Alaska Affidavit of Domicile for Deceased

Description

How to fill out Affidavit Of Domicile For Deceased?

US Legal Forms - among the most significant libraries of legitimate kinds in the United States - offers an array of legitimate file templates you can down load or print. Making use of the website, you can get a large number of kinds for business and individual uses, sorted by classes, says, or keywords.You will discover the most up-to-date models of kinds such as the Alaska Affidavit of Domicile for Deceased within minutes.

If you already have a membership, log in and down load Alaska Affidavit of Domicile for Deceased through the US Legal Forms library. The Obtain option will appear on every single kind you see. You get access to all formerly downloaded kinds in the My Forms tab of your account.

If you want to use US Legal Forms the very first time, listed here are basic instructions to help you get started out:

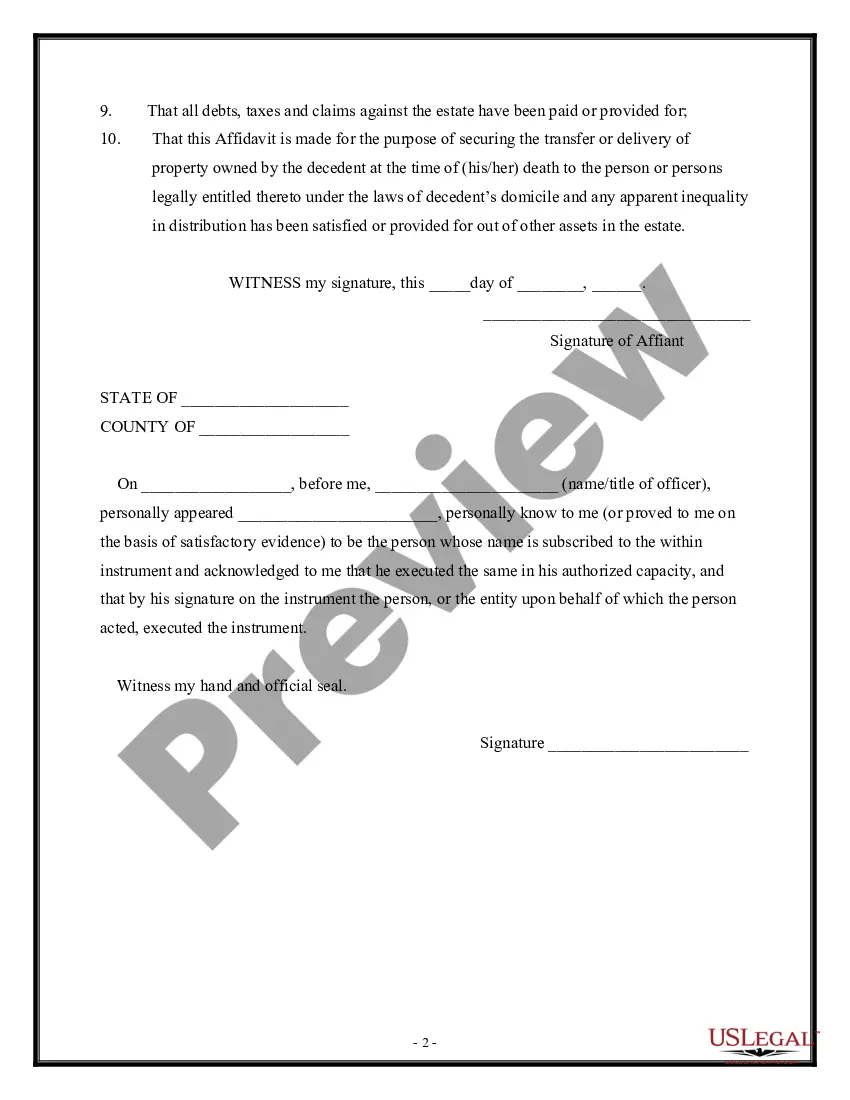

- Be sure to have chosen the proper kind for the city/area. Click on the Review option to examine the form`s information. See the kind outline to actually have chosen the appropriate kind.

- If the kind doesn`t satisfy your needs, utilize the Research discipline towards the top of the monitor to get the one which does.

- Should you be pleased with the form, validate your option by clicking the Acquire now option. Then, select the costs strategy you like and give your qualifications to register on an account.

- Method the deal. Use your bank card or PayPal account to finish the deal.

- Choose the formatting and down load the form on the system.

- Make changes. Complete, edit and print and signal the downloaded Alaska Affidavit of Domicile for Deceased.

Each web template you put into your money lacks an expiration date which is your own forever. So, in order to down load or print yet another backup, just go to the My Forms portion and click on on the kind you require.

Obtain access to the Alaska Affidavit of Domicile for Deceased with US Legal Forms, probably the most considerable library of legitimate file templates. Use a large number of professional and express-specific templates that fulfill your small business or individual needs and needs.

Form popularity

FAQ

Exempt property is personal property of the person who died, worth up to $10,000, that the Personal Representative must give to certain family members.

If you want to avoid probate, you will also need to transfer ownership of all of your property to the revocable trust or name the revocable trust as a beneficiary of your property.

In Alaska, a death must be registered with the local registrar within three days. The body may not be buried or cremated until the death certificate is filed. (Alaska Statutes § 18.50. 230(a).)

You must sign the deed and get your signature notarized, and then record (file) the deed with the district recorder's office before your death. Otherwise, it won't be valid. You can make a transfer on death deed for Alaska with WillMaker.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

In fact, many estates can be settled without any court involvement at all. Estates valued at less than $50,000, plus $100,000 worth of motor vehicles, can often avoid the probate process in court, provided the estate contains no real property (land or a home).

The surviving spouse receives the Homestead Allowance, Family Allowance and Exempt Property in addition to the elective share. A surviving spouse may also be entitled to an additional $50,000 in certain situations. Calculating the exact amount of the elective share is very complicated.

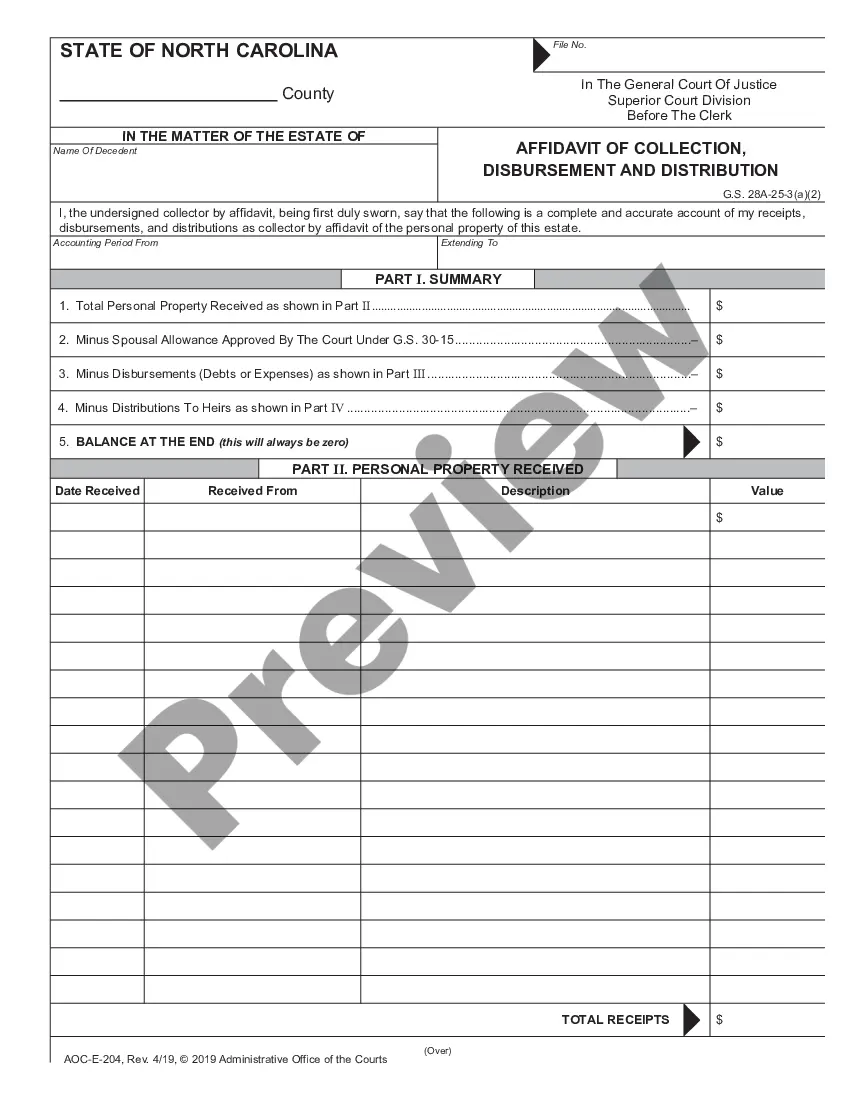

A probate is required when a person dies and owns property that does not automatically pass to someone else, or the estate doesn't qualify to use the Affidavit for Collection of Personal Property procedure. A probate allows a Personal Representative to transfer legal title of that property to the proper persons.