Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

It is feasible to invest hours online looking for the legal document template that meets the state and federal stipulations you will require.

US Legal Forms offers a vast array of legal forms that are evaluated by experts.

You can easily download or print the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping from the service.

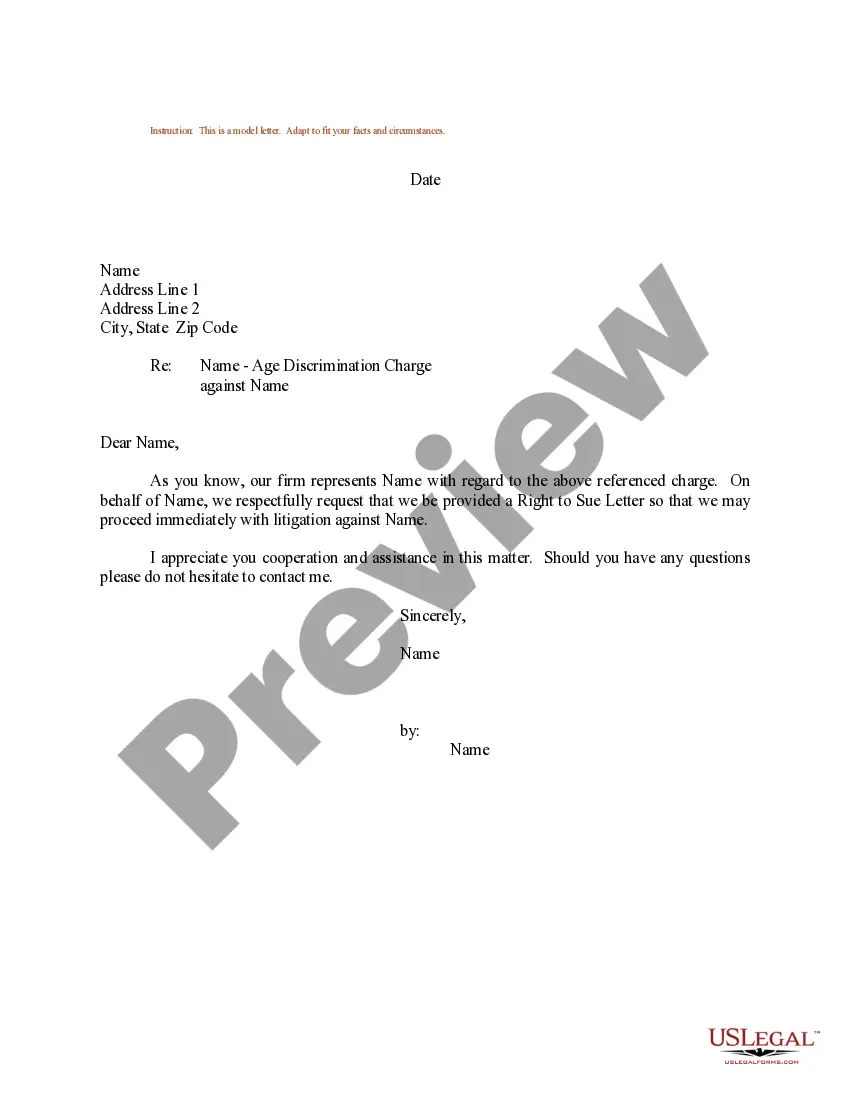

If available, utilize the Preview option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the county/town of your preference.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The contract for the provision of accounting services is a legal document that outlines the terms under which a CPA provides services to a client. This contract typically covers responsibilities, fees, and the scope of work, which includes accounting and tax consulting. By referencing the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, clients can ensure they have a robust framework to guide their understanding of the services offered and the expectations involved.

The agreement between a CPA and client is a mutual understanding that defines the terms of the professional relationship. Often referred to as an engagement letter, this agreement specifies the services the CPA will offer, such as advice on accounting, tax matters, and record keeping. Employing the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can facilitate a smooth collaboration and foster trust between both parties.

A CPA agreement is a formal contract that delineates the relationship and services provided by a certified public accountant to their client. This document often includes detailed information regarding fees, timelines, and the specific services related to accounting and tax issues. Utilizing the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can help ensure that both the CPA and client are aligned on their objectives and obligations.

An agreement between a CPA and her client is typically referred to as an engagement letter or a client agreement. This important document outlines the scope of services the CPA will provide, including aspects related to accounting, tax matters, and record keeping. The Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping serves as a key framework for establishing clear expectations and ensuring both parties understand their responsibilities.

A letter of disengagement for an accountant is a formal document that signifies the conclusion of your accountant's services. It details the reason for separation, the effective date, and requests for the finalization of any ongoing matters. Utilizing this letter protects both parties by ensuring clarity and professionalism. Incorporating elements from the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping could offer additional structure.

A sample letter to fire your accountant should start with your contact information, followed by the date and your accountant's information. Clearly state your intent to discontinue services, specify the effective date, and request the transfer of your records. Closing the letter on a positive note can help maintain a professional demeanor. Referencing the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can guide the content.

To drop a bookkeeping client, approach the situation with care and professionalism. Start by holding a conversation to discuss your decision, followed by a formal letter to confirm the termination. Be clear about any final steps, including the return of documents. The Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a useful reference for managing this process effectively.

Informing your accountant about your decision to leave should be done directly, preferably in a meeting or via a thoughtful letter. Clearly state your reasons and ensure they feel heard. This also provides a chance to clarify any outstanding work or transfers. Utilizing the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can offer a structured way to handle this transition.

When you decide to fire an accounting client, communicate directly and respectfully. Schedule a meeting to discuss your decision and explain your reasoning. Follow up with a formal termination letter to ensure clarity on your parting. In line with the Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, this outlines the professional standards you adhere to.

To terminate your relationship with an accountant, you can send them a formal notification, ideally in writing. Specify the date of termination and ensure that you request a complete transfer of your financial records. It’s often beneficial to review any existing contracts first. The Alaska General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping provides a framework that may ease this process.