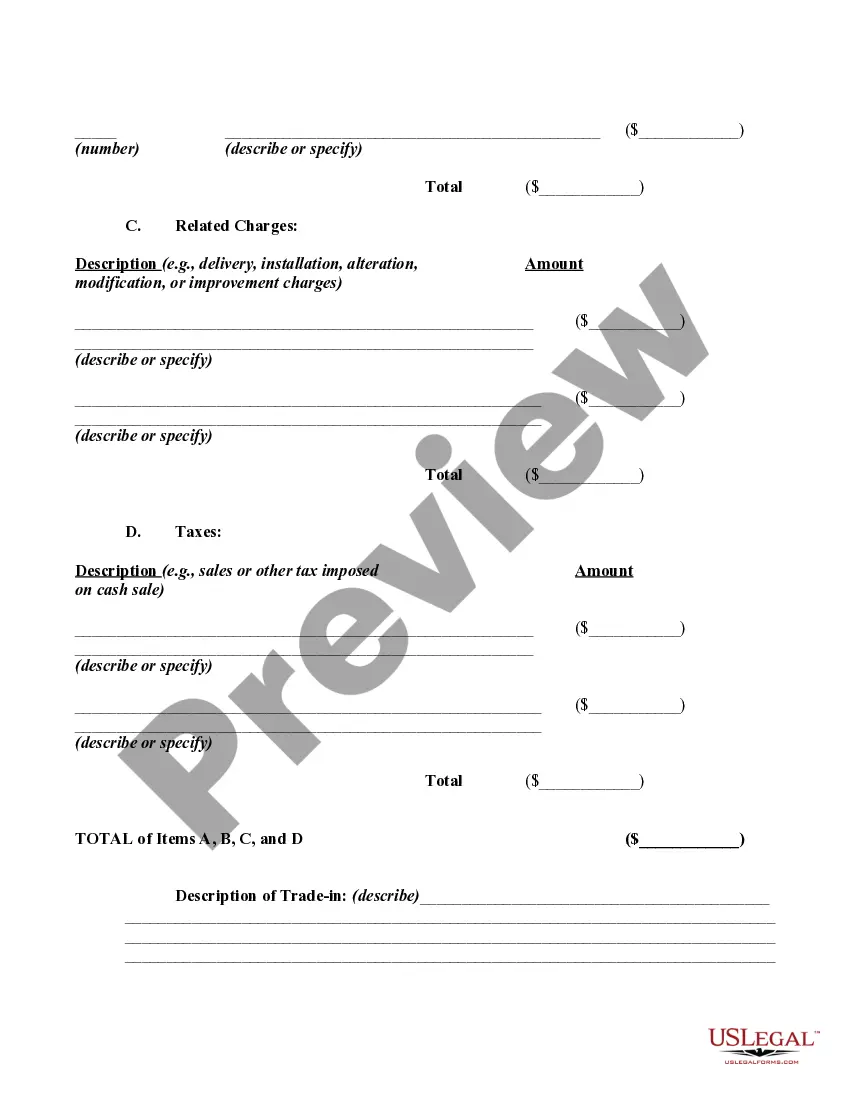

Alaska Retail Installment Contract and Security Agreement (RI CSA) is a legal document that governs the purchase of goods or services through installment payments in the state of Alaska. It outlines the terms and conditions of the sale, payment schedule, and security interests involved in the transaction. The RI CSA serves as a binding agreement between the buyer (referred to as the debtor) and the seller (referred to as the creditor) and is established to protect the rights and interests of both parties. It is commonly used in various retail sectors, including automotive, electronics, furniture, and appliances. The Alaska RI CSA lays out specific provisions that must be met by both the debtor and the creditor. These provisions include the description of the goods or services being purchased, the purchase price, and the payment schedule. Additionally, the RI CSA may include information regarding late fees, interest rates, and any additional charges associated with the installment plan. One of the essential aspects of the Alaska RI CSA is its security agreement component. This clause grants the creditor a security interest in the goods being financed. In the event the debtor fails to make the required payments, the creditor can repossess the goods and sell them to recoup the outstanding amount. This security interest ensures that the creditor has a form of collateral, reducing the risk involved in offering installment financing. Although the Alaska RI CSA generally follows standard formats, there can be some variation in certain industries or specific transactions. For example, in the automotive sector, the Alaska Retail Installment Sales Contract and Security Agreement (RIS CSA) is commonly used, tailored specifically for vehicle purchases. It includes provisions related to vehicle specifications, warranties, and insurance requirements. In summary, the Alaska Retail Installment Contract and Security Agreement is a legally binding document that sets out the terms and conditions for installment purchases in Alaska. It safeguards the rights of both the buyer and seller and outlines specific provisions related to payment schedules, interest rates, and security interests. Different industries may have their variations of the contract, such as the Alaska Retail Installment Sales Contract and Security Agreement in the automotive sector.