This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

Choosing the right authorized record template can be a battle. Obviously, there are a lot of web templates accessible on the Internet, but how would you get the authorized form you want? Utilize the US Legal Forms website. The services provides thousands of web templates, such as the Alaska Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, which can be used for organization and personal requirements. All the kinds are inspected by experts and meet up with state and federal needs.

If you are presently registered, log in to the account and click on the Download key to get the Alaska Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. Make use of your account to look with the authorized kinds you possess ordered previously. Visit the My Forms tab of your account and get an additional copy from the record you want.

If you are a whole new end user of US Legal Forms, listed here are basic recommendations so that you can comply with:

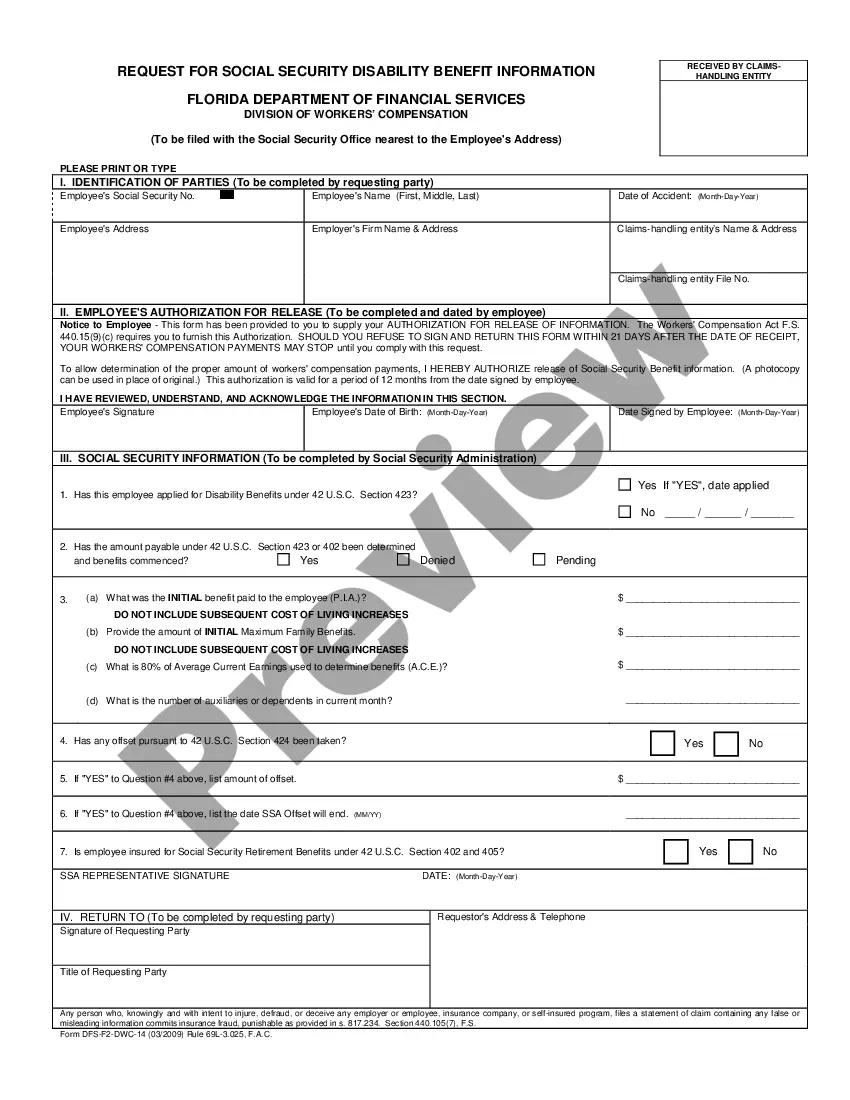

- First, make sure you have selected the appropriate form to your city/region. You may check out the shape while using Preview key and study the shape description to guarantee it is the right one for you.

- In the event the form does not meet up with your requirements, use the Seach discipline to discover the right form.

- When you are positive that the shape is proper, go through the Acquire now key to get the form.

- Select the rates strategy you want and type in the needed information and facts. Create your account and pay money for an order utilizing your PayPal account or bank card.

- Choose the document structure and download the authorized record template to the gadget.

- Full, edit and produce and indication the attained Alaska Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

US Legal Forms may be the most significant catalogue of authorized kinds in which you can see numerous record web templates. Utilize the service to download appropriately-created paperwork that comply with status needs.

Form popularity

FAQ

If the estate only includes personal property (e.g. bank accounts, household items, insurance payable to the estate, motor vehicles, boats) valued at less than $50,000 (plus $100,000 in motor vehicles), and an heir or devisee is willing to wait 30 days after death, he is authorized to collect the property by presenting ...

If you want to avoid probate, you will also need to transfer ownership of all of your property to the revocable trust or name the revocable trust as a beneficiary of your property.

In fact, many estates can be settled without any court involvement at all. Estates valued at less than $50,000, plus $100,000 worth of motor vehicles, can often avoid the probate process in court, provided the estate contains no real property (land or a home).

The set of laws that governs probate and related areas. Allowances are special payments that the Personal Representative makes to family members of the person who died from estate property. Along with and exempt property they can total up to $55,000 (or more in some cases).

If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you have living parents but no descendants, your spouse will inherit the first $200,000 of your intestate property. They will also inherit 3/4 of any remaining intestate property.

Does Alaska Require Probate? The state government does require all wills in Alaska to go through probate court to prove their validity and ensure that courts follow the deceased's wishes.

A probate is required when a person dies and owns property that does not automatically pass to someone else, or the estate doesn't qualify to use the Affidavit for Collection of Personal Property procedure. A probate allows a Personal Representative to transfer legal title of that property to the proper persons.

If the person who died left very little probate property, the surviving spouse is entitled to a minimum amount of the person's total property. This amount is called the spouse's elective share. It is approximately equal to one-third of the person's probate property and nonprobate property.