Alaska Participation Agreement in Connection with Secured Loan Agreement is a legal contract that outlines the terms and conditions between parties involved in a secured loan transaction. This agreement defines the rights and obligations of the participating lender and the borrower in relation to the loan. The purpose of the Alaska Participation Agreement is for a lender to enter into a loan transaction with a borrower and subsequently sell or transfer a portion of the loan to another party, known as the participating lender. The participating lender agrees to acquire an interest in the loan, typically a percentage, in exchange for providing a certain amount of funds to the borrower. The agreement identifies and describes various key elements that need to be clearly stated, such as the loan amount, interest rate, repayment terms, and security interest. It also stipulates the responsibilities of the participating lender, borrower, and any other involved parties. There are different types of Alaska Participation Agreements in Connection with Secured Loan Agreements, including: 1. Active Participation Agreement: This type of agreement allows the participating lender to actively participate in the decision-making process regarding the loan. They may have voting rights and be involved in major decisions, such as amendments to the loan agreement or restructuring the loan. 2. Passive Participation Agreement: In this type of agreement, the participating lender does not have active involvement in the decision-making process. They simply provide the funds and receive their share of the loan proceeds and interest payments without having a say in the loan management. 3. Fixed Percentage Participation Agreement: This agreement stipulates a fixed percentage that the participating lender acquires from the loan. The percentage remains constant throughout the loan term, and the participating lender's interest is limited to that specific percentage. 4. Conditional Percentage Participation Agreement: Unlike the fixed percentage agreement, this type of agreement allows for the involvement of additional conditions. These conditions may alter the participating lender's interest percentage based on specific events or milestones, such as the borrower's credit rating or the loan performance. Alaska Participation Agreement in Connection with a Secured Loan Agreement provides clarity and legal protection for all parties involved, ensuring a smooth transaction and efficient loan management. It is crucial to consult legal professionals when drafting or entering into such agreements to ensure compliance with Alaska's laws and regulations.

Alaska Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Alaska Participation Agreement In Connection With Secured Loan Agreement?

It is possible to spend hrs on the web searching for the authorized file design which fits the state and federal requirements you need. US Legal Forms supplies thousands of authorized forms that are evaluated by experts. It is simple to obtain or printing the Alaska Participation Agreement in Connection with Secured Loan Agreement from the support.

If you already possess a US Legal Forms bank account, you may log in and click the Download key. Next, you may total, edit, printing, or indicator the Alaska Participation Agreement in Connection with Secured Loan Agreement. Each authorized file design you get is yours forever. To acquire yet another backup of the purchased develop, proceed to the My Forms tab and click the related key.

If you use the US Legal Forms website the very first time, keep to the easy instructions under:

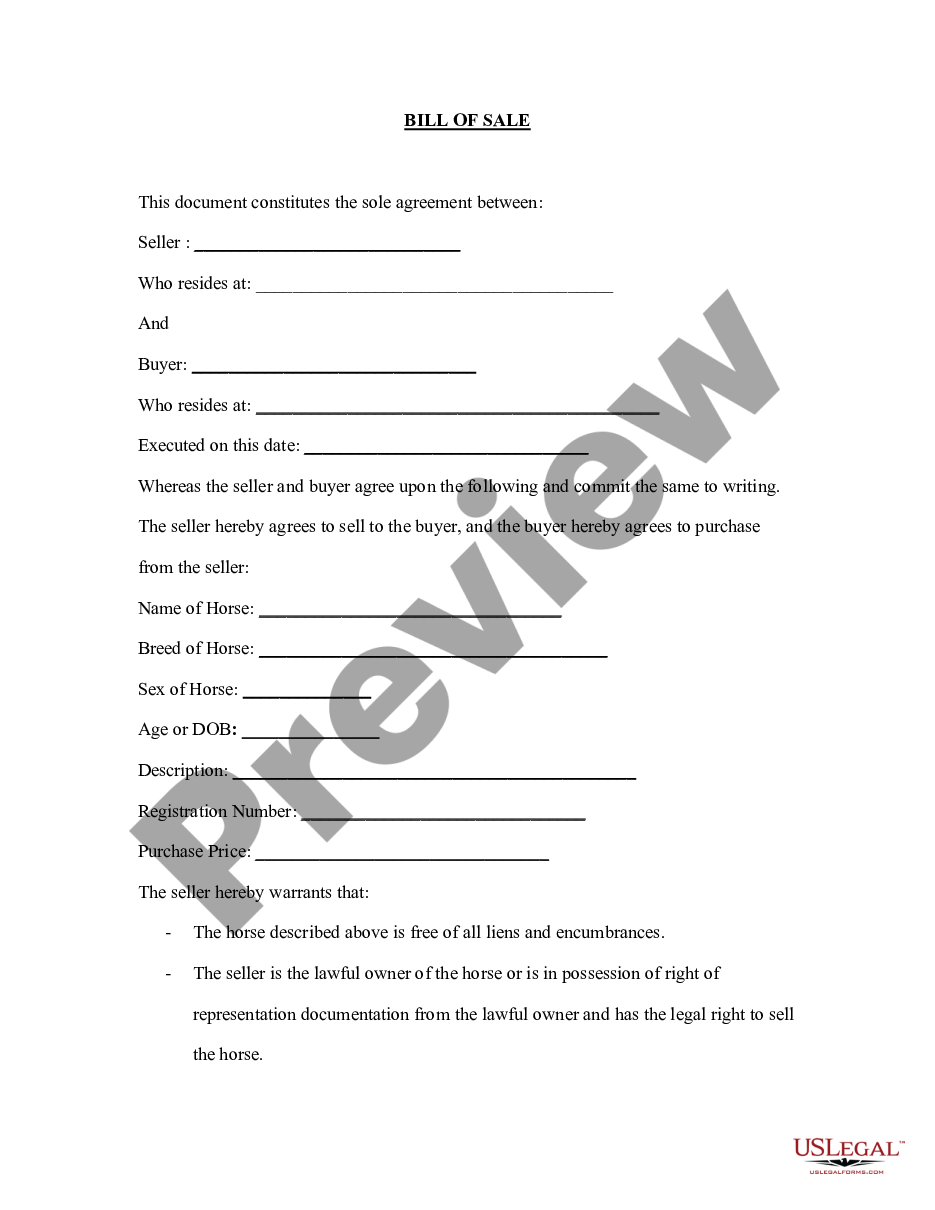

- Very first, be sure that you have selected the right file design to the county/area of your liking. Read the develop description to ensure you have picked out the proper develop. If offered, utilize the Review key to appear through the file design as well.

- If you wish to locate yet another edition in the develop, utilize the Lookup area to obtain the design that fits your needs and requirements.

- Once you have discovered the design you would like, click Acquire now to carry on.

- Choose the costs prepare you would like, key in your credentials, and register for a merchant account on US Legal Forms.

- Total the purchase. You should use your bank card or PayPal bank account to purchase the authorized develop.

- Choose the formatting in the file and obtain it to the gadget.

- Make alterations to the file if required. It is possible to total, edit and indicator and printing Alaska Participation Agreement in Connection with Secured Loan Agreement.

Download and printing thousands of file layouts making use of the US Legal Forms web site, that offers the greatest collection of authorized forms. Use skilled and express-particular layouts to handle your small business or personal requires.