An Alaska Revocable Trust for Real Estate, also known as a living trust or inter vivos trust, is a legal document that allows individuals to place their real estate assets into a trust for management, protection, and distribution purposes. This type of trust is established by an individual, referred to as the granter or settler, who transfers ownership of their property to the trust. The Alaska Revocable Trust for Real Estate provides flexibility and control to the granter as it can be modified, amended, or revoked during their lifetime. This feature distinguishes it from an irrevocable trust, which cannot be easily changed once established. By creating a revocable trust for real estate, individuals can maintain control over their assets and have the freedom to make alterations according to their changing needs and circumstances. A key benefit of an Alaska Revocable Trust for Real Estate is the avoidance of probate, a court-supervised process of validating a will and distributing assets. When a property is transferred to a trust, it no longer becomes a part of the granter's probate estate, thus bypassing the lengthy and costly probate process. This allows for a smoother and faster transfer of the real estate to the intended beneficiaries upon the granter's death. Additionally, by utilizing this trust, individuals can ensure the privacy of their property arrangements as the details of the trust — including property ownership and distribution instructions — remain confidential, unlike the public nature of the probate process. Though there may not be specific types of Alaska Revocable Trusts for Real Estate, the trust can be customized to meet the unique needs of the granter and their real estate assets. For example, a granter may choose to establish a Revocable Trust for Residential Real Estate or a Revocable Trust for Commercial Real Estate, tailoring the trust's provisions and instructions accordingly. In conclusion, an Alaska Revocable Trust for Real Estate provides individuals with control, privacy, and the ability to avoid probate when it comes to managing and distributing their real estate assets. This flexible legal tool offers various advantages for those seeking efficient and personalized estate planning solutions.

Alaska Revocable Trust for Real Estate

Description

How to fill out Alaska Revocable Trust For Real Estate?

US Legal Forms - one of the biggest collections of authorized documents in the United States - provides a vast array of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the most recent versions of forms like the Alaska Revocable Trust for Real Estate in just minutes.

If you have a membership, Log In and retrieve the Alaska Revocable Trust for Real Estate from the US Legal Forms library. The Download button will be visible on each form you view. You gain access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Find the format and download the form to your device. Make changes. Fill out, edit, and print and sign the downloaded Alaska Revocable Trust for Real Estate.

- Make sure you have selected the correct form for your city/region.

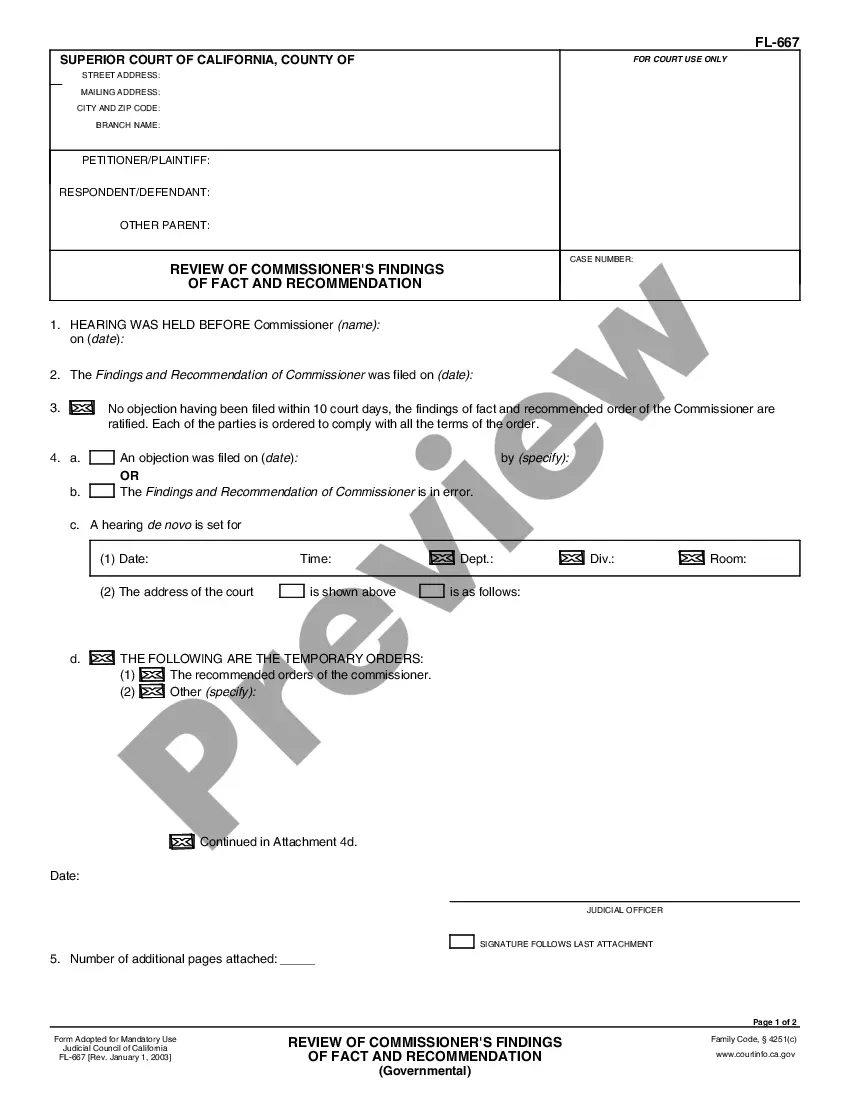

- Click on the Preview button to review the content of the form.

- Read the form description to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download Now button.

- Then, choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, putting your home in an Alaska Revocable Trust for Real Estate can be a wise decision for many homeowners. It helps streamline estate planning and allows for a more seamless transfer of property to your beneficiaries. Additionally, a trust can provide peace of mind, knowing your assets are we managed according to your wishes. For tailored guidance, consider using US Legal Forms as a reliable resource for creating your trust.

While an Alaska Revocable Trust for Real Estate offers many advantages, there are some disadvantages to consider. For example, transferring your house into a trust may involve upfront legal fees and paperwork that some may find cumbersome. Furthermore, if not managed correctly, a trust can create complications that may affect your property taxes or your ability to secure loans. It's essential to carefully evaluate your options to determine if a trust aligns with your goals.

One effective method to leave a house to your children is through an Alaska Revocable Trust for Real Estate. This approach allows you to retain control over your property during your lifetime, while ensuring a smooth transfer upon your passing. A trust can help avoid probate, making the process faster and less complicated for your heirs. Additionally, a trust can provide specific instructions on how you want your children to inherit the property.

The 5 year rule affects how assets are treated when you create an Alaska Revocable Trust for Real Estate. Generally, assets transferred to the trust may be excluded from your taxable estate if they have been held in the trust for at least five years. This rule is crucial for estate planning, as it can help reduce potential estate taxes or delays. By understanding this rule, you can better navigate your estate planning goals.

The major disadvantage of an Alaska Revocable Trust for Real Estate is the potential complexity and costs associated with setup and maintenance. Individuals might find themselves needing legal assistance, which can become burdensome. Additionally, if not adequately funded, the trust may not function as intended.

One of the biggest mistakes parents make when setting up an Alaska Revocable Trust for Real Estate is failing to properly fund the trust. Not transferring assets into the trust can render the trust ineffective, leading to complications upon death. Regularly reviewing and updating the trust ensures that all intended assets are included.

A family trust, such as an Alaska Revocable Trust for Real Estate, may lead to family disagreements regarding asset distribution. Some members may feel excluded or unhappy with the decisions made by the trust creator. Transparent communication and clear guidelines can help mitigate these issues.

While an Alaska Revocable Trust for Real Estate offers many advantages, there are some downsides. Trusts can incur initial setup costs and ongoing management fees, which might be a consideration for some. Additionally, if not properly managed, there can be confusion or conflicts among beneficiaries.

Your parents may benefit from placing their assets in an Alaska Revocable Trust for Real Estate. This can streamline the distribution process and provide them with greater control over their assets, even during their lifetime. Additionally, it can protect their assets from probate, making it easier for you and your family later.

To place your house in an Alaska Revocable Trust for Real Estate, begin by creating the trust document. Next, transfer the title of your property to the trust, which involves filling out the necessary paperwork for the property deed. It may be beneficial to consult with a legal professional to ensure all steps are correctly completed.