Alaska Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

You are able to invest time on the web trying to find the authorized file design that fits the federal and state specifications you want. US Legal Forms offers a large number of authorized forms that happen to be examined by experts. It is possible to obtain or print the Alaska Acknowledgment by Debtor of Correctness of Account Stated from your services.

If you already have a US Legal Forms account, you can log in and click the Down load switch. Following that, you can total, edit, print, or sign the Alaska Acknowledgment by Debtor of Correctness of Account Stated. Every single authorized file design you purchase is your own for a long time. To acquire one more copy of any bought type, visit the My Forms tab and click the related switch.

Should you use the US Legal Forms website for the first time, adhere to the basic directions listed below:

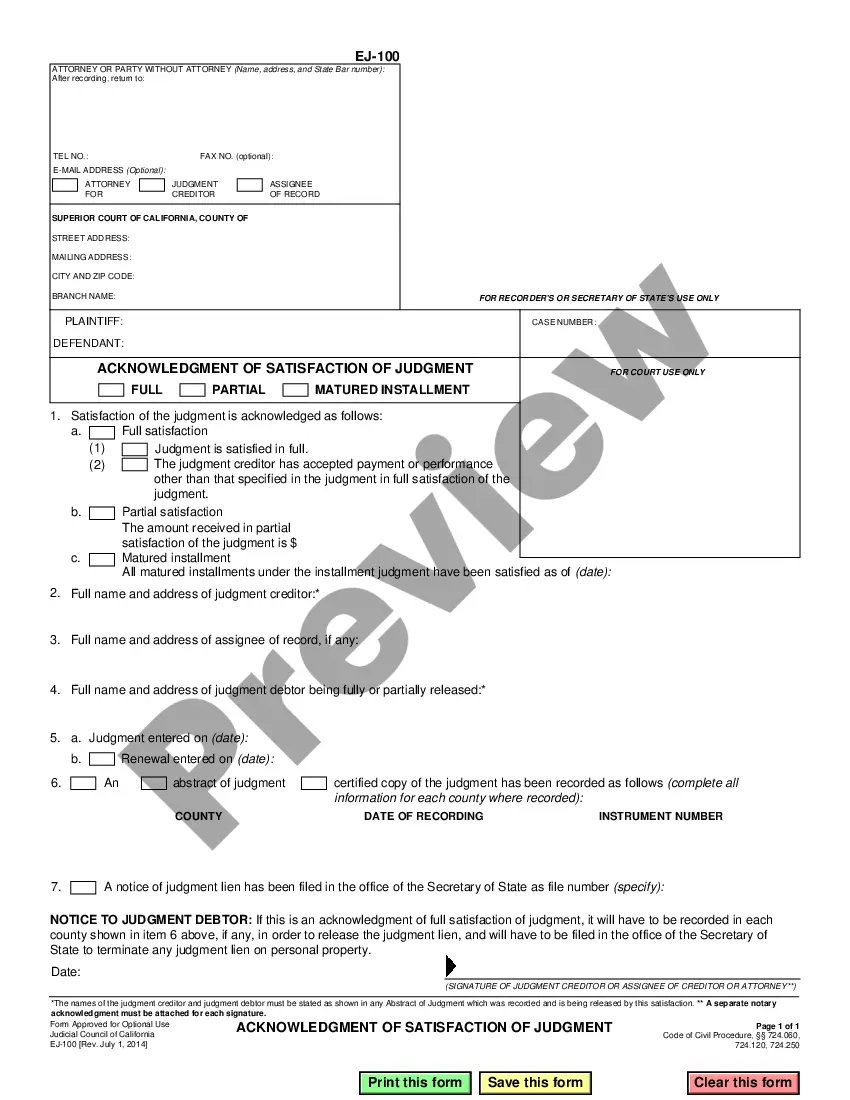

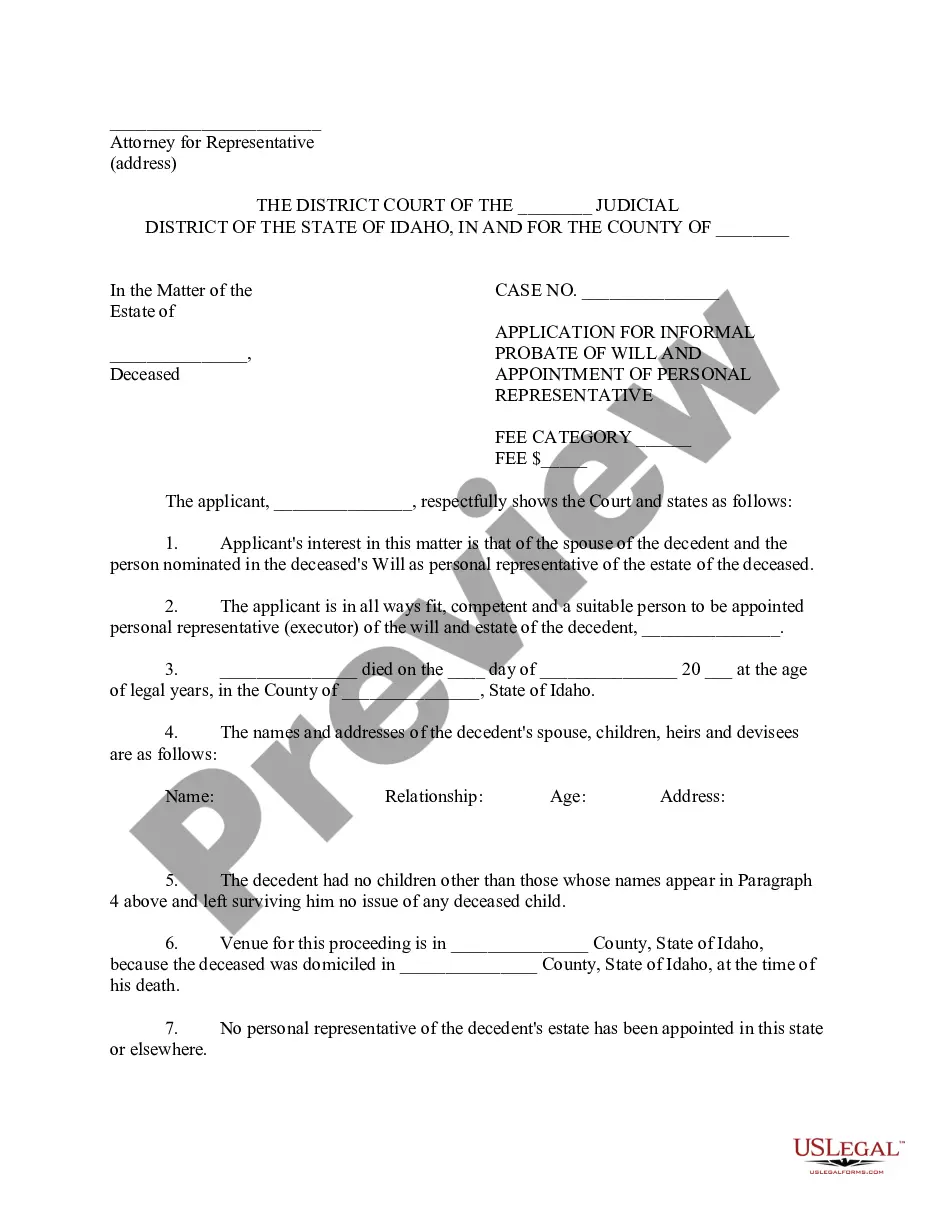

- Initially, make certain you have selected the right file design to the state/city of your liking. See the type explanation to make sure you have chosen the proper type. If accessible, take advantage of the Review switch to search throughout the file design as well.

- In order to get one more edition from the type, take advantage of the Lookup field to find the design that fits your needs and specifications.

- When you have identified the design you desire, click Buy now to move forward.

- Find the prices prepare you desire, enter your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your charge card or PayPal account to fund the authorized type.

- Find the structure from the file and obtain it to the system.

- Make changes to the file if required. You are able to total, edit and sign and print Alaska Acknowledgment by Debtor of Correctness of Account Stated.

Down load and print a large number of file templates while using US Legal Forms Internet site, that offers the most important collection of authorized forms. Use skilled and state-distinct templates to deal with your business or specific demands.

Form popularity

FAQ

Rule 76 - Form Papers (a)Form in General. All pleadings, motions, affidavits, memoranda, instructions and other papers and documents presented for filing with the clerk or intended for use by the judge, must conform to the following requirements: (1)Paper Size and Quality: Documents must be 8-1/2 x 11 inches.

A forcible entry and detainer case may be dismissed by the clerk for want of prosecution without further notice to the parties and without further order if (i) the case has been pending for more than 180 days from the date the complaint was filed; (ii) no trial or hearing is scheduled; (iii) no application for default ...

A temporary restraining order may be granted without written or oral notice to the adverse party or that party's attorney only if (1) it clearly appears from specific facts shown by affidavit or by the verified complaint that immediate and irreparable injury, loss, or damage will result to the applicant before the ...

Rule 84 - Change of Name (a)Petition. Every action for change of name shall be commenced by filing a verified petition entitled in the name of petitioner, showing the name which petitioner desires to adopt and setting forth the reasons for requesting a change of name. (b)Notice of Application.

If a party fails to appear at the time and place appointed, the master may proceed ex parte or, in the master's discretion, adjourn the proceedings to a future day, giving notice to the absent party of the adjournment.

72. Rule 72 - Eminent Domain (a)Applicability of Other Rules. The procedure for the condemnation of property under the power of eminent domain is governed by the Civil Rules, except as otherwise provided in this rule.

Rule 69 - Execution-Examination of Judgment Debtor-Restraining Disposition of Property- Execution After Five Years (a)Execution -- Discovery. Process to enforce a judgment shall be by a writ of execution, unless the court directs otherwise.

Upon notice to every other party and upon leave of court, a party may deposit with the court all or any part of any sum of money or any other thing capable of physical delivery which is the subject of the action or due under a judgment.