Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

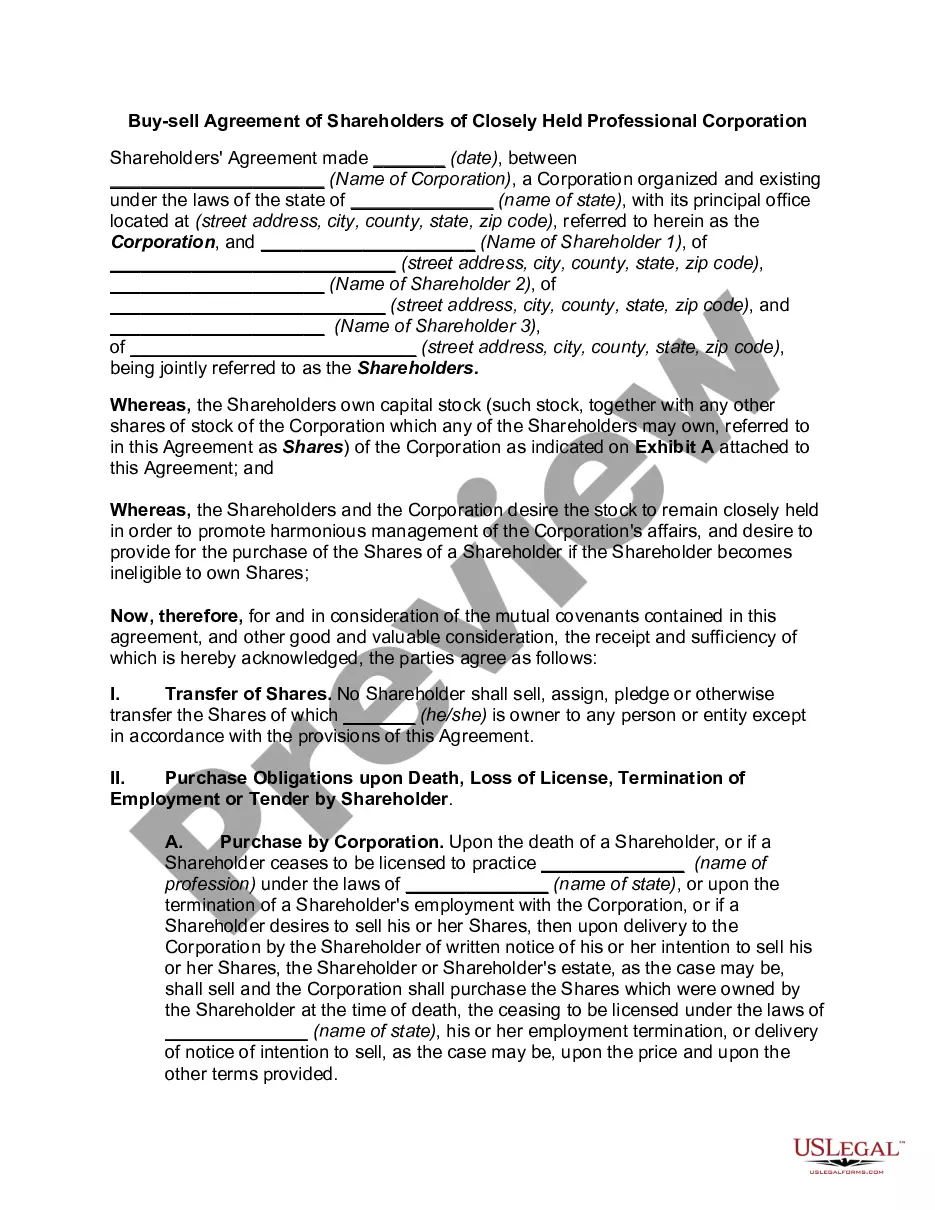

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Selecting the ideal authentic document format could be a challenge.

Naturally, there are numerous templates accessible online, but how can you find the genuine type that you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple guidelines you can follow: First, ensure you have selected the appropriate type for your area. You can browse the document using the Preview button and review the document outline to confirm it is suitable for you.

- The service offers a vast array of templates, including the Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, suitable for business and personal needs.

- All documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to download the Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Utilize your account to browse the legal templates you may have previously purchased.

- Visit the My documents tab of your account to retrieve an additional copy of the documents you need.

Form popularity

FAQ

Another common term for a shareholder agreement is a stockholders agreement. This legal document serves the same purpose, establishing the terms under which shareholders operate within the company. When drafting an Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, you can use these terms interchangeably while ensuring all relevant details are covered.

Setting up a shareholders agreement involves outlining roles, responsibilities, and rights among shareholders. Start by defining ownership stakes, decision-making processes, and procedures for resolving disputes. To ensure a comprehensive approach, consider incorporating an Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. This will provide clarity and protect all parties involved.

To obtain a shareholders agreement, you can consult legal professionals who specialize in corporate law. However, you can also find ready-made templates through platforms like uslegalforms, which offer a variety of legal documents tailored for your needs. Crafting an Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation becomes simpler with accessible resources.

A Shareholders Agreement is a comprehensive document that outlines the rights, responsibilities, and duties of shareholders in a corporation. It often includes the buy-sell agreement provisions, ensuring transparency among shareholders. When forming an Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, integrating these features helps protect everyone’s interests.

Typically, the buy-sell agreement is drafted by the shareholders of the corporation, often with the assistance of legal professionals. This ensures that all parties understand their rights and obligations under the agreement. Establishing an Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation involves careful consideration of each shareholder's intentions and strategic planning.

sell agreement is often referred to as a buysell contract. This legal document outlines the terms under which shareholders can buy or sell their interests in a closely held corporation. It is essential for providing a clear exit strategy for shareholders, especially in the context of an Alaska BuySell Agreement between Two Shareholders of Closely Held Corporation.

Backing out of a buy-sell agreement is not straightforward and often depends on the terms set within the agreement itself. If you encounter a significant reason to withdraw, the Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation may include clauses for this situation. However, it's vital to consult legal advice before attempting to withdraw, as it may have legal implications.

The main purpose of a buy-sell agreement is to establish clear guidelines for the transfer of shares upon specific triggering events. The Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation helps protect both the company and its shareholders by ensuring a predetermined process for ownership changes. This can minimize conflicts and provide financial security for the exiting shareholder.

You might not need a buy-sell agreement if your corporation has a clearly defined exit strategy or if you have agreements in place addressing potential ownership transfer. However, lacking the Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation could lead to complications during unforeseen events like the death of a shareholder. It's wise to consider the unique circumstances of your business and future intentions.

While a shareholder agreement and a buy-sell agreement may overlap, they serve different purposes. A buy-sell agreement focuses specifically on the terms of selling and transferring ownership of shares, as stipulated in the Alaska Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. In contrast, a shareholder agreement encompasses broader issues like governance, voting rights, and management responsibilities.