Pre-approved credit card offers must provide with each written solicitation a clear and conspicuous statement that a credit reporting agency was the source of the information and that the consumer can opt out. The follow form is an example of such a notice.

Alaska Notice to Accompany Credit Card Offer - Right to Prohibit Use of

Description

How to fill out Notice To Accompany Credit Card Offer - Right To Prohibit Use Of?

Finding the right authorized document design might be a struggle. Of course, there are plenty of templates accessible on the Internet, but how will you discover the authorized form you require? Take advantage of the US Legal Forms website. The assistance provides thousands of templates, for example the Alaska Notice to Accompany Credit Card Offer - Right to Prohibit Use of, which you can use for business and personal needs. All the forms are checked by specialists and fulfill federal and state needs.

When you are presently signed up, log in in your profile and then click the Down load key to get the Alaska Notice to Accompany Credit Card Offer - Right to Prohibit Use of. Utilize your profile to check through the authorized forms you might have purchased previously. Go to the My Forms tab of your own profile and obtain one more duplicate from the document you require.

When you are a whole new consumer of US Legal Forms, listed here are basic guidelines for you to adhere to:

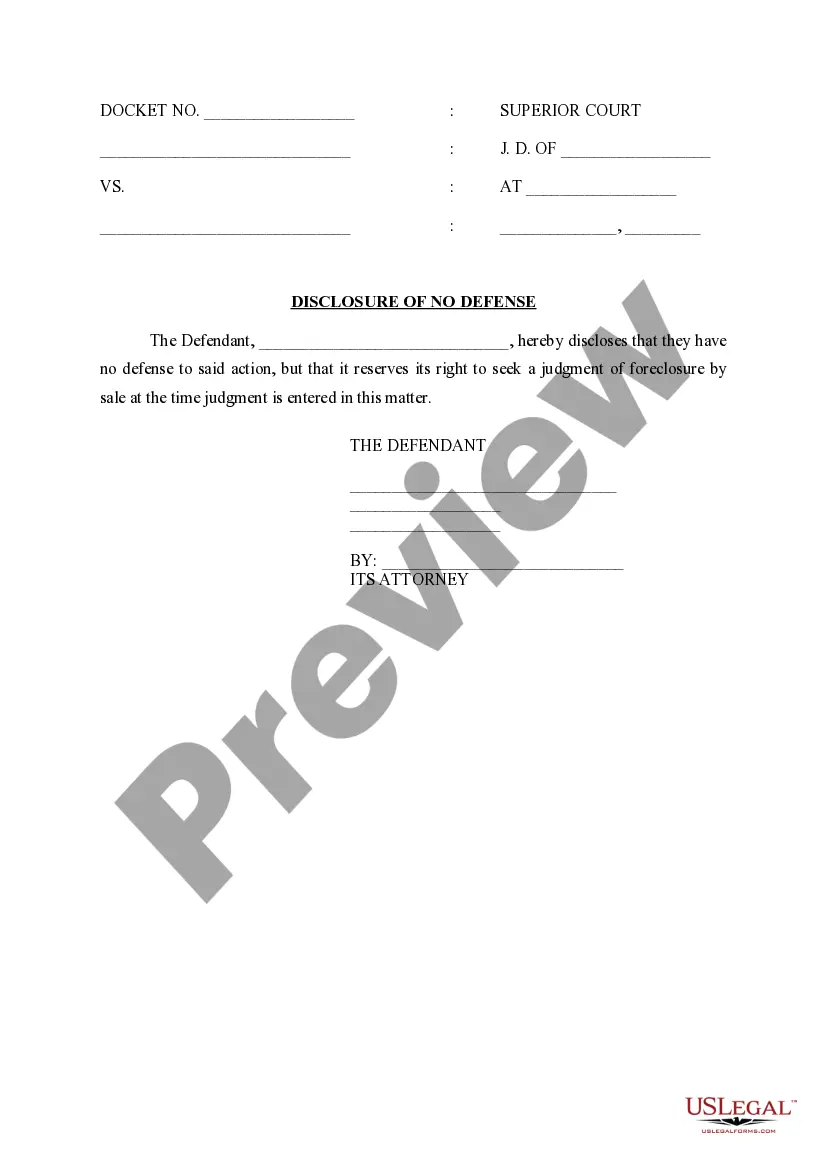

- Very first, be sure you have selected the appropriate form for your personal area/state. You are able to look through the shape making use of the Preview key and study the shape outline to guarantee this is basically the right one for you.

- In case the form will not fulfill your needs, take advantage of the Seach area to discover the proper form.

- When you are certain the shape is acceptable, click the Get now key to get the form.

- Opt for the costs program you want and type in the needed details. Design your profile and buy an order making use of your PayPal profile or bank card.

- Choose the data file formatting and download the authorized document design in your gadget.

- Complete, revise and produce and signal the obtained Alaska Notice to Accompany Credit Card Offer - Right to Prohibit Use of.

US Legal Forms may be the most significant local library of authorized forms that you can discover a variety of document templates. Take advantage of the service to download appropriately-manufactured documents that adhere to state needs.

Form popularity

FAQ

Federal Threshold Doubles Currently, to qualify as ?exempt? from local minimum and overtime wage laws under Alaska Statute 23.05. 055(b), an employee's weekly salary must be at least twice the amount a person would make working forty hours at minimum wage.

Sec. 01.10.055. (a) A person establishes residency in the state by being physically present in the state with the intent to remain in the state indefinitely and to make a home in the state.

140. Pay periods; penalty. (a) An employee and employer may agree in an annual initial contract of employment to monthly pay periods when the employer shall pay the employee for all labor performed or services rendered.

Section 23.10. 065 - Minimum wages (a) Except as otherwise provided for in law, an employer shall pay to each employee a minimum wage, as established herein, for hours worked in a pay period, whether the work is measured by time, piece, commission or otherwise.

PENALTIES AND INTEREST. [AS 23.30. 155] If payment is not made by the 7th day after payment is due, a penalty equal to an additional 25% of the amount then due must be paid to you by the insurer. If a payment was not paid when it was due, the insurer also owes you interest.

A person may not sell or attempt to sell property or services by telephonic means if the person makes substantially the same offer on substantially the same terms to two or more persons, unless the telephone seller is registered with the Department of Law at least 30 days before the solicitation campaign.

The Alaska Airlines Credit Card gives you a 25 days grace period to avoid paying interest on your purchases. The grace period runs from the end of the billing period until the card's payment due date. You won't owe any interest as long as you pay your balance in full during that timeframe.

The Alaska Airlines Visa® credit card offers a few travel protections through Visa Signature, like lost luggage reimbursement, rental car insurance, and travel and emergency assistance services.