Alaska Employment Verification Letter for Bank

Description

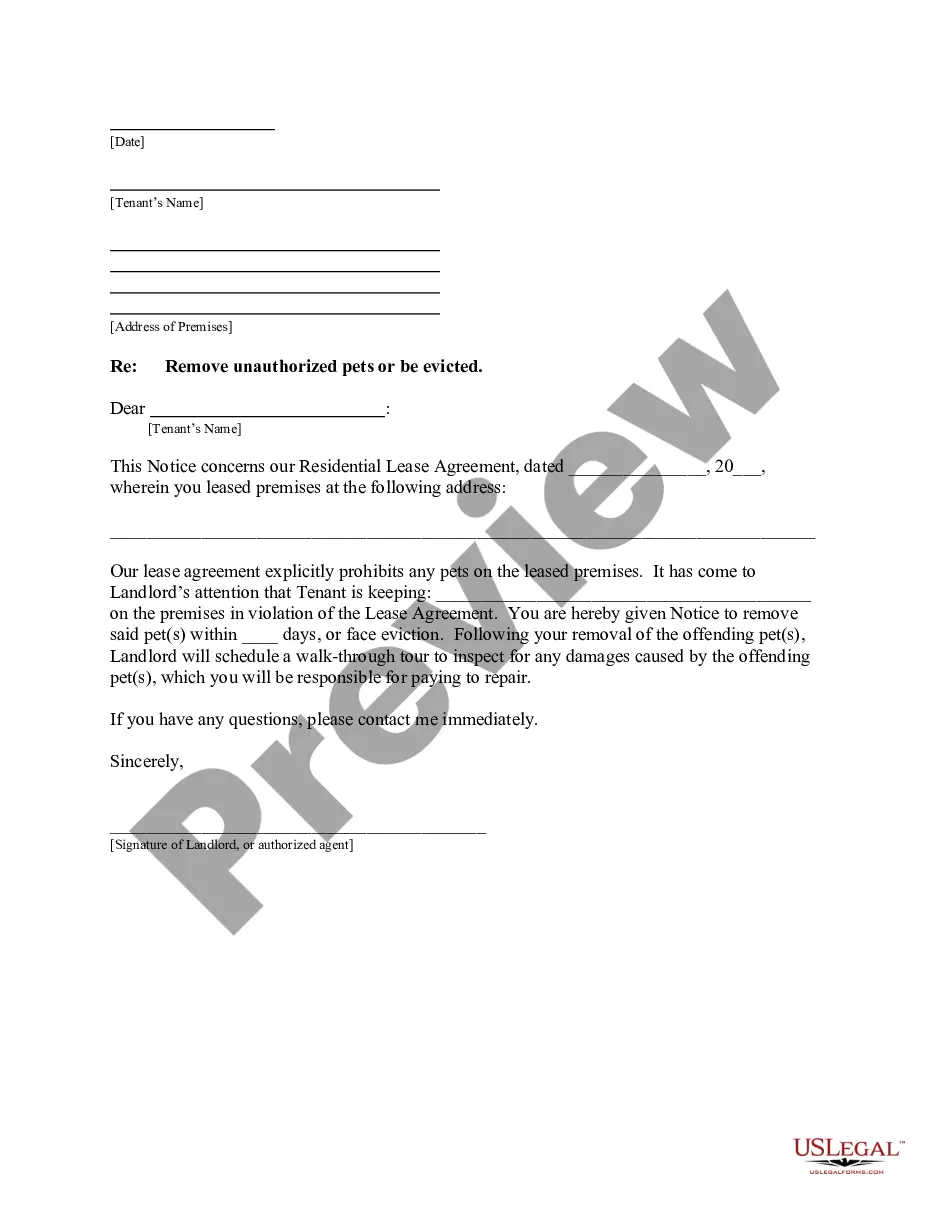

How to fill out Employment Verification Letter For Bank?

If you need to thoroughly download or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Make use of the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your system.

- Utilize US Legal Forms to obtain the Alaska Employment Verification Letter for Bank within just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to get the Alaska Employment Verification Letter for Bank.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review feature to check the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative forms from the legal form template.

- Step 4. Once you have found the form you need, click on the Acquire now button. Select your preferred pricing plan and enter your credentials to register for an account.

Form popularity

FAQ

To obtain your employment verification letter, contact your human resources department or your direct manager. They will guide you on the process and provide the necessary documents. Many companies have standard formats, so ensure you request the specific version needed for banking purposes, like the Alaska Employment Verification Letter for Bank.

A job letter is a document issued by an employer that confirms an employee's position and employment status. This letter typically specifies the employee's job title, salary, and tenure. Banks often require this type of documentation for verification when individuals apply for loans or credit. You can create a compliant Alaska Employment Verification Letter for Bank easily with US Legal Forms.

To write a job letter for the bank, clearly state your name, job title, and employment details. Include the duration of employment and your current salary if necessary. Ensure that the letter is concise while highlighting your role and responsibilities. For an official document, consider using the Alaska Employment Verification Letter for Bank template from US Legal Forms.

To verify employment for Alaska Airlines employees, utilize the standard procedures established by the airline, which generally involve contacting their HR department. When pursuing an Alaska Employment Verification Letter for Bank, it is crucial to provide the necessary employee details and any forms that could expedite the verification process.

To obtain a bank letter, reach out to your bank and inquire about their specific requirements. Generally, you need to provide personal identification and relevant employment information, such as your Alaska Employment Verification Letter for Bank. Your bank may provide a template or guidelines to assist you in this process.

To request an employment verification letter, you should first contact your HR department or supervisor. Provide necessary details, such as your full name, position, and the purpose of the letter, specifically mentioning that it is for your Alaska Employment Verification Letter for Bank. This will ensure a timely and accurate response.

A job letter for bank, often an Alaska Employment Verification Letter for Bank, provides proof of your employment status and details such as your position, duration with the company, and salary. Banks request this document to confirm your financial reliability when you apply for loans or open accounts. Obtaining this letter is crucial, and using platforms like UsLegalForms can simplify the process.

To find the phone number for a workplace in Alaska, check the company’s official website or contact their main office. If you are requesting an Alaska Employment Verification Letter for Bank, it is essential to have accurate contact information to inquire about your letter efficiently. Make sure to ask for help if you have trouble locating the number.

A bank letter request is a formal inquiry made to your bank asking for an official letter that confirms specific information about your accounts. This request may arise when you need to provide verification for employment, loans, or other financial transactions. If your request pertains to employment verification, combining it with an Alaska Employment Verification Letter for Bank can expedite the process.

Generally, a bank statement alone is not sufficient as proof of employment. While it may provide insights into your financial activity, banks usually require a formal letter. An Alaska Employment Verification Letter for Bank explicitly states your employment status, making it the preferred document for verification.