An Alaska Contract of Sale of Commercial Property with No Broker Involved is a legally binding agreement between a buyer and a seller for the purchase and sale of a commercial property in the state of Alaska, without the involvement of a real estate broker. This contract outlines the terms and conditions of the sale, including the purchase price, payment terms, property description, contingencies, and other important details. The purpose of this contract is to facilitate the smooth transfer of ownership from the seller to the buyer, ensuring that both parties are protected and their interests are safeguarded throughout the transaction process. By eliminating the need for a broker, both the buyer and seller can negotiate directly, potentially saving on commission fees. When it comes to different types of Alaska Contracts of Sale of Commercial Property with No Broker Involved, there can be variations based on the specific circumstances and preferences of the parties involved. Some common types include: 1. Standard Alaska Contract of Sale of Commercial Property with No Broker Involved: This is a basic contract template that covers all essential details of the transaction, such as the property address, purchase price, earnest money deposit, closing date, and any contingencies or conditions that need to be met before the sale is finalized. 2. Alaskan Contract of Sale with Specific Contingencies: This type of contract includes specific contingencies based on the needs and concerns of the buyer and seller. Examples of contingencies may include property inspections, financing approvals, environmental assessments, or obtaining necessary permits or licenses. 3. Lease-to-Own Contract of Sale: This type of contract is used when the buyer wishes to enter into a lease agreement with the option to purchase the commercial property at a later date. It outlines the terms and conditions of the lease as well as the purchase option, including the purchase price and the duration of the lease before the option can be exercised. 4. Seller-Financed Contract of Sale: In this type of contract, the seller acts as the lender, financing the purchase of the commercial property. The contract specifies the terms of the loan, including the interest rate, repayment schedule, and any other agreed-upon conditions. It is important for both parties to thoroughly review and understand the contract before signing. Consulting with a legal professional who specializes in real estate transactions in Alaska is highly recommended ensuring compliance with state laws and regulations.

Alaska Contract of Sale of Commercial Property with No Broker Involved

Description

How to fill out Alaska Contract Of Sale Of Commercial Property With No Broker Involved?

Have you been within a placement where you need to have files for possibly organization or person uses nearly every day time? There are a variety of lawful file web templates available online, but getting versions you can depend on is not simple. US Legal Forms delivers a large number of form web templates, just like the Alaska Contract of Sale of Commercial Property with No Broker Involved, that are written to fulfill federal and state needs.

Should you be presently acquainted with US Legal Forms internet site and get a free account, merely log in. Afterward, you are able to acquire the Alaska Contract of Sale of Commercial Property with No Broker Involved format.

If you do not come with an account and need to start using US Legal Forms, follow these steps:

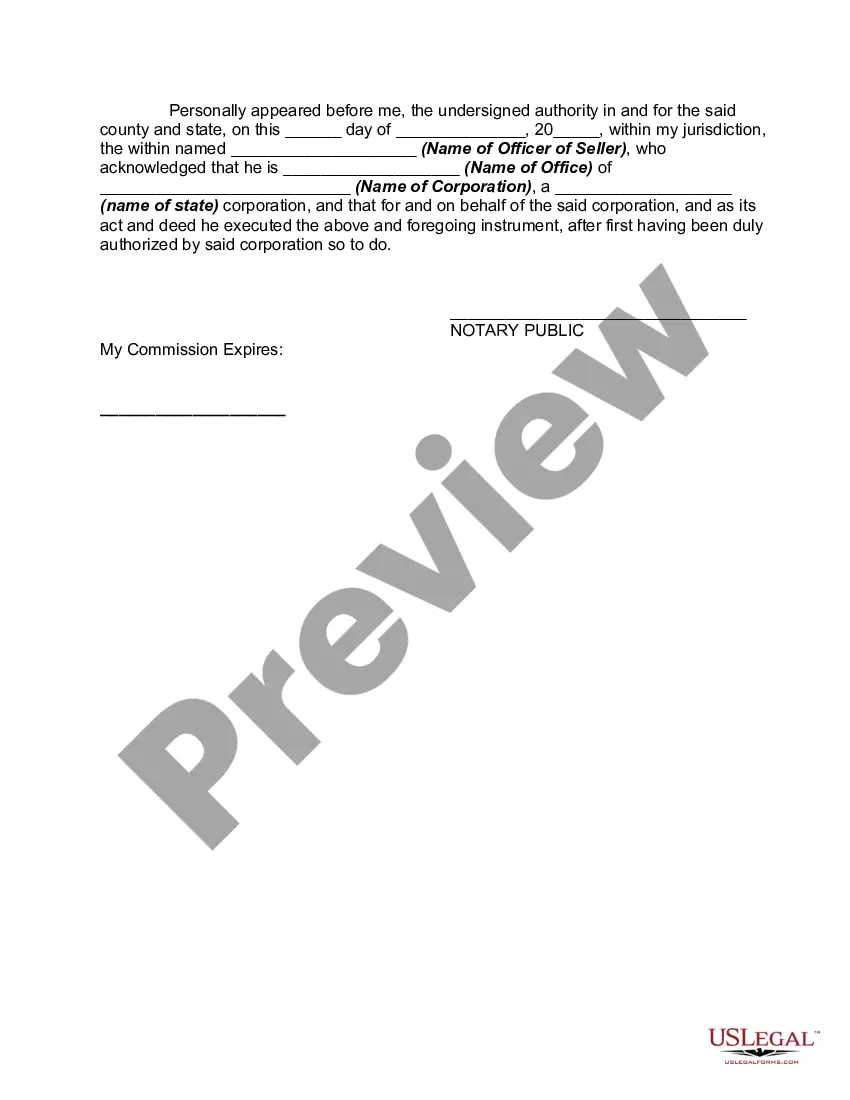

- Get the form you need and ensure it is to the appropriate city/state.

- Utilize the Preview option to review the form.

- See the outline to ensure that you have selected the right form.

- If the form is not what you are seeking, utilize the Look for industry to get the form that fits your needs and needs.

- Whenever you discover the appropriate form, simply click Get now.

- Pick the prices program you would like, fill out the specified details to make your money, and pay money for an order using your PayPal or credit card.

- Choose a handy data file structure and acquire your duplicate.

Discover all the file web templates you possess bought in the My Forms menu. You may get a extra duplicate of Alaska Contract of Sale of Commercial Property with No Broker Involved at any time, if needed. Just select the needed form to acquire or print the file format.

Use US Legal Forms, one of the most extensive selection of lawful types, to save time and avoid mistakes. The support delivers expertly made lawful file web templates that can be used for a variety of uses. Make a free account on US Legal Forms and begin creating your lifestyle easier.