A loan workout is a series of steps taken by a lender with a borrower to resolve the problem of delinquent loan payments. Steps can include rescheduling loan payments into lower installments over a longer period of time so that the entire outstanding principal is eventually repaid. One of the items lenders often ask for during the loan workout or loan modification process is a hardship letter. A hardship letter is a written explanation as to what has caused you to fall behind on your mortgage. Some of the hardships that that lenders consider during the loan workout process are the following: Illness; Loss of Job; Reduced Income; Failed Business; Job Relocation; Death of Spouse or Co-Borrower; Incarceration; Divorce; Military Duty; and Damage to Property (e.g., natural disaster or fire).

Alaska Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate

Description

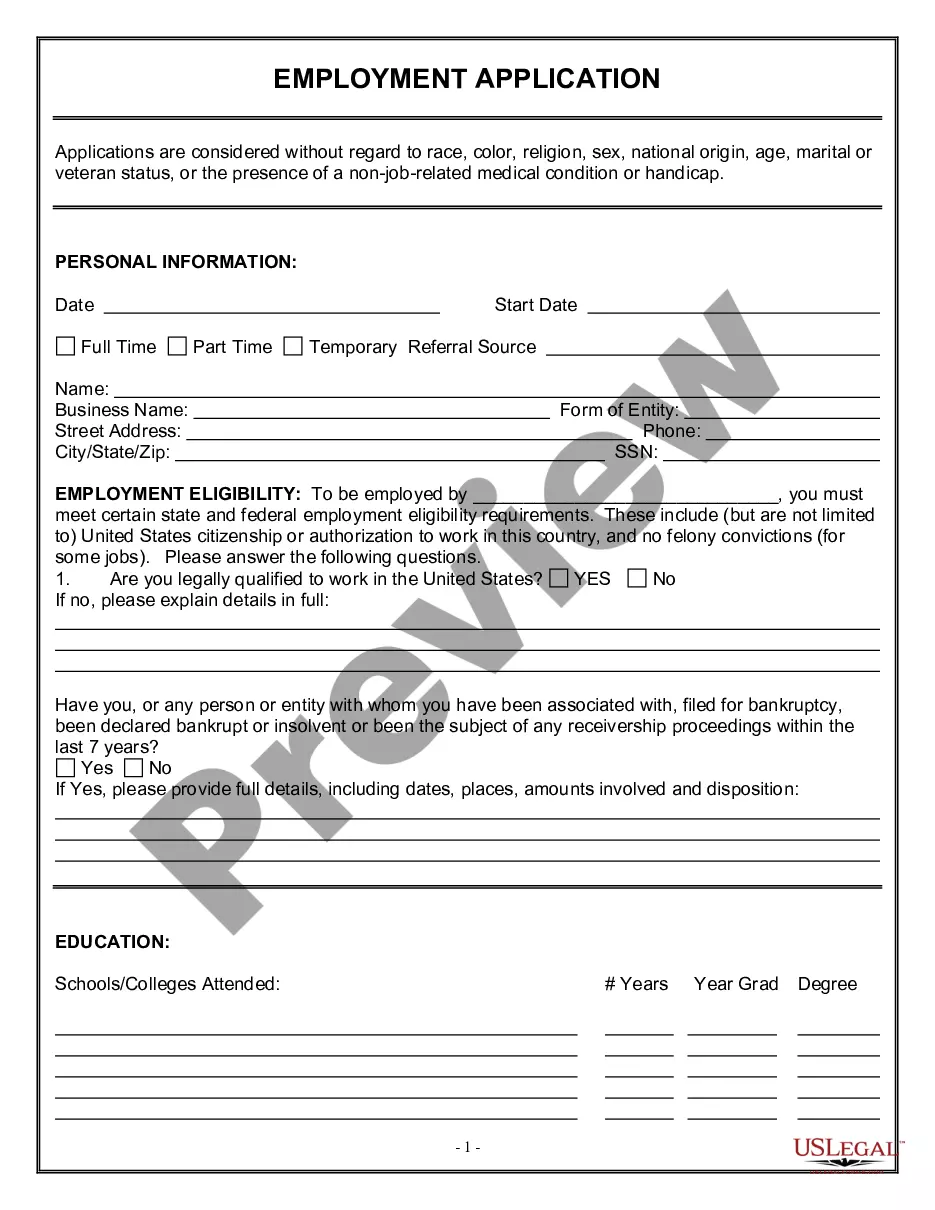

How to fill out Request To Lender Or Loan Servicer For Loan Modification Due To Financial Hardship - Requesting Change To Fixed Rate Of Interest Of Adjustable Rate?

If you wish to complete, download, or printing lawful record templates, use US Legal Forms, the most important selection of lawful varieties, which can be found on the Internet. Make use of the site`s simple and practical search to obtain the paperwork you need. A variety of templates for company and individual reasons are sorted by classes and states, or keywords. Use US Legal Forms to obtain the Alaska Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate within a couple of clicks.

Should you be already a US Legal Forms client, log in for your accounts and click the Down load switch to find the Alaska Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate. You may also entry varieties you in the past downloaded inside the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form to the proper city/land.

- Step 2. Utilize the Review choice to look over the form`s content. Don`t forget about to learn the information.

- Step 3. Should you be unsatisfied together with the type, utilize the Look for area on top of the display screen to discover other versions from the lawful type web template.

- Step 4. When you have identified the form you need, click the Acquire now switch. Opt for the prices prepare you like and add your credentials to sign up for the accounts.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the deal.

- Step 6. Select the file format from the lawful type and download it on your own system.

- Step 7. Full, change and printing or signal the Alaska Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate.

Each and every lawful record web template you get is your own forever. You may have acces to every single type you downloaded with your acccount. Go through the My Forms area and choose a type to printing or download again.

Be competitive and download, and printing the Alaska Request to Lender or Loan Servicer for Loan Modification Due to Financial Hardship - Requesting Change to Fixed Rate of Interest of Adjustable Rate with US Legal Forms. There are thousands of skilled and express-certain varieties you may use for your company or individual demands.

Form popularity

FAQ

Qualifying for a mortgage loan modification Lenders can set their own criteria for eligibility, but the requirements are usually that: You've missed at least one payment. You can provide proof of financial hardship. You have evidence that you could make your payments with a modified loan.

Loan Modification Process. Then the findings are assessed, including current financial situation, assets, debts, income, and current property value, After reviewing all the facts, including verifying the property's current value, a determination is made as to what kind of Modification would be best.

Mortgage Loan Modification Requirements the home is your primary residence. you've gone through a financial hardship like you had to take a lower-paying job or you went through a divorce and experienced a loss of household income, and. that you have enough steady income to make regular payments under a modification.

Document requirements may vary by lender, but you will likely need to provide: Explanation and evidence of your financial hardship (such as loss of income, increase in expenses, death of a co-borrower or divorce)

While a loan modification can prevent you from defaulting on your loan, it can still negatively impact your credit score. In the long run, however, modifying your loan will likely be better for your credit than foreclosure. It's a way to head off bigger problems while you act to get back on a good financial footing.

When you take a loan modification, you change the terms of your loan directly through your lender. Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater.

Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score. A home loan modification does the same.

You don't make enough money to support a loan modification. You don't have clear title to your property. You don't have a valid financial hardship reason. You make too much money and have too many assets.