Title: Alaska Term Loan Agreement: A Comprehensive Guide for Business or Corporate Borrowers and Banks Introduction: An Alaska Term Loan Agreement is a legally binding contract established between a business or corporate borrower and a bank in the state of Alaska. This article aims to shed light on the different types of Alaska Term Loan Agreements, their key provisions, and the significance of relevant keywords for businesses or corporate borrowers operating in Alaska. Types of Alaska Term Loan Agreements: 1. Fixed-Rate Term Loan Agreement: In this type of agreement, the borrower receives a loan at a fixed interest rate for a specific period, typically ranging from 2 to 10 years. This ensures predictability in monthly payments for the borrower. 2. Variable-Rate Term Loan Agreement: Here, the loan interest rate is subject to change based on market fluctuations. Typically, the rate is tied to a standard benchmark such as the Prime Rate or LIBOR (London Interbank Offered Rate). This agreement offers potential benefits in case of decreasing interest rates but carries the risk of higher payments if rates increase. 3. Secured Term Loan Agreement: This agreement involves collateral — assets pledged by the borrower to mitigate the lender's risk. If the borrower defaults, the bank holds the right to seize the collateral to recover the outstanding loan amount. 4. Unsecured Term Loan Agreement: In contrast to the secured agreement, this type does not require any collateral. It relies solely on the borrower's creditworthiness, making it suitable for established businesses with a solid financial profile. Key Provisions of an Alaska Term Loan Agreement: 1. Loan Amount and Purpose: Clearly defines the loan amount requested by the borrower and describes the purpose for which the funds will be utilized within the business or corporate context. 2. Interest Rate and Repayment Terms: States the agreed-upon interest rate, specifying whether it is fixed or variable. It also outlines the repayment schedule, including the frequency and duration of installments. 3. Conditions Precedent: Details the conditions that must be met before the loan disbursement, such as obtaining required licenses or permits, submitting financial statements, or providing collateral documentation. 4. Representations and Warranties: The borrower explicitly represents the accuracy of provided information, including financial statements, tax returns, and business operations. Failure to meet these representations could result in a breach of contract. 5. Events of Default and Remedies: Specifies the circumstances under which the borrower would be considered in default, allowing the bank to demand immediate payment, take legal action, or seize collateral assets. 6. Fees and Expenses: Outlines any fees or costs associated with the loan, such as origination fees, closing costs, or late payment penalties. 7. Governing Law and Jurisdiction: Specifies that the agreement is subject to Alaska state laws and determines the appropriate jurisdiction for resolving potential disputes. Relevant Keywords: Alaska Term Loan, Business Loan Agreement, Corporate Borrower, Bank, Fixed-Rate, Variable-Rate, Secured, Unsecured, Loan Amount, Interest Rate, Repayment Terms, Conditions Precedent, Representations, Warranties, Events of Default, Remedies, Fees, Expenses, Governing Law, Jurisdiction. Note: It is advisable to consult with legal professionals or financial advisors to ensure compliance with current regulations and tailored agreements that suit specific circumstances.

Alaska Term Loan Agreement between Business or Corporate Borrower and Bank

Description

How to fill out Alaska Term Loan Agreement Between Business Or Corporate Borrower And Bank?

If you have to comprehensive, down load, or printing authorized record web templates, use US Legal Forms, the most important variety of authorized varieties, that can be found online. Use the site`s simple and easy handy look for to discover the papers you will need. Various web templates for organization and individual purposes are sorted by groups and says, or keywords and phrases. Use US Legal Forms to discover the Alaska Term Loan Agreement between Business or Corporate Borrower and Bank within a couple of click throughs.

When you are already a US Legal Forms client, log in to the profile and click on the Acquire switch to find the Alaska Term Loan Agreement between Business or Corporate Borrower and Bank. Also you can accessibility varieties you formerly saved in the My Forms tab of your respective profile.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form to the right metropolis/region.

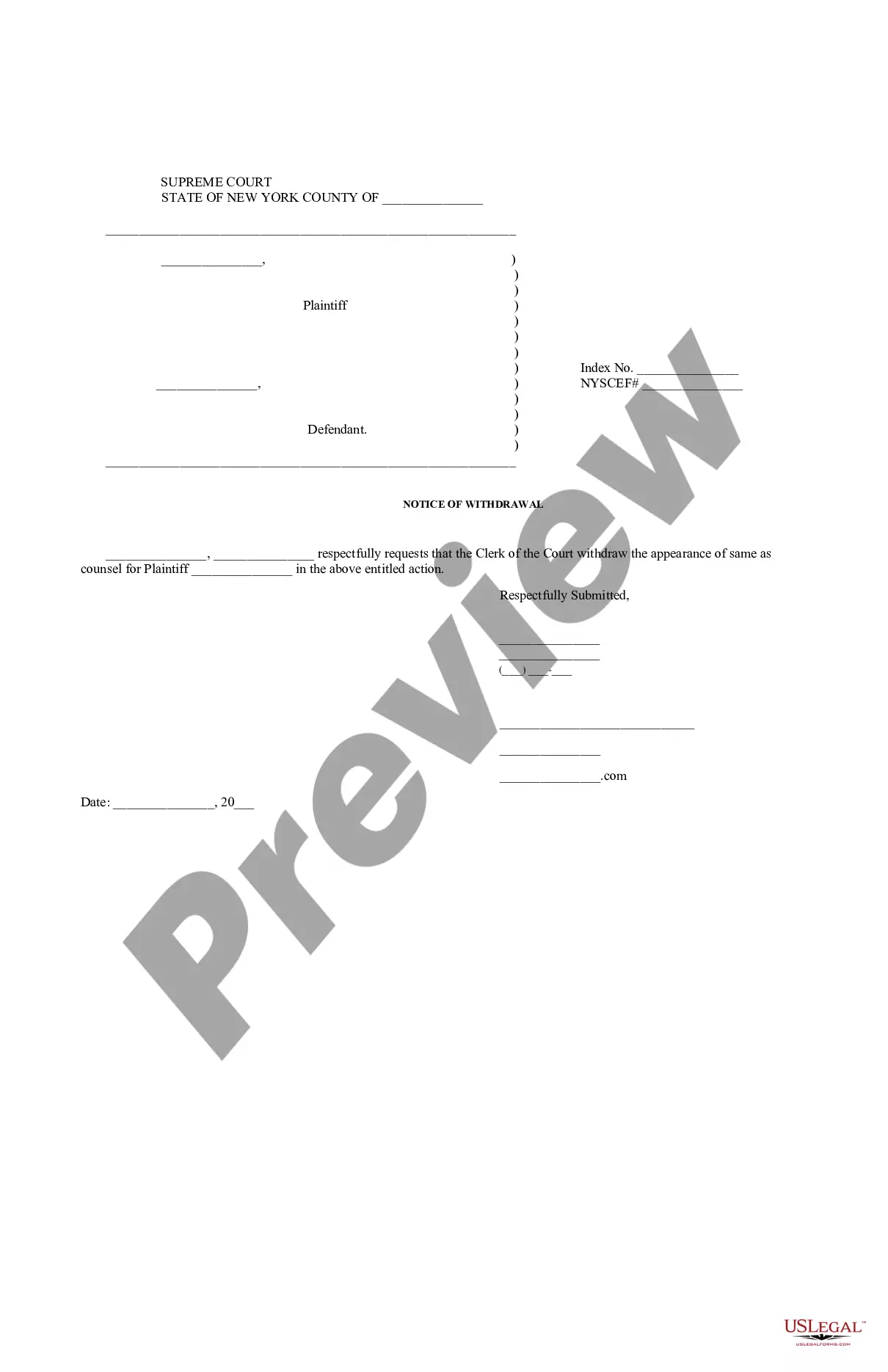

- Step 2. Use the Preview method to look over the form`s content material. Don`t forget about to learn the explanation.

- Step 3. When you are not satisfied with all the form, utilize the Research industry towards the top of the monitor to discover other variations in the authorized form format.

- Step 4. Upon having discovered the form you will need, go through the Get now switch. Choose the costs prepare you prefer and add your qualifications to register on an profile.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal profile to finish the transaction.

- Step 6. Find the format in the authorized form and down load it on your own device.

- Step 7. Comprehensive, edit and printing or sign the Alaska Term Loan Agreement between Business or Corporate Borrower and Bank.

Each authorized record format you acquire is your own property permanently. You possess acces to each form you saved inside your acccount. Select the My Forms portion and select a form to printing or down load yet again.

Compete and down load, and printing the Alaska Term Loan Agreement between Business or Corporate Borrower and Bank with US Legal Forms. There are many expert and express-particular varieties you can utilize for your organization or individual demands.