Alaska Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of

Description

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

Are you currently in a placement in which you will need files for either business or person purposes virtually every day? There are a variety of legitimate document layouts available on the Internet, but finding versions you can trust isn`t effortless. US Legal Forms delivers 1000s of kind layouts, just like the Alaska Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of, which are composed to meet state and federal specifications.

In case you are presently knowledgeable about US Legal Forms internet site and possess your account, simply log in. Next, you are able to down load the Alaska Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of template.

If you do not have an profile and want to start using US Legal Forms, adopt these measures:

- Get the kind you will need and ensure it is for your right metropolis/state.

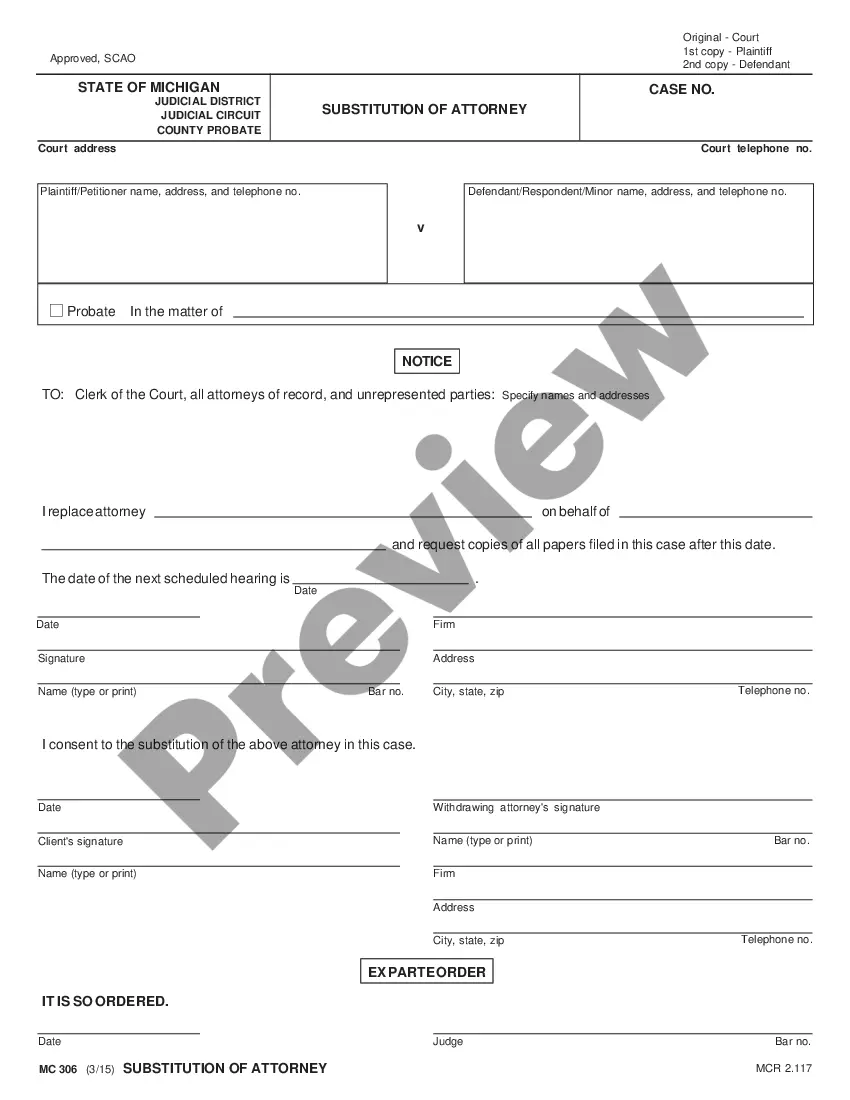

- Take advantage of the Review button to analyze the shape.

- Read the explanation to actually have chosen the right kind.

- In the event the kind isn`t what you are looking for, use the Lookup field to obtain the kind that suits you and specifications.

- Once you discover the right kind, simply click Purchase now.

- Choose the rates strategy you would like, complete the desired information to create your bank account, and purchase the transaction with your PayPal or credit card.

- Decide on a handy file file format and down load your duplicate.

Locate all of the document layouts you have bought in the My Forms menus. You can get a more duplicate of Alaska Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of whenever, if needed. Just click the necessary kind to down load or printing the document template.

Use US Legal Forms, by far the most comprehensive assortment of legitimate types, to conserve some time and steer clear of faults. The support delivers appropriately produced legitimate document layouts that can be used for an array of purposes. Generate your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

6 ways to stop foreclosure Mortgage repayment plan. ... Loan modification. ... Deed-in-lieu of foreclosure. ... Short sale. ... Short refinance. ... Refinance with a hard money loan.

A notice of default is a formal public notice that is filed with the state court and states that the borrower is in arrears. It is used when a borrower delays in making mortgage repayments, and the mortgage lender files the notice of default as the first step of a foreclosure process.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

(Explain income and expenses or attach a budget) I have enclosed copies of (budget, bank statements, paystubs, W-2, etc.) Please consider a workout agreement (or repayment plan, loan modification, etc.) for our loan. We appreciate your willingness to work with us to prevent foreclosure of our home.

To officially begin an Alaska foreclosure, the trustee records a notice of default in the appropriate recording district not less than 30 days after the default and not less than 90 days before the sale.

Foreclosure Sale If you don't make up the missed payments by the deadline provided in the notice of default, the lender will file a notice of sale. This notice will include the date, time, and place of the foreclosure auction. It will be recorded with the county clerk and is typically published in a newspaper.

A hardship letter is a letter written by homeowners to their lenders to make known their financial situations and why they can't meet up with their regular payment. Also, hardship letters can be used to request loan modification and other forms of loan workouts.

A financial hardship letter is a document in which you can detail your financial situation for your lender in hopes of getting a payment extension or reduction. This letter should explain your current financial situation and why you're unable to make payments.