Alaska Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

It is feasible to allocate time online attempting to locate the sanctioned document template that complies with the federal and state stipulations you will require.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can actually download or print the Alaska Miller Trust Forms for Medicaid from the services.

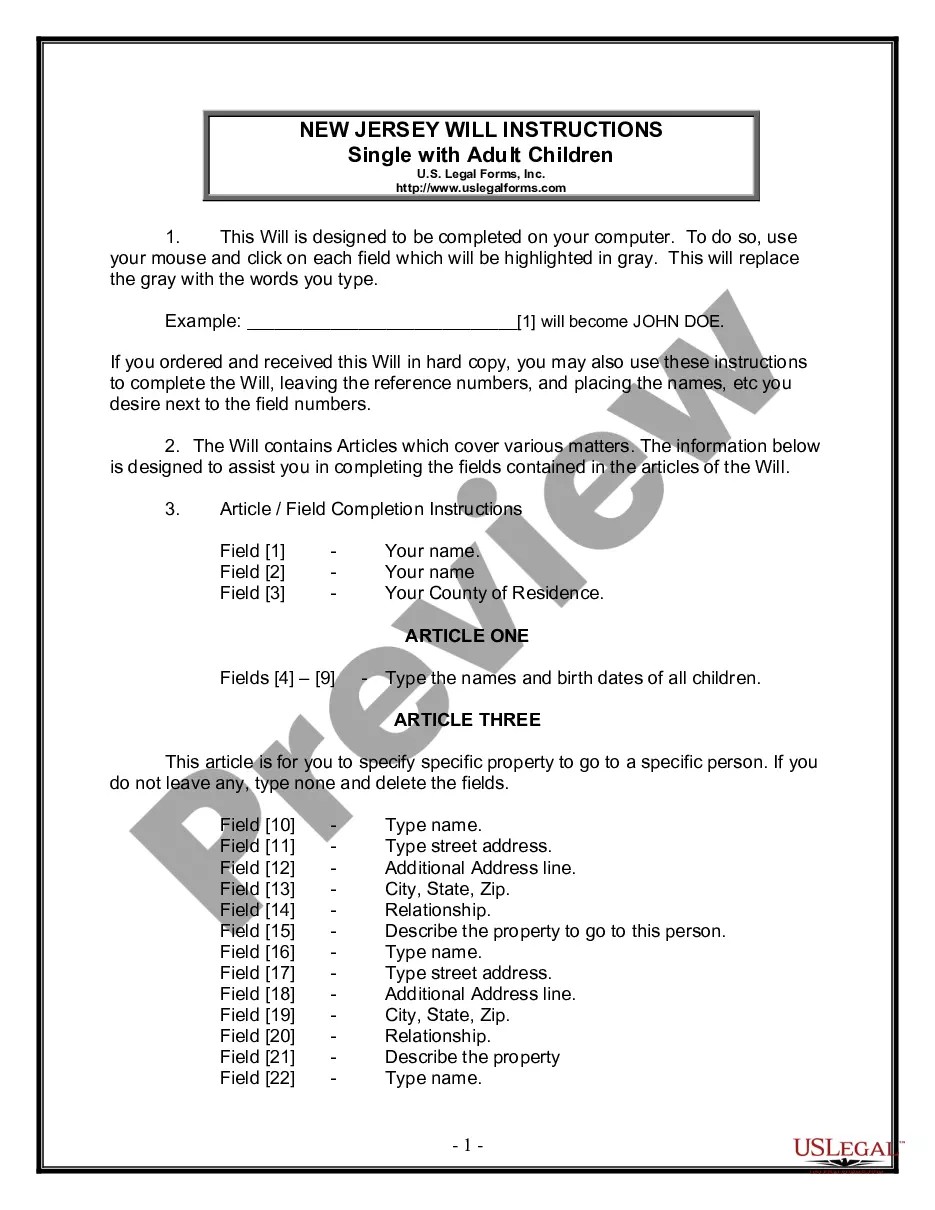

If available, utilize the Preview button to review the document template as well.

- If you currently possess a US Legal Forms account, you may Log In and click on the Download button.

- Then, you may complete, modify, print, or sign the Alaska Miller Trust Forms for Medicaid.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and select the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines outlined below.

- First, ensure that you have selected the correct document template for the area/region you choose.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

To stay on Medicaid in Alaska, your income must remain within designated limits based on your household configuration. If your income exceeds these thresholds, a Miller trust can help you effectively manage it. Understanding these limits and using Alaska Miller Trust Forms for Medicaid can help you navigate your eligibility while receiving necessary medical care.

Yes, you can use a Miller trust to qualify for Medicaid. This type of trust permits individuals with excess income to allocate their funds in a way that makes them eligible. Utilizing Alaska Miller Trust Forms for Medicaid simplifies the process and helps ensure you meet all legal requirements for Medicaid assistance.

A Medicaid qualifying trust in Alaska is a financial tool designed to help individuals qualify for Medicaid while protecting their assets. These trusts, like the Miller Trust, allow individuals to place excess income into a separate account, thereby meeting income limits. By managing your income this way, you can still access crucial healthcare benefits.

The maximum income limit for Medicaid in Alaska is determined by federal guidelines and state adjustments. For an individual, the current limit usually falls within a specific range, which is updated each year. To accurately assess your eligibility, consider utilizing Alaska Miller Trust Forms for Medicaid, which can help clarify your income situation.

In Alaska, income limits for Medicaid eligibility vary based on household size and specific programs. Generally, single individuals must have an income below a certain threshold, which is adjusted annually. It’s important to consult the latest guidelines or utilize Alaska Miller Trust Forms for Medicaid to ensure you meet the necessary requirements.

A Medicaid qualifying trust is a legal arrangement that allows individuals to manage their income and assets while meeting Medicaid eligibility requirements. Specifically, these trusts help individuals preserve their assets and qualify for benefits that cover healthcare and long-term care. In Alaska, the Miller Trust is a common type of Medicaid qualifying trust, providing a solution for those needing assistance.

Yes, Medicaid reviews trusts when determining eligibility, but not all trusts affect asset limits the same way. An Alaska Miller Trust for Medicaid is designed to be compliant, allowing you to retain some income without affecting your eligibility. It's important to understand how these insights apply to your specific case. Consulting professionals can provide you with clarity and help you manage your assets effectively.

A Miller trust acts as a tool to help individuals qualify for Medicaid by allowing them to place excess income into a trust. This trust then meets specific Medicaid requirements and enables you to gain benefits while protecting your other assets. Using Alaska Miller Trust Forms for Medicaid simplifies this process and ensures you comply with state regulations. Proper setup is essential for effective use.

In Alaska, the asset limit for Medicaid varies based on the specific program, but for most, it is around $2,000 for an individual. The Alaska Miller Trust Forms for Medicaid can help you navigate these regulations. It is crucial to understand how these limits apply to your situation, as they may change. Staying informed will help you maintain eligibility.

Yes, you can sell a house held in an Alaska Miller Trust for Medicaid. However, there are specific steps you must follow. The proceeds from the sale must be managed according to Medicaid rules to avoid jeopardizing your eligibility. It’s wise to consult legal experts to ensure compliance.