Alaska Articles of Association for Social Club

Description

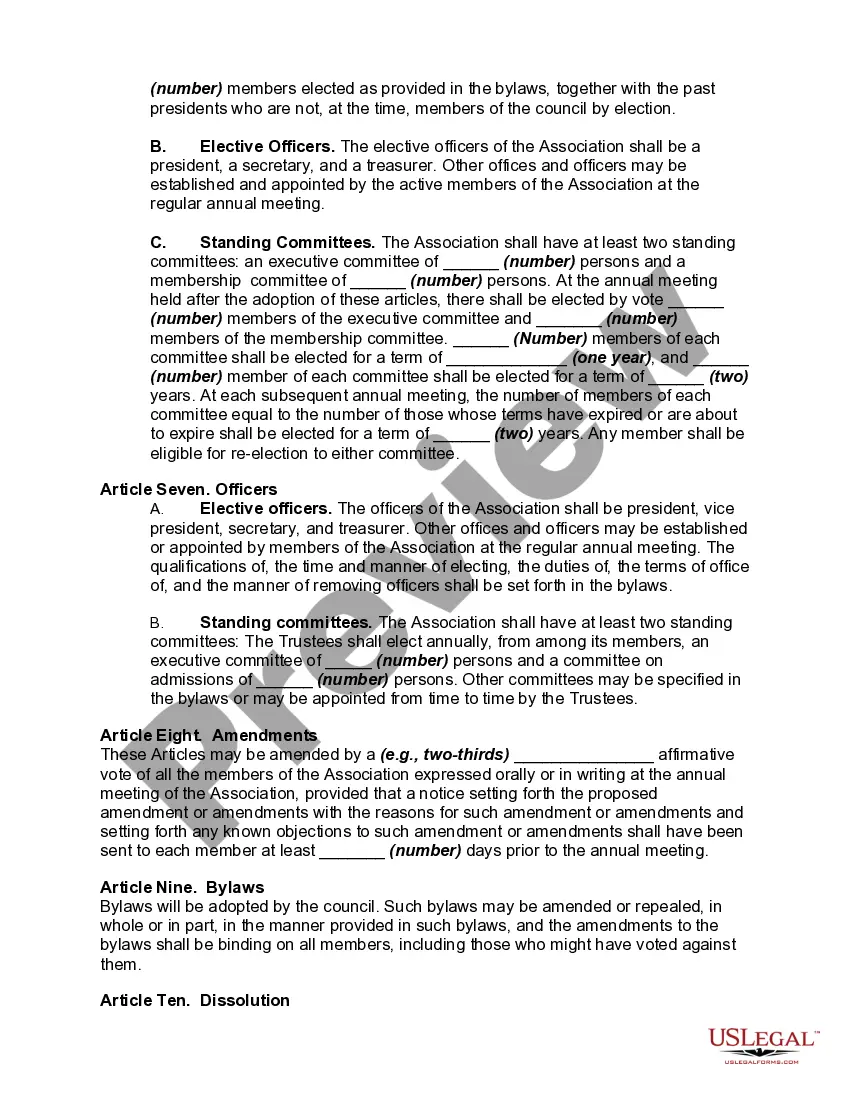

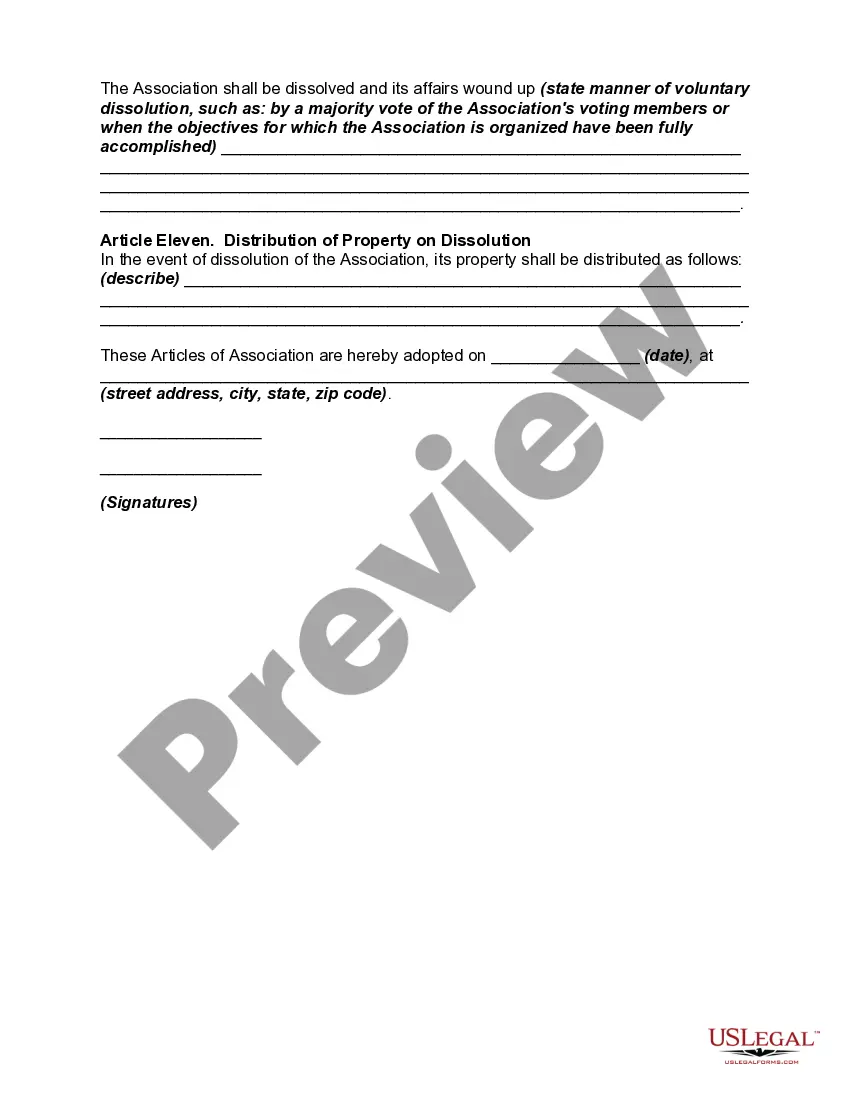

How to fill out Articles Of Association For Social Club?

If you want to comprehensive, download, or produce authorized file templates, use US Legal Forms, the greatest assortment of authorized forms, which can be found on the web. Take advantage of the site`s easy and practical look for to discover the paperwork you require. Various templates for company and person uses are sorted by categories and claims, or key phrases. Use US Legal Forms to discover the Alaska Articles of Association for Social Club in just a couple of click throughs.

When you are already a US Legal Forms customer, log in for your bank account and click on the Download key to find the Alaska Articles of Association for Social Club. Also you can entry forms you in the past acquired in the My Forms tab of your own bank account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the appropriate city/nation.

- Step 2. Make use of the Review option to check out the form`s content. Do not forget to learn the explanation.

- Step 3. When you are unhappy together with the develop, use the Lookup area near the top of the monitor to discover other types in the authorized develop format.

- Step 4. When you have found the form you require, go through the Buy now key. Pick the costs prepare you favor and add your credentials to register to have an bank account.

- Step 5. Approach the purchase. You can use your bank card or PayPal bank account to complete the purchase.

- Step 6. Choose the structure in the authorized develop and download it on the gadget.

- Step 7. Comprehensive, change and produce or sign the Alaska Articles of Association for Social Club.

Every authorized file format you purchase is the one you have permanently. You may have acces to every single develop you acquired inside your acccount. Go through the My Forms section and decide on a develop to produce or download yet again.

Compete and download, and produce the Alaska Articles of Association for Social Club with US Legal Forms. There are many skilled and state-specific forms you may use for the company or person needs.

Form popularity

FAQ

Alaska has a 2.0 to 9.40 percent corporate income tax rate. Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent. Alaska's tax system ranks 3rd overall on our 2024 State Business Tax Climate Index.

How to Start a Nonprofit in Alaska Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.

Yes, your nonprofit will need to obtain a business license from the Alaska Division of Corporations, Business and Professional Licensing. You can get your license online at the Alaska Division of Corporations website. There is a $50 fee.

A benefit to forming your business in Alaska is that in most states you are required to file annual reports AND pay the required fees, but Alaska only requires a Annual report from it's LLCs and corporations so instead of filing every single year, you file every other year. This will save you paperwork and fees.

Alaska recognizes the federal S corporation election and does not require a state-level S corporation election.

To form an Alaska S corp, you'll need to ensure your company has an Alaska formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.