This form is intended for a major commercial office complex. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses

Description

How to fill out Detailed Office Space Lease With Lessee To Pay Pro-rata Share Of Expenses?

Locating the appropriate genuine document template can be quite a challenge.

Of course, there are numerous designs available online, but how can you find the authentic form you require.

Use the US Legal Forms website. This service offers thousands of templates, including the Alaska Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses, suitable for both business and personal use.

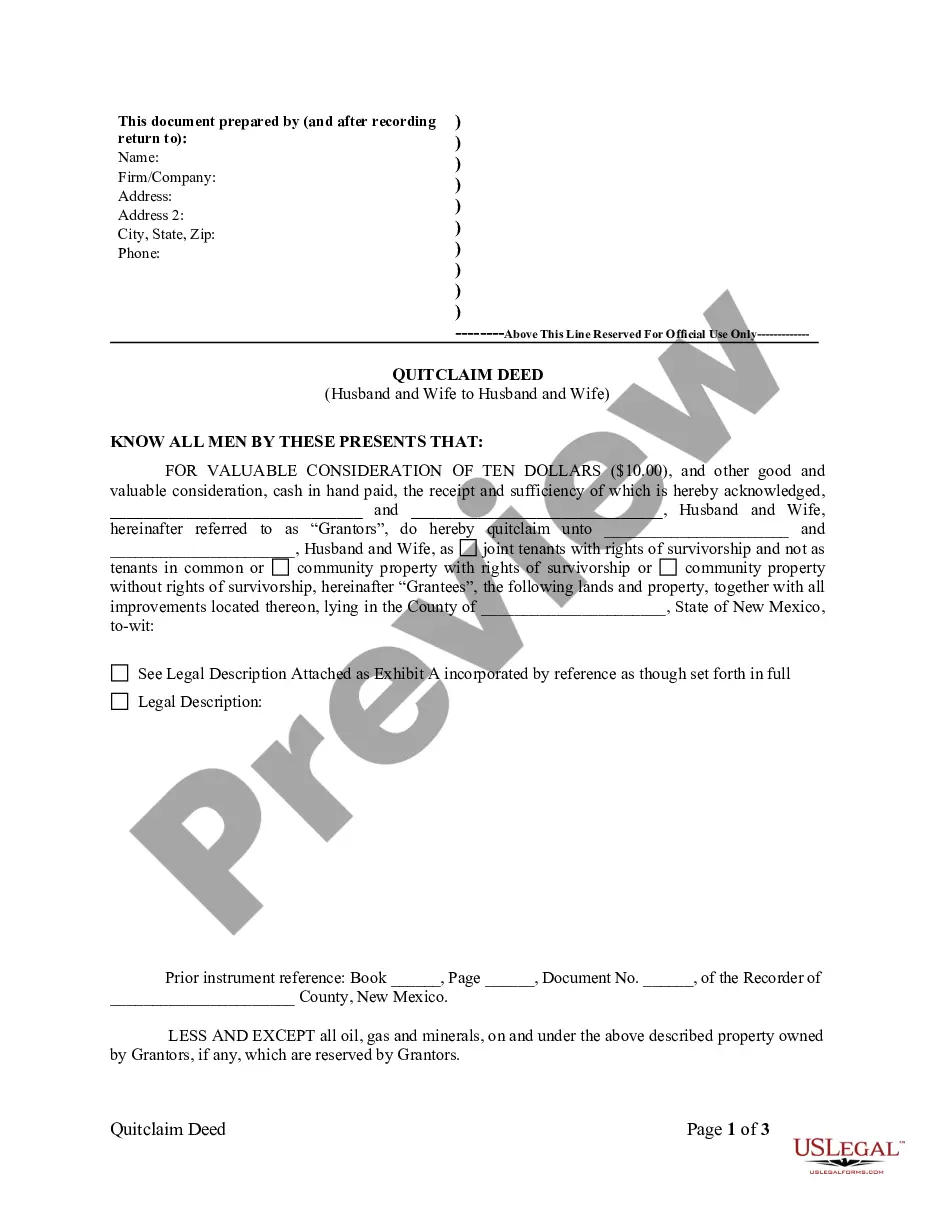

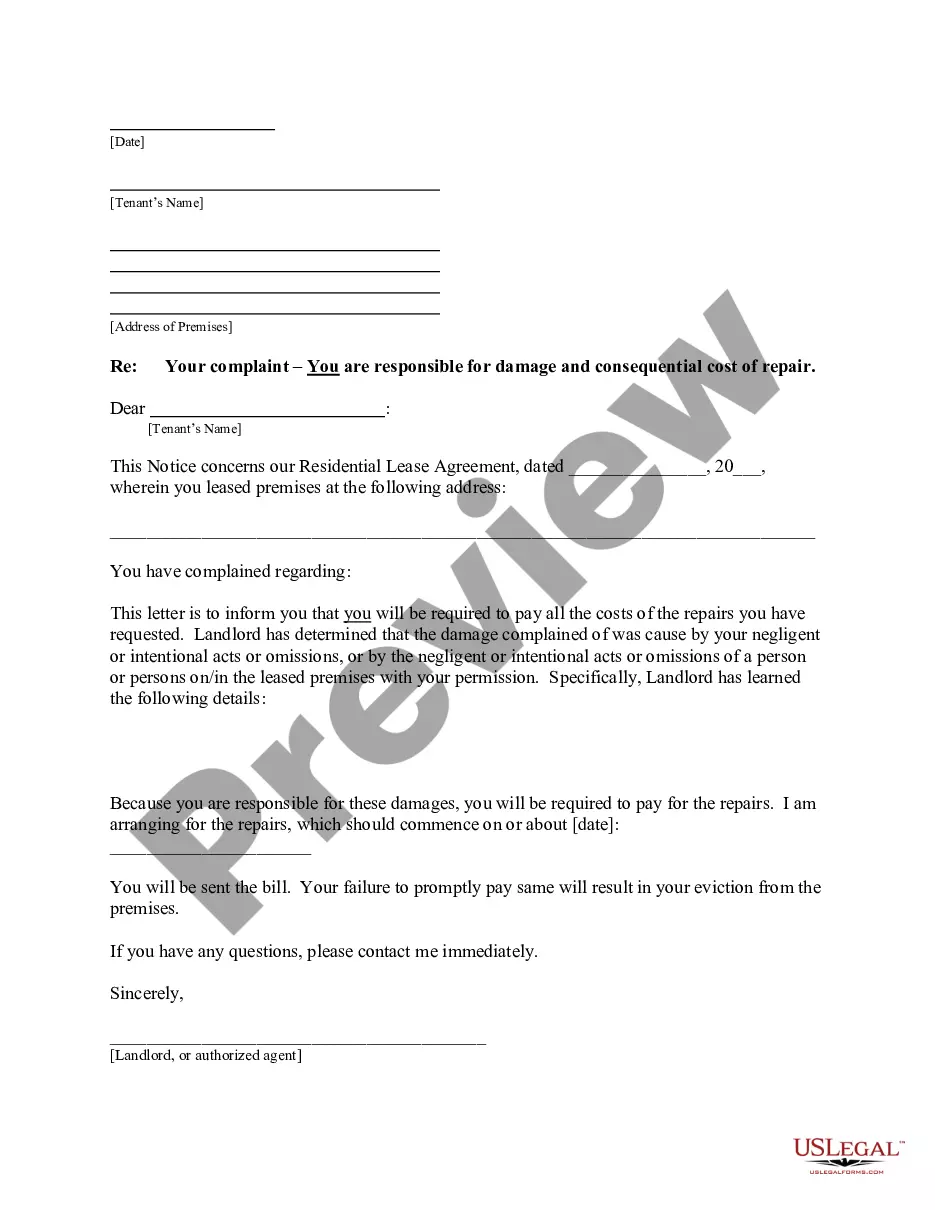

First, make sure you have selected the right form for your location/region. You can preview the form using the Preview button and read the description to ensure it is the right fit for you.

- All documents are vetted by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Alaska Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses.

- Utilize your account to browse through the legal templates you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

In the context of commercial real estate, the term Pro Rata Share is a method of calculating a tenant's share of a building's expenses based upon a calculation defined in a tenant's lease. Pro Rata Share of expenses is generally expressed as a percentage.

Also known as tenant's pro rata share. The portion of a building occupied by the tenant expressed as a percentage. When a tenant is responsible for paying its proportionate share of the landlord's costs for the building, such as operating expenses and real estate taxes, the tenant pays this amount over a base year.

With a triple net lease (NNN), the tenant agrees to pay the property expenses such as real estate taxes, building insurance, and maintenance in addition to rent and utilities. Triple net leases are commonly found in commercial real estate.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

There are three basic types of net leases: single, double, and triple net leases. With a triple net lease, the tenant promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities.

Under a net lease, the tenant is responsible for some or all costs associated with the property, such as utilities, maintenance, insurance, and other expenses.

Gross Lease/Full Service Lease In a gross lease, the tenant's rent covers all property operating expenses. These expenses can include, but aren't limited to, property taxes, utilities, maintenance, etc. The landlord pays these expenses using the tenant's rent to offset the costs.

One of two types of leases based on payment of expenses of the leased property and here the tenant (lessee) pays some for all of the expenses, sometimes called net, double net or triple net leases; it depends on how many property expenses the tenant pays.

The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. Net leases are commonly used in commercial real estate.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.