The Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders is a vital legal document that outlines the rights, responsibilities, and governance structure of a close corporation in the state of Alaska. This agreement is specifically tailored for corporations where shareholders are actively involved in the management and decision-making processes. Under this agreement, shareholders are provided with a clear framework for managing the corporation, ensuring smooth operations, protecting their interests, and resolving conflicts. This agreement embraces the unique characteristics of close corporations, where a limited number of shareholders are directly engaged in running the company. Key provisions of the Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders typically cover various aspects, such as: 1. Management Structure: The agreement defines the roles and responsibilities of shareholders in managing the corporation. It outlines how decisions will be made and who will be involved in key strategic and operational matters. It may specify the composition of a board of directors and the selection of officers. 2. Shareholder Meetings: The agreement usually outlines the procedures for shareholder meetings, including the frequency, notice requirements, and voting mechanisms. It may provide guidelines on quorum and the minimum percentage of votes required for passing resolutions. 3. Transfer of Shares: This agreement addresses the transferability of shares amongst the shareholders. It may establish preemptive rights, allowing existing shareholders to purchase shares before they are sold to external parties or to other shareholders. It may also contain provisions related to the valuation of shares and the process for transferring ownership. 4. Shareholder Disputes: In case of conflicts or disputes, this agreement serves as a means of resolving disagreements amicably. It may establish a mediation or arbitration process to settle disputes, saving shareholders from costly and time-consuming legal battles. 5. Buy-Sell Agreements: Some Alaska Agreements of Shareholders also include buy-sell provisions. These provisions offer mechanisms for shareholders to buy back shares from other shareholders in certain situations, such as retirement, disability, or death. It ensures a smooth transition of ownership and prevents unwanted external interference. While the Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders is a comprehensive legal document, there may be variations or customizations based on the specific needs and goals of the corporation. Some specific types of this agreement can include: 1. Alaska Agreement of Shareholders of a Close Corporation with Equal Management: This agreement type is suitable for close corporations where all shareholders have equal say in the management and decision-making process. Each shareholder is granted equal voting rights, and major decisions require unanimous consent amongst all shareholders. 2. Alaska Agreement of Shareholders of a Close Corporation with Majority Management: In this agreement, majority shareholders hold a significant decision-making advantage over minority shareholders. Majority shareholders have more voting power and can make key decisions with a simple majority vote, ensuring efficient decision-making in larger corporations. 3. Alaska Agreement of Shareholders of a Close Corporation with Rotating Management: This type of agreement introduces a system where shareholders rotate management responsibilities periodically. Each shareholder takes turns to actively manage the corporation, ensuring equal involvement and accountability amongst shareholders. In conclusion, the Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders outlines the governance structure, decision-making process, and shareholder rights within a close corporation. It is a crucial legal document that helps maintain transparency, efficiency, and fairness in managing the corporation while protecting the interests of all shareholders involved.

Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

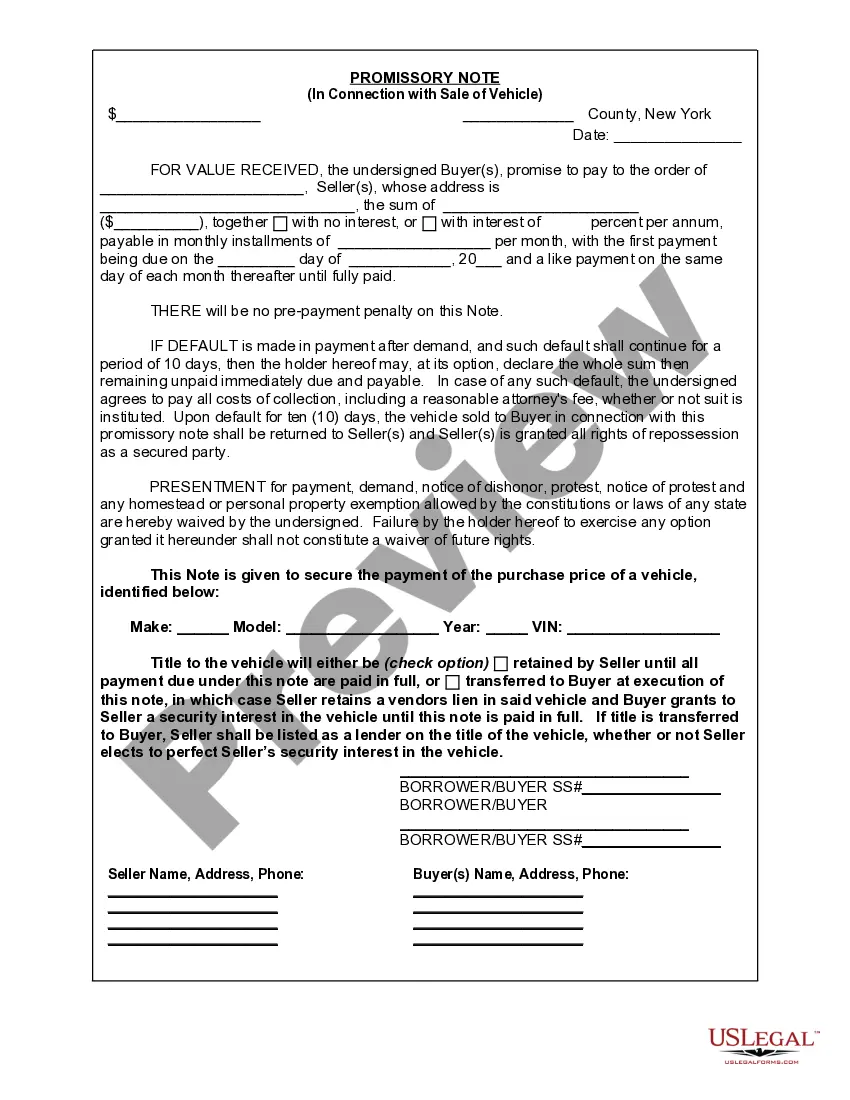

How to fill out Alaska Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Finding the right authorized papers web template might be a have difficulties. Of course, there are tons of templates available online, but how can you obtain the authorized type you want? Make use of the US Legal Forms site. The support gives 1000s of templates, like the Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders, that you can use for enterprise and personal requirements. All the types are inspected by professionals and satisfy state and federal requirements.

Should you be presently registered, log in to your accounts and click the Acquire option to get the Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders. Make use of accounts to look from the authorized types you possess bought formerly. Visit the My Forms tab of your accounts and have another duplicate in the papers you want.

Should you be a brand new customer of US Legal Forms, listed below are basic instructions that you can stick to:

- Very first, make certain you have selected the proper type for your metropolis/county. You are able to look through the form utilizing the Preview option and look at the form outline to make certain this is the right one for you.

- If the type is not going to satisfy your requirements, utilize the Seach area to discover the right type.

- Once you are sure that the form would work, select the Purchase now option to get the type.

- Select the prices prepare you need and type in the essential information. Create your accounts and buy the transaction making use of your PayPal accounts or credit card.

- Choose the file formatting and acquire the authorized papers web template to your product.

- Full, revise and print out and indication the received Alaska Agreement of Shareholders of a Close Corporation with Management by Shareholders.

US Legal Forms is the largest local library of authorized types in which you can find numerous papers templates. Make use of the service to acquire appropriately-created documents that stick to express requirements.

Form popularity

FAQ

The major requirement to forming a corporation is filing the Articles of Incorporation, which is a legal document that provides proof that your company exists and is authorized to operate in the state. A proper Articles of Incorporation document will include the following information: The corporation's name.

5), the modern corporation has all five of the following characteristics: separate legal personality. limited liability of its shareholders. centralised delegated management under a board structure. transferable shares (in the case of listed companies: freely tradable shares) absentee investor ownership.

A company refers to an individual or group of individuals who conduct commercial business practices to earn a profit. Company is a general term without legal recognition, regulations and permissions. A corporation is always a company, but not all companies are corporations.

Alaska Native village corporations are owned by Alaska Native shareholders and hold title to nearly 17 million acres of land across Alaska. Alaska Native village corporations manage the land for the benefit of their shareholders.

A corporation, sometimes called a C corp, is a legal entity that's separate from its owners. Corporations can make a profit, be taxed, and can be held legally liable. Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures.

Start with a basic search for the company's official name. Names of corporations must end with either the identifier "Incorporated" or "Corp." If one of these identifiers is present, then the company is most likely a corporation.

Meaning of cash call in English a request from a company to its shareholders asking them to provide more money: a cash call on sb A cash call on investors is one option for financing the purchase.

Alaska recognizes the federal S corporation election and does not require a state-level S corporation election.